As seen on:

As seen on:

Latest Articles

October brings fresh opportunities for dividend investors as we look at three Singapore REITs that stand out in a changing market landscape.

Singapore’s push towards net-zero by 2050 is opening up fresh opportunities. Discover three Singapore-listed companies that could benefit from the nation’s green transition.

The STI’s 30 blue chips are the backbone of Singapore’s market. Here’s a breakdown of what is inside.

As we enter the easing cycle will DBS or OCBC come out on top?

Alibaba’s stock has staged an impressive rebound, climbing sharply after its latest earnings call. The numbers themselves were hardly eye-catching, but investors focused on something different.

Beyond Singapore’s blue-chip names lies three hidden Singapore stocks rewarding investors with dividends this October.

Popular

Diversified REITs can provide resilience during real estate downturns.

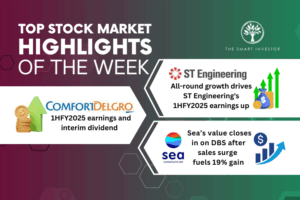

We review a slew of earnings reports from a land transport giant and an e-commerce behemoth.

The STI is above 4,200. Here’s what you need to know before the next move.

The STI is at new highs, but can it last? Watch our webinar recording to get a strategic edge and navigate the opportunities and risks ahead.

Stocks

Mapletree Industrial Trust provides AI exposure, while Mapletree Logistics Trust offers e-commerce exposure. In a world of lower interest rates, which REIT will be a better buy now?

Three dependable dividend stocks show how investors can build steady, lasting income – and why living off dividends alone isn’t a dream.

Singapore REITs promise income and growth, but false assumptions about them could be sabotaging your portfolio performance.

These four Singapore dividend stocks have proven they can outpace inflation and protect your income.

Getting Started

The recent rise in bond yields has certainly put the cat among the pigeons. It has ruffled a few feathers by raising the spectre of inflation.

This is how you can generate a stream of passive cash flow that will pay you for life.

In the second part of this series, we take a look at two other investment options for the CPF Investment Account.

This guide explains the difference between growth and income investing.