As seen on:

As seen on:

Latest Articles

Here are five stocks that will dish out dividends this month.

As several Singapore blue-chip stocks are hitting 52-week highs, those chasing greens in stock charts…

Are these three stocks an opportunity to buy low, sell high, or are they unsuspecting traps?

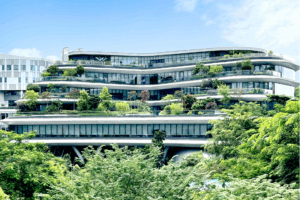

With the market pricing in interest rate cuts soon, real estate investment trusts (REITs) could be among the first to benefit.

This week brought a mix of winners and losers. Singapore blue chips posted both profit growth and post-earnings declines, while several local stocks hit fresh 52-week highs. Globally, Nvidia delivered strong results and Sea Limited overtook DBS as Singapore’s largest company.

We look at the latest integrated healthcare project from an established healthcare player and a lawsuit brought about by a blue-chip company.

Popular

The REIT sector has endured nearly three years of pessimism, but could the tide finally be turning?

These stocks are flying higher, but should they appear on your buy watchlist?

We look at the Singaporean businesses that qualify to be in the coveted Southeast Asia’s Top 500 list.

Here are some key advantages that REITs have over owning physical investment property.

Stocks

If semi-annual reporting makes you nervous about a stock holding, that’s not a reporting problem — it’s a conviction problem.

It’s a milestone that has investors asking: How much higher can this go?

October brings fresh opportunities for dividend investors as we look at three Singapore REITs that stand out in a changing market landscape.

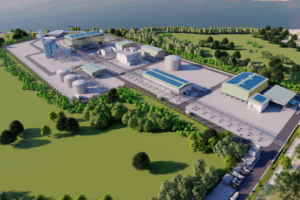

Singapore’s push towards net-zero by 2050 is opening up fresh opportunities. Discover three Singapore-listed companies that could benefit from the nation’s green transition.

Getting Started

SGX RegCo has established a working group to study how Singapore’s retail bonds market can be improved. Here are my suggestions for investor-education.

Why you should be checking the dividend payout ratio before you buy your next dividend stock. And more.

A story of how SBS Transit Ltd (SGX: S68) went from a non-performer to a top performer in a matter of months. And our patience paid off.

An aggressive marketing campaign in the heart of CDB has Jeremy Chia up in arms. Here’s what he has to say.