Discover the 5 best dividend stocks Singapore investors can buy for steady quarterly income and sustainable long-term payouts.

Browsing: Smart Investing

The STI crossing 5,000 feels historic. But even at record levels, some blue-chip stocks still offer long-term value — if you focus on fundamentals, not fear.

Discover why new investors are choosing gold and how to balance precious metals with long-term stock market returns.

When the stock market panics, it pays to check if the fear makes sense.

Turn everyday Singaporean staples into reliable passive income by prioritising companies with the cash reserves to sustain their dividend payouts.

A well-built prosperity portfolio focuses on dependable dividend stocks that generate rising income and compound wealth steadily over the long term.

Some AI-linked stocks have undergone deep selloffs. Before writing them off, investors should ask whether these market selloffs by the market are truly justified by the companies’ fundamentals.

Are Singapore’s retail REITs still a buy? We dive into the 2026 updates for CICT, FCT, and MPACT to see which offers the best growth and distribution yield.

As the lunar new year approaches, here’s what Singapore investors should look for if they’re hoping for bigger “ang pow” payouts in 2026.

It’s time to pivot.

After strong rallies, SIA, Keppel, and ST Engineering are back in focus- but which blue-chip still offers meaningful upside for long-term investors?

Reliable dividends don’t come from chasing the highest yield. These four Singapore stocks stand out for consistency, cash flow strength, and disciplined payouts.

Boost your passive income with these eight Singapore dividend stocks for the Year of the Fire Horse.

Discover 5 disciplined habits to harness the 2026 “Fire Horse” energy. Huat ah!

The Year of the Red Fire Horse symbolises strength, resilience, and forward momentum. These Singapore blue chips stand out for their staying power and ability to thrive across market cycles.

Investors seeking 5%+ yields beyond the STI can find opportunity in these three Singapore stocks with dividend sustainability at their core.

With markets evolving and interest rates shifting, investing a lump sum in 2026 requires balance.

Budget 2026 expands the EQDP to S$6.5 billion, boosting Singapore equities and shining a spotlight on high-yield “Next 50” mid-cap stocks.

These five Temasek-owned Singapore blue chips combine income, recovery potential, and long-term growth, making them worth a closer look for investors building a resilient portfolio.

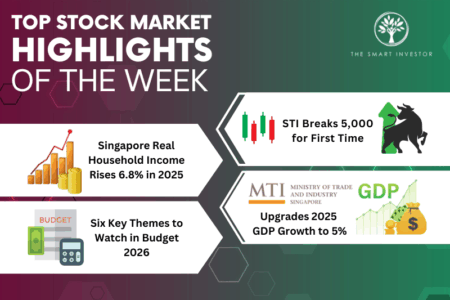

STI hits historic 5,000 as Singapore raises GDP forecasts and gears up for the 2026 Budget announcement.