Here are four stocks that have declared higher dividends this earnings season.

Browsing: Smart Analysis

Income investors should focus on these three REITs, which boast strong sponsors and a good distribution yield.

With Singapore expecting higher levels of tourism in the coming years, here are five stocks that look set to ride on this positive trend.

These five blue-chip stocks’ share prices have done exceptionally well this year. So, should they be included in your investment portfolio?

Here are five promising companies that you can consider buying to help you further diversify your portfolio.

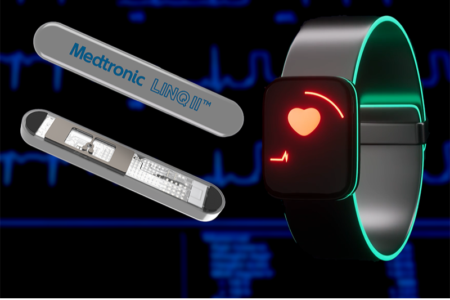

Here are three healthcare stocks that could prove resilient against Trump’s raft of tariffs.

After announcing its five-year targets, the engineering firm just released its latest business update.

These five REITs have strong operational attributes that should allow them to do well.

We look at the latest earnings from Singapore’s sole postal service provider and a land transport giant.

Let compounding take place over generations to allow your generational wealth to multiply.

The hospitality REIT is looking at its second privatisation attempt by its sponsor.

Both superpowers have agreed to reduce tariffs, so is the coast clear for buying stocks?

We sifted out five REITs that paid out higher distributions despite the macroeconomic headwinds.

Income investors can look forward to higher dividends from these four companies when they release their results later this month.

These blue-chip stocks can offer attractive dividend yields for income investors.

Here are three attractive stocks that will give you exposure to the booming artificial intelligence sector.

Here are five US growth stocks you can consider adding to your portfolio.

The REIT sector continues to face headwinds, but does this mean that income investors should avoid Singapore REITs altogether?

With the three Singapore banks having announced their earnings, which is the best bank to choose from?

Stock-market volatility is only a problem if we do not know what we are invested in. Consequently, income investors should focus on cash flow.