As seen on:

As seen on:

Latest Articles

Three Singapore small caps are quietly positioning themselves to profit from AI’s insatiable appetite for chips, power, and precision tools.

The investor who reads is never surprised. The market goes up, they’re prepared. It goes down, they’re ready.

Big Tech is spending billions on AI. Here’s how Meta, Microsoft and Alphabet are already turning AI hype into real revenue and profits.

For income investors, the sweet spot lies between yield and growth, and these three Singapore stocks strike that balance in 2026.

CICT and FCT are popular income REITs, but a closer look at fundamentals reveals which may offer stronger long-term value.

With the local market’s board lot size planned for another reduction since 2015, higher-priced stocks with great fundamentals are poised to benefit from the increased liquidity.

Popular

We highlight four solid blue-chip names that you can buy and safely own for the rest of your life.

ST Engineering and Sembcorp are both climbing on strong earnings, but which industrial giant offers better value and long-term upside for investors today?

Falling rates don’t have to mean falling income. These Singapore banks show why dividends may still hold up.

Watch our webinar replay to learn how investors can approach dividends, REITs and blue-chip stocks in Singapore for 2026.

Stocks

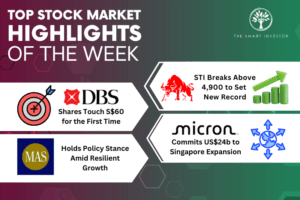

A record-breaking week saw the STI cross 4,900, DBS hit $60, MAS hold policy steady, and Micron commit US$24 billion to expand its Singapore operations.

Keppel DC REIT and Keppel Corporation offer very different risk-return profiles — here’s how to decide which Keppel stock best fits your investment goals.

Get Smart: When Your Dividend Stocks Disagree: A Masterclass in Portfolio Diversification

Dividend changes aren’t always good or bad. Here’s what DBS, OCBC and UOB’s different dividend moves really reveal about strategy and strength.

Bear markets can feel terrifying, but selling everything at the wrong time may do more harm than good — here’s how smart investors respond when markets fall.

Getting Started

Here are some simple steps to generate a sustainable, double-digit dividend yield.

When Singaporean investors look at Malaysia, many are turned off by the risks. Others, like my co-founder David Kuo, see an opportunity.

Will Singapore’s Budget 2025 revitalize SGX and attract new listings?

This Valentine’s Day, why not think about your shared financial future?