MAS’s S$5 billion support for local equities could lift selected dividend stocks, and we highlight three Singapore names positioned to benefit.

Browsing: Smart Analysis

DBS, Singtel, and ST Engineering are trading near multi-year highs, but fundamentals could be keeping these blue-chips’ momentum alive.

We highlight four solid blue-chip names that you can buy and safely own for the rest of your life.

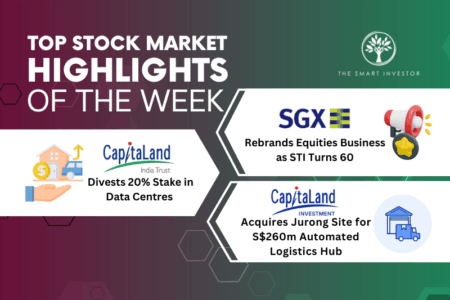

Singapore market highlights featuring the SGX Stock Exchange rebrand and strategic portfolio moves by CapitaLand India Trust and CapitaLand Investment.

ST Engineering and Sembcorp are both climbing on strong earnings, but which industrial giant offers better value and long-term upside for investors today?

Falling rates don’t have to mean falling income. These Singapore banks show why dividends may still hold up.

Forget headline yields as these under-the-radar Singapore stocks rely on real free cash flow to fuel sustainable passive income.

Watch our webinar replay to learn how investors can approach dividends, REITs and blue-chip stocks in Singapore for 2026.

This investing mistake looks harmless at first, but has lasting consequences for many Singapore investors.

These three Singapore stocks combine fortress balance sheets with yields above 5%.

These five stocks should allow you to sleep soundly at night while collecting attractive dividends.

With a solid yield now, investors ask: can CapitaLand Integrated Commercial Trust (CICT) sustain its payout through 2026 and beyond?

Most new investors lose money not because markets are unfair, but because they fall into the same predictable traps early on.

Here are four Singapore REITs to watch in January 2026 and what makes them stand out for long-term income investors.

Discover the three cash-rich Singapore stocks that pay yields higher than CPF, backed by strong balance sheets and resilient cash flows.

These three defensive Singapore stocks could help investors protect income and stability as markets stay volatile heading into 2026.

Looking to strengthen your passive income in 2026? These three dividend stocks could offer a reliable payout and steady cash flow as the new year begins.

REITs are often one of the first investments new investors consider. Here’s why they’re so popular – and what beginners should understand before buying their first REIT.

DBS just delivered another record quarter, backed by resilient income and strong dividends. But with the share price at all-time highs and interest rates easing, the bigger question is whether the fundamentals can keep up in 2026.

Discover five cash-rich Singapore companies with strong balance sheets, dependable earnings and rising dividends — ideal for investors seeking long-term stability and steady passive income.