As seen on:

As seen on:

Latest Articles

Sheng Siong’s Share Price is Hitting an All-Time High: Can the Supermarket Operator Continue to Shine?

We explore Sheng Siong’s expansion plans to determine if its share price can continue to climb.

This week’s Smart Reads covers five dividend-paying blue chips, the impact of Trump’s tariffs on Singapore banks, a REIT comparison, and key earnings updates for investors to watch.

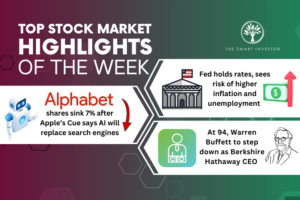

Top Stock Market Highlights of the Week: US Federal Reserve, Alphabet and Warren Buffett

We look at the latest US central bank’s interest rate decision and how Apple intends to compete with Google.

There’s nothing like Berkshire Hathaway’s AGM, the Woodstock for Capitalists.

Singapore’s three major banks — DBS, UOB and OCBC — just released their Q1 2025 results. Despite global uncertainties, all three posted resilient performances, with DBS and OCBC beating profit forecasts. Here’s how each bank fared and what it means for investors.

These four stocks are doing well, but should they become a part of your investment portfolio? Let’s find out.

Popular

We compare two CapitaLand REITs to see which makes the better investment.

The bellwether index is attempting to break its all-time high, but can 2025 be the year when this happens?

We have faith that these four stocks can up their dividends next year.

4 Singapore Blue-Chip Stocks with Dividend Yields Higher Than Your CPF Ordinary Account

We feature four promising blue-chip stocks that provide you with a better dividend yield than your CPF account.

Stocks

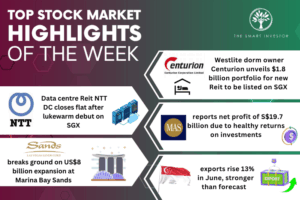

Top Stock Market Highlights of the Week: Centurion Accommodation REIT, NTT DC REIT, MAS, Marina Bay Sands and Singapore Exports

We look at a potential new REIT listing and the expansion of an iconic property along Singapore’s skyline.

These local transport businesses are resilient and provide a decent dividend yield.

These three dividend-paying stocks are a surefire way to start building your reliable passive income stream.

Smaller, second-line stocks are seeing a surge in interest, resulting in some of them hitting their year-highs.