The secret to effortless investing.

Browsing: REITs

We review the earnings for an aviation stock and technology business and look at the latest economic numbers out of China.

Stability and predictability are traits that are highly sought after by investors.

Here’s why Singapore REITs continue to be an attractive asset class.

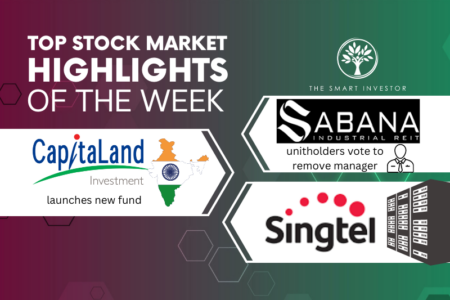

We look at Sabana REIT’s recent extraordinary general meeting and see how a property giant is expanding its funds under management.

We sift out five Singapore REITs that are not only resilient but also sport distribution yields exceeding 5%.

We feature five stocks that are dishing out dividends this month.

We review the latest acquisition from a hospitality trust and look at how long it takes the average Singaporean consumer to achieve financial freedom.

CICT continues to deliver as it reports healthy growth for both its segments.

Here are five Singapore REITs that reported higher DPUs.

We dig deep into the industrial REIT’s latest earnings report to gain several insights.

Having sufficient stamina and patience will help you to cross the finish line.

The logistics REIT has several ongoing redevelopment projects that will act as catalysts moving forward.

The data centre REIT sees good long-term prospects even as it grapples with higher interest expenses.

The trio of Singapore-listed US commercial REITs are going through a trying time now. Is there light at the end of the tunnel?

Inflation may be trending higher than usual this year, but here are five Singapore REITs that can help you safely beat it.

The road to salary independence begins by taking your first step.

We look at why Temasek finds India a promising country for investments and find out more about ComfortDelGro’s latest contract.

These four Singapore REITs have attributes that make them attractive to own over the long term.

If you are thinking of a suitable sector to park your money in, healthcare offers resilience and enjoys long-term catalysts.