Discover five cash-rich Singapore companies with strong balance sheets, dependable earnings and rising dividends — ideal for investors seeking long-term stability and steady passive income.

Browsing: Smart Analysis

Three blue-chip REITs enter January 2026 with pivotal earnings releases that could signal whether their turnaround strategies are gaining traction.

These STI stalwarts are poised to outperform.

A roundup of key market moves this week, from industrial expansion and asset divestments to major tech acquisitions and new contract wins.

Three Singapore small-cap stocks that new investors can study for insights into fundamentals, resilience, and how smaller companies can support a diversified portfolio.

The best investment lesson from 2025 was about accepting what we know and don’t know.

Discover three reliable dividend-paying stocks that offer stable, long-term passive income — helping retirees build financial security without taking unnecessary risks.

Unlock Asia’s next growth wave with these 3 healthcare stocks.

The government’s equity stimulus could reshape market sentiment, but its impact on dividends for retail investors deserves closer scrutiny.

A quiet SGX holiday week saw a surprise REIT takeover bid, debt relief for Manulife US REIT, and NVIDIA’s largest-ever US$20 billion AI acquisition.

Three dividend-paying small caps positioned to capture the Christmas spirit—from chocolate treats to luxury timepieces.

These small-cap REITs yield 7% or more—but are the payouts sustainable?

Three blue-chip stocks have seen their stock price languish, trailing the broader market. Has the market gotten it wrong?

Learn what Free Cash Flow really means, why investors prioritise it over earnings, and how it reveals the true strength of a business.

Here’s where Singapore’s blue-chip REITs are finding growth.

Discover five global dividend stocks that offer stable income, resilient cash flows, and long-term diversification beyond Singapore’s market.

Three Singapore blue chips delivered standout first-half results—here’s what dividend investors need to know.

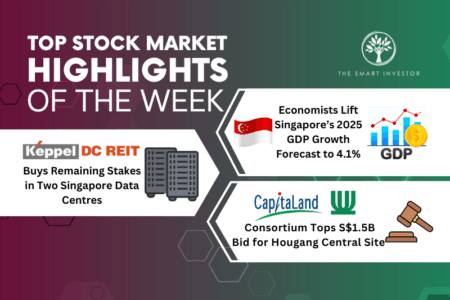

On the dock: Singapore’s economic growth forecast, a data centre REIT’s acquisition of remaining stakes in two properties, and a consortium’s top bid for a mega mixed-use project.

December spending adds up fast. Steady dividends from strong Singapore stocks can feel like a quiet Christmas bonus when it matters most.

Can these three Singapore blue-chip stocks ride the market momentum into a year-end rally? We look at their fundamentals and what could drive their next leg up.