When faced with uncertainty, take the first step and throw your cap over the wall. Now, you have to figure out how to cross over to the other side.

Browsing: Smart Investing

Singapore’s largest lender reported a blowout quarter with earnings way above analysts’ expectations.

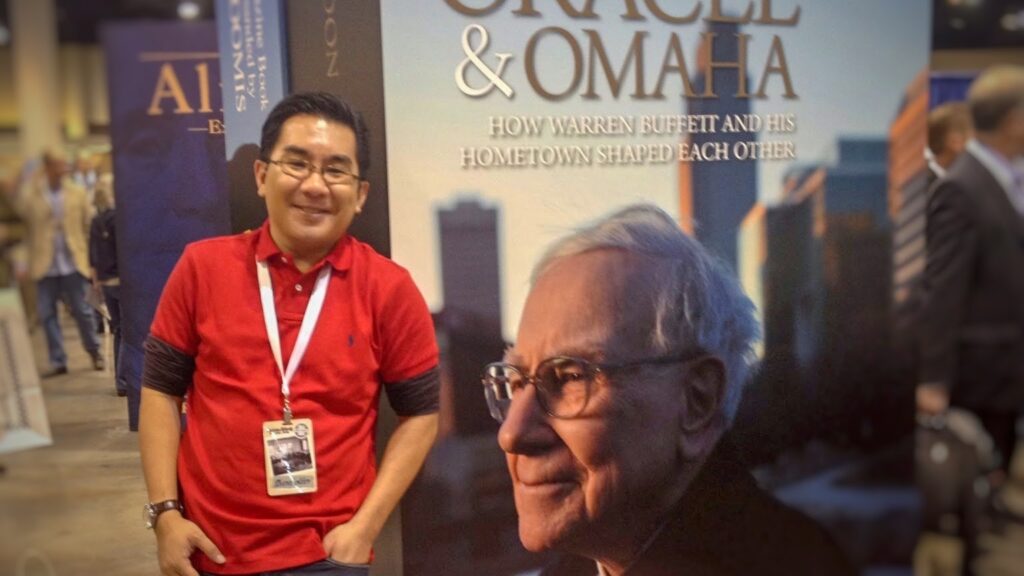

Here I was in Omaha, at the centre of the Woodstock for Capitalists, eight years ago. There is no event that comes close to this AGM.

These five companies have what it takes to continue growing despite the crisis.

Know which investing discipline is best for you; do not lurch aimlessly from one transaction to the next.

Millennials who are targeting to retire with a million dollars should consider these three key steps.

Learning from someone who has achieved financial success is an effective way to prepare for your retirement.

Here are five REITs that reported a jump in their year on year distributions.

Here are five pieces of investment wisdom from the Oracle of Omaha that can help you to invest better.

These four companies have shown an impressive track record of growth.

The news just keeps getting better as the financial technology company reports another strong set of earnings.

The offshore and marine giant reported better financial results, though uncertainties remain.

It’s crucial to pick up cues on management’s behaviour to get insights on the companies you own.

We conclude our three-part series on REITs by describing ways they can grow and the risks associated with them.

The Deliveroo IPO debacle should not be seen as a barometer of future stock market listings for a few reasons.

The airline continues to burn cash as it engages in cost-cutting measures.

Here are five stocks that income-seeking investors should put on their watchlists.

Here are three businesses that will provide a great mix of growth and dividends.

You don’t make money from buying stocks; you make money from holding them.

These three businesses will benefit from the expected rise in consumer demand as the world recovers from the pandemic.