As seen on:

As seen on:

Latest Articles

Discover three high-quality US dividend stocks that combine stable payouts, global growth, and long-term compounding potential — ideal additions for Singapore investors seeking income diversification.

Singapore Airlines (SGX: C6L) is not the only travel stock in town. Investors may want to consider SATS Ltd (SGX: S58) and SIA Engineering (SGX: S59) too.

With interest rates expected to ease, these three Singapore REITs — CICT, FCT and Parkway Life REIT — look poised to raise their dividends in 2026

This week’s Smart Reads highlights cash-rich dividend stocks, blue chips with 2026 growth potential, REITs poised for recovery, and the CPF salary cap change. We also review small-cap outperformers and overlooked growth names with long-term upside.

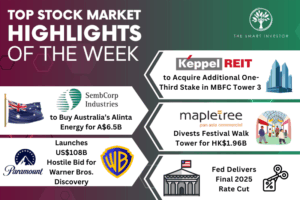

Two companies and a REIT make major acquisition bids as another REIT divests its assets.

The Trade Desk has plunged 67% this year, but the business tells a different story. We explore whether this former growth star is breaking down or setting up for a long-term recovery.

Popular

Singapore’s market saw fresh catalysts this week – from REIT moves and index reshuffles to resilient earnings and a new IPO hitting the market.

Markets are at new highs and portfolios are in the green, but what should investors do next? Buy more, take profit, or hold steady? Here’s how quality dividend stocks and a long-term mindset can guide your next move.

OCBC reported steady 3Q earnings as record non-interest income offset margin pressures and supported the bank’s overall performance.

The path to STI 10,000 runs through just 10 stocks. Here’s what needs to happen.

Stocks

Markets rise and fall, but blue-chip stocks Singapore continue to anchor portfolios. Here’s why they remain the bedrock of investing in 2026.

MAS’s S$5 billion support for local equities could lift selected dividend stocks, and we highlight three Singapore names positioned to benefit.

DBS, Singtel, and ST Engineering are trading near multi-year highs, but fundamentals could be keeping these blue-chips’ momentum alive.

We highlight four solid blue-chip names that you can buy and safely own for the rest of your life.

Getting Started

Planning for retirement? Here is how to create multiple sources of income on top of payouts from your CPF Life.

Becoming a millionaire and retiring as early as possible is a common goal for many people.

Investing well in a time of turbulence requires more than talent. Here’s what you can do to improve your chances.

We explain why bonds are becoming increasingly attractive in a climate of rising interest rates and provide reasons why they are a good addition to investors’ portfolios.