As seen on:

As seen on:

Latest Articles

Can dividends beat inflation on their own? We take a look at CICT, DBS, OCBC and Parkway Life REIT to show which yields actually sustain.

Despite market headwinds, these five Singapore REITs delivered higher DPUs, showing that quality assets and prudent management still pay off.

As the saying goes, cash is king — but which US companies have that in abundance?

Having recently raised its payout, we examine if CapitaLand Integrated Commercial Trust is a buy here.

These five dividend-paying Singapore stocks are knocking on the door of the coveted Straits Times Index.

Asia’s tourism industry is booming again, with airlines, hotels, and leisure businesses set to benefit. The key for investors is identifying which stocks can ride this powerful wave of growth.

Popular

Looking for safe investments for beginners? Blue-chip stocks are reliable, long-term investments backed by strong, established companies. Known for stability, steady growth, and regular dividends, they’re a smart choice for building wealth without unnecessary risk.

Just as United Healthcare hits its lowest point in years, Warren Buffett makes his move.

Diversified REITs can provide resilience during real estate downturns.

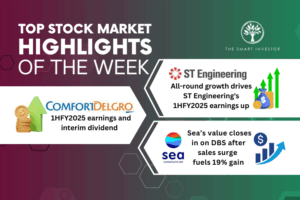

We review a slew of earnings reports from a land transport giant and an e-commerce behemoth.

Stocks

Find out which three lesser-known Singapore dividend stocks can strengthen, diversify and boost your retirement income beyond the traditional STI names.

Chasing high yields can be tempting, but it often leads to painful losses. Here are three common mistakes income investors make and how to avoid them.

The best dividend portfolios do more than survive market cycles. They grow stronger with time. Here are five simple rules to help you build one that lasts a lifetime.

Which growth stock stands to achieve better returns in 2026?

Getting Started

We tackle this tough question as both good and bad news regarding the pandemic continue to flow in.

In many ways, SaaS applications are tailor-made for the pandemic as more and more processes have to be moved online to keep businesses running.

As demographics, population sizes and languages are different, it should not be surprising that needs and wants differ according to countries.

Should investors consider investing in conglomerates? We take a look at some aspects of these behemoths.