As seen on:

As seen on:

Latest Articles

Three Singapore blue chips delivered standout first-half results—here’s what dividend investors need to know.

This week’s Smart Reads looks at whether SGX’s rally signals a dividend boom, income stocks yielding more than banks, and REITs that could raise payouts in 2026. We also cover special dividends, quarterly-paying stocks, and US dividend names worth knowing.

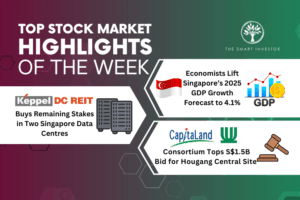

On the dock: Singapore’s economic growth forecast, a data centre REIT’s acquisition of remaining stakes in two properties, and a consortium’s top bid for a mega mixed-use project.

December spending adds up fast. Steady dividends from strong Singapore stocks can feel like a quiet Christmas bonus when it matters most.

Can these three Singapore blue-chip stocks ride the market momentum into a year-end rally? We look at their fundamentals and what could drive their next leg up.

As the year ends, here are five simple but powerful steps every investor should take to strengthen their portfolio and prepare for 2026.

Popular

These three REITs could potentially provide investors with stable monthly income

With the STI hovering at 4,500, investors are asking whether Singapore’s market is on the verge of a breakout or due for a pause.

Discover three under-the-radar Singapore stocks delivering dividend yields higher than the STI and offering attractive opportunities for income investors.

Singapore’s three local banks — DBS, OCBC, and UOB — have all submitted their final…

Stocks

MAS’s S$5 billion support for local equities could lift selected dividend stocks, and we highlight three Singapore names positioned to benefit.

DBS, Singtel, and ST Engineering are trading near multi-year highs, but fundamentals could be keeping these blue-chips’ momentum alive.

We highlight four solid blue-chip names that you can buy and safely own for the rest of your life.

Singapore market highlights featuring the SGX Stock Exchange rebrand and strategic portfolio moves by CapitaLand India Trust and CapitaLand Investment.

Getting Started

We can’t control the price of a share, but we have control over our choice of companies to invest in.

Wondering how you can generate new investment ideas? Here are several methods you may wish to try out.

Statistics and numbers from the past inform you on how to invest for the future.

Here are several useful investment resolutions you can make for the New Year.