Reliable dividends don’t come from chasing the highest yield. These four Singapore stocks stand out for consistency, cash flow strength, and disciplined payouts.

Browsing: Yahoo

Boost your passive income with these eight Singapore dividend stocks for the Year of the Fire Horse.

Discover 5 disciplined habits to harness the 2026 “Fire Horse” energy. Huat ah!

The Year of the Red Fire Horse symbolises strength, resilience, and forward momentum. These Singapore blue chips stand out for their staying power and ability to thrive across market cycles.

Investors seeking 5%+ yields beyond the STI can find opportunity in these three Singapore stocks with dividend sustainability at their core.

With markets evolving and interest rates shifting, investing a lump sum in 2026 requires balance.

Budget 2026 expands the EQDP to S$6.5 billion, boosting Singapore equities and shining a spotlight on high-yield “Next 50” mid-cap stocks.

These five Temasek-owned Singapore blue chips combine income, recovery potential, and long-term growth, making them worth a closer look for investors building a resilient portfolio.

This week’s Smart Reads covers dividend stocks to buy with S$10,000, blue chips raising payouts, and whether CPF investing can outperform over time. We also examine stocks at multi-year highs and the AI cloud race.

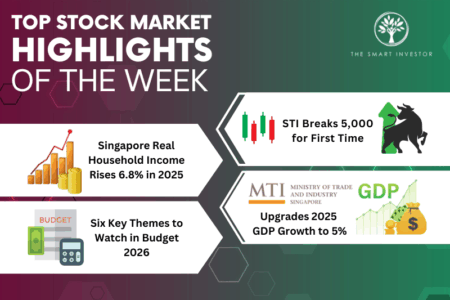

STI hits historic 5,000 as Singapore raises GDP forecasts and gears up for the 2026 Budget announcement.

Reaching S$1,000 a month in dividends before 60 is achievable with discipline, realistic assumptions, and the right mix of income-generating assets.

As stock markets rise, so does your anxiety to sell.

Learn why these three Singapore blue-chip REITs are increasing payouts and if their dividend growth is sustainable for 2026.

We analyze the latest earnings for Singtel, StarHub, Prime US REIT, and CapitaLand Investment to see how these four Singapore stocks are navigating current market headwinds.

S-REITs offer opportunity in 2026, but avoiding common income pitfalls remains crucial for building resilient dividend portfolios.

Discover three Singapore dividend stocks hitting their stride this Chinese New Year.

Hongkong Land’s share price is hitting 52-week highs, but long-term investors should look beyond price action to assess whether the business still merits holding.

Start your investing journey with these five simple metrics to quickly assess business quality and long-term potential.

Some REITs may stand to benefit from the Ministry of Trade and Industry’s newly released industrial land through its Industrial Government Land Sales (IGLS) programme.

Many investors leave their CPF untouched. This article explores why long-term investors consider using CPF to invest in stocks and how compounding can change retirement outcomes.