As seen on:

As seen on:

Latest Articles

MAS’s S$5 billion support for local equities could lift selected dividend stocks, and we highlight three Singapore names positioned to benefit.

DBS, Singtel, and ST Engineering are trading near multi-year highs, but fundamentals could be keeping these blue-chips’ momentum alive.

These three Singapore blue-chip stocks could be well-positioned for steady growth and resilient earnings as the market heads into the year ahead.

This week’s Smart Reads focuses on cash-rich companies with rising dividends, defensive stocks for 2026, and blue chips to own ahead of earnings season. We also look at DBS at all-time highs and REITs to watch in January.

We highlight four solid blue-chip names that you can buy and safely own for the rest of your life.

Singapore market highlights featuring the SGX Stock Exchange rebrand and strategic portfolio moves by CapitaLand India Trust and CapitaLand Investment.

Popular

With interest rates expected to ease, these three Singapore REITs — CICT, FCT and Parkway Life REIT — look poised to raise their dividends in 2026

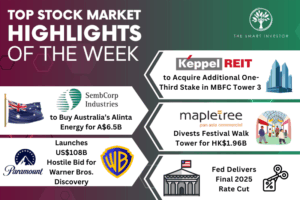

Two companies and a REIT make major acquisition bids as another REIT divests its assets.

These three Singapore stocks are hitting record highs. Dive into their backgrounds, what’s driving their gains, and whether they still offer value for investors in today’s market.

As interest rates peak and economic growth stabilises, these four Singapore REITs could be among the first to benefit from a sector recovery in 2026.

Stocks

The investor who reads is never surprised. The market goes up, they’re prepared. It goes down, they’re ready.

Big Tech is spending billions on AI. Here’s how Meta, Microsoft and Alphabet are already turning AI hype into real revenue and profits.

For income investors, the sweet spot lies between yield and growth, and these three Singapore stocks strike that balance in 2026.

CICT and FCT are popular income REITs, but a closer look at fundamentals reveals which may offer stronger long-term value.

Getting Started

There are over 500 stocks that make up the S&P 500 index. The Magnificent 7 account for over 31% of its weightage.

With interest rates poised to head lower, this could be a good chance to invest in different sectors for long-term upside.

How has the US stock market historically performed when the Federal Reserve had cut interest rates?

August was a wild ride for the stock market. We will recap some of the most influential events of the month.