We provide examples of industries and companies that pay out regular dividends.

Browsing: Investing Strategy

While cheap may imply that a stock is affordable, its fundamentals may not qualify it as a suitable investment idea.

Searching around for good blue-chip stocks? Here are three that should sit well in your CPF investment account.

Dependability of passive income is a key trait that investors should look for in a REIT.

The brokerages are playing catch-up with the swift rise in share prices of glove companies.

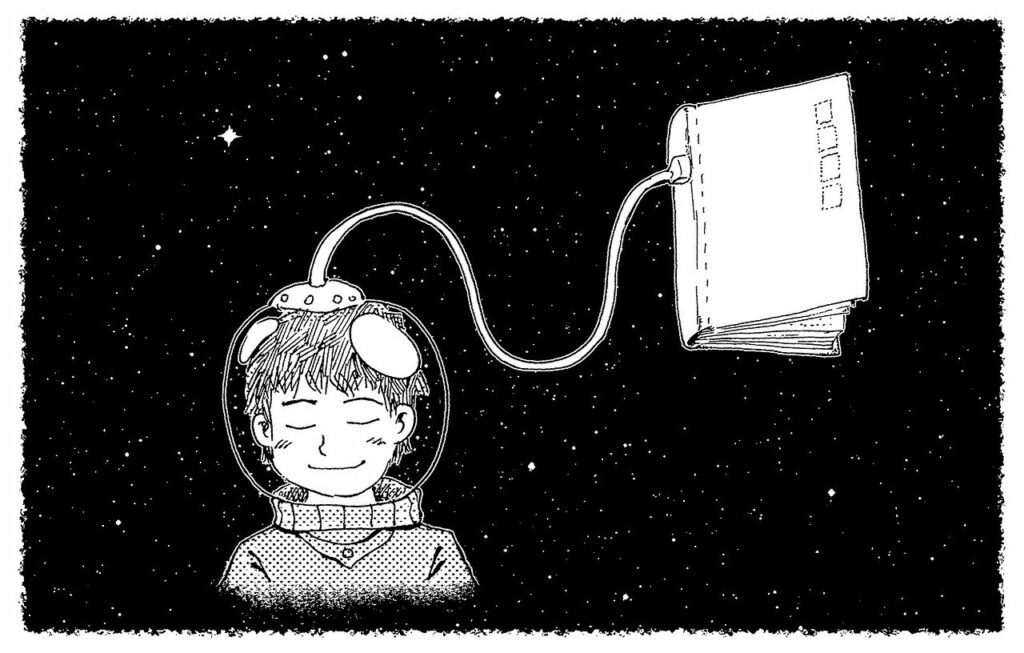

There are two kinds of problems in this world: puzzles and mysteries. Puzzles can be solved by collecting information. Mysteries, on the other hand, require insight.

Here are three ways you can ensure your investment portfolio holds up well during this pandemic.

If something seems too good to be true, then it probably is.

Unlike other asset classes, it does not reward you while you own it.

These three businesses are trading at their cheapest level in a year. But, are they value traps?

Are you confused by the stock market right now? Here’s some information to help you make better sense of things.

The legendary investor has made a move into commodities. How should you react?

With a wide range of businesses out there for selection, should you just stick to blue-chip companies?

We distill the essence of income investing for the uninitiated.

The telco continues to face pressure for all its business divisions.

These three emotions act as stumbling blocks to the success of your investment portfolio.

The pandemic may have radically altered the landscape for the healthcare industry. Does this company still have a compelling investment thesis?

Keen to find both blue-chip companies that pay out great dividends? We introduce three that should go into your watchlist.

Only six of the Straits Times Index (SGX: ^STI) companies have increased their dividends or kept it unchanged. What should you do?

COVID-19 has taught us two key investing lessons.