As seen on:

As seen on:

Latest Articles

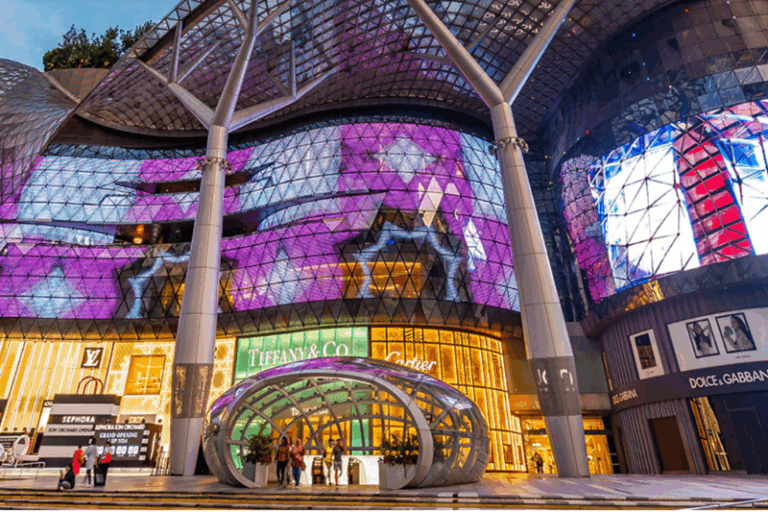

All three Mapletree REITs are in the midst of strategic portfolio reshuffles. Here’s what to look for when they report results in late January.

We break down how everyday investors can start building durable, long-term dividend income today.

This week’s Smart Reads focuses on dividend stocks positioned for falling rates, blue chips benefiting from structural tailwinds, and promising ideas for 2026. We also compare OCBC, CICT, and Alphabet after strong runs.

Retail strategy shifts, explosive software earnings, a fresh IPO, and a Trump-fuelled rally defined this week’s biggest stock market developments.

Two retail giants with very different business strategies. Which company offers the best value for you?

These five income stocks offer yields higher than CPF’s 2.5 to 4% and provide investors with opportunities for stronger long-term passive income.

Popular

Singapore bank stocks are trading near record highs. Here’s what could drive returns and dividends in 2026, and what risks investors should watch.

Markets rise and fall, but blue-chip stocks Singapore continue to anchor portfolios. Here’s why they remain the bedrock of investing in 2026.

DBS, Singtel, and ST Engineering are trading near multi-year highs, but fundamentals could be keeping these blue-chips’ momentum alive.

These three Singapore blue-chip stocks could be well-positioned for steady growth and resilient earnings as the market heads into the year ahead.

Stocks

ST Engineering’s special dividend has caught the attention of many investors. But is this payout a genuine opportunity or a one-off boost already priced in?

2026 is testing investor conviction, but long-term investing continues to work by leaning on time, business fundamentals, and income rather than prediction.

DBS is a long-term blue-chip favourite, but price still matters — here’s a simple framework to help investors calculate a sensible entry price.

Explore how 3 blue-chip Singapore REITs are pivoting strategies to safeguard unitholder distributions during this upcoming earnings week.

Getting Started

It is important to be realistic, especially about valuations, when we invest.

Women are great at saving but often miss out on investing. Learn why investing is essential for financial security and how to get started today.

“Read last year’s market predictions and you’ll never again take this year’s predictions seriously.” — Morgan Housel

S$1,000 may not seem like much in today’s inflationary environment, but it’s enough to start investing in the stock market. This guide will show you practical steps on how you can invest with just S$1,000.