As seen on:

As seen on:

Latest Articles

US tech giants Meta, Alphabet, and Microsoft posted strong results, proving AI investments are fueling profits.

From property to commodities, these four Singapore companies just released earnings that highlight resilience amid global headwinds.

November’s earnings trifecta could reshape dividend expectations—with one bank defying gravity, one REIT bleeding cash, and one telco juggling profits with public outrage.

Singapore’s Straits Times Index (SGX: STI) has a weight problem: three banks control half the index, but growth may have to come from somewhere else.

This week’s Smart Reads highlights REIT earnings, bank strength, and CPF-friendly stocks. We also feature cash-rich small caps, telcos evolving beyond 5G, and US tech giants powering the next market rally.

A week of turning points: the Fed cuts rates, Nvidia crosses US$5 trillion, Amazon trims jobs, Coliwoo lists, and SGX RegCo introduces flexible new listing rules.

Popular

CAREIT(SGX: 8C8U) made a strong IPO debut with its price up over 6%. Yields look appealing, but here are 3 things investors should take note of.

Here’s why diversification is important in investing and how you can achieve it for your investment portfolio.

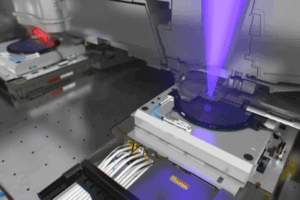

Every smartphone in your pocket, every car with advanced electronics, and every server that powers the internet relies on one company’s machines. That company is ASML.

Singapore blue-chips outpaced the STI in September 2025, proving that smart stock selection still matters in a record-high market.

Stocks

Starting with S$10,000? You do not need complicated strategies or dozens of stocks. This five-step guide shows you how to set your investment goal, choose the right mix of companies, build a strong core with Singapore stocks and stay invested with confidence through 2026 and beyond.

Seatrium wins BP deepwater contract, Apple nears smartphone lead, Alibaba’s cloud grows on AI demand, and Jardine Matheson maintains guidance.

Here’s how to turn small, steady investments into a reliable dividend stream — one month, one stock, one payout at a time.

Discover the three Singapore dividend stocks to watch this December as resilient earnings, steady cash flows and smart capital allocation support sustainable payouts.

Getting Started

Catch the recording of our recent REITs webinar here!

The first step towards becoming a better investor is in recognising the importance of making mistakes. The next is in internalising them into your investment process.

Investing in banks means you have to not just look at their performance, but also at the overall economic landscape.

Here are some valuable lessons you can learn from the past regarding bear markets.