The US budget that has sneaked through Upper House and has now been sent down to the Lower House. It…

Browsing: Smart Investing

These four stocks could be perfect for a growth investor’s portfolio.

Here are four stocks that I could buy if I had extra cash.

We feature five US stocks with solid dividend track records that reported a commendable set of earnings.

Here are three REITs announcing corporate actions that deserve your attention.

We look at four stocks breaking through their 52-week highs to determine if they are worthy of being included in your investment portfolio.

Looking for more passive income? Here are four stocks dishing out dividends next month.

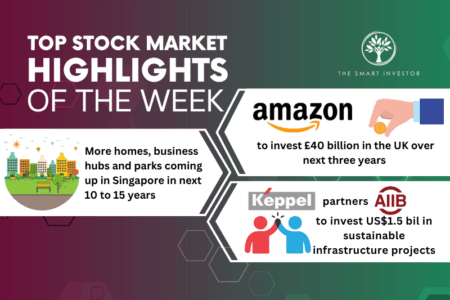

We look at an e-commerce giant’s latest investment commitment along with Singapore’s plans for new HDB and towns within the heartlands.

Here’s how you can identify companies that are poised to declare special dividends.

We feature four companies dishing out special dividends that can boost your passive income.

These four companies have been raising their dividends steadily over the years.

Discover which companies are buying back their shares and what could be your next investment move.

Investors now have an expanded range of Hong Kong and Thai stocks to choose from.

We explore the three local banks to determine if their share prices can continue to break new highs.

We profile four Singapore REITs that can weather downturns while providing an attractive distribution yield.

Looking for stocks to park in your CPF Investment Account? Here are three you can count on.

Singapore’s small-cap stocks are an acquired taste but there may be some hidden gems out there.

Consumer stocks enjoy steady long-term demand and can help you to grow your portfolio in line with the economy’s growth.

The S&P index is nearing its all-time highs again, but what should investors do?

The REIT sector has endured nearly three years of pessimism, but could the tide finally be turning?