As seen on:

As seen on:

Latest Articles

While retiring early is alluring, is it really for you?

With the earnings season coming to a close, we single out four attractive blue-chip stocks that saw an increase in profits.

Discover the 3 cutting-edge digital health companies transforming the medical space.

Want monthly income from your investments? See how DBS, Singtel, and ST Engineering can anchor a steady Singapore dividend portfolio.

These five stocks have performed well this year, but can they continue to do so? Read on to find out.

This week’s Smart Reads features Singapore REITs with yields above 5%, US growth stocks paying rising dividends, and Warren Buffett’s latest healthcare bet. We also cover Singapore companies raising dividends, opportunities in AI and energy, and how to earn like a landlord without owning property.

Popular

Investors can utilise this attractive mix of growth and income to boost their investment portfolio.

These three stocks can help you weather tough macroeconomic conditions while dishing out attractive dividends.

Over the past decade, a blue chip stock quietly delivered a 253% return and rewarded patient investors.

With these five stocks hovering at year-highs, should you sell them, hold for better upside, or buy even more? Read on to find out.

Stocks

Singapore’s Straits Times Index (SGX: ^STI) closed above the 4,400 level last Friday, a historical high after advancing approximately 16.5% in 2025.

If you look beyond the STI, there is a whole universe of stocks that may be worth discovering.

Lower interest rates make high yields (>5%) more attractive .

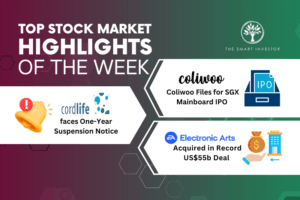

From a record-breaking gaming industry buyout to significant regulatory action in Singapore’s healthcare sector, this week delivered major corporate developments across diverse industries.

Getting Started

Two REITs and a major Singapore telco are down from their highs. But is this an opportunity for you to buy these companies?

Imagine if you only worked one day in a year and your portfolio outperformed most fund managers. One fund manager shows us how it can be done.

Taking too much risk can lead to sizeable losses. But taking too little risk can lead to mediocre results. So, what is a Smart Investor to do?

We tend to forget that public transport companies are no different to other businesses – they must be profitable.