This week’s Smart Reads looks at blue-chip REITs and banks in focus, how to spot safe income stocks in 2026, and whether it’s too late to buy or sell names like DBS, SGX, and Nvidia.

Browsing: Yahoo

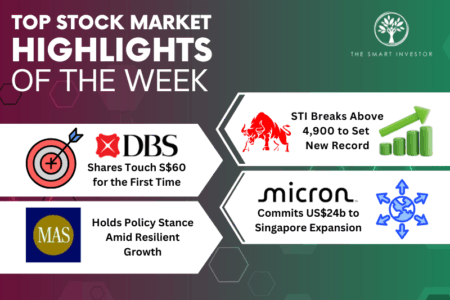

A record-breaking week saw the STI cross 4,900, DBS hit $60, MAS hold policy steady, and Micron commit US$24 billion to expand its Singapore operations.

Keppel DC REIT and Keppel Corporation offer very different risk-return profiles — here’s how to decide which Keppel stock best fits your investment goals.

Dividend changes aren’t always good or bad. Here’s what DBS, OCBC and UOB’s different dividend moves really reveal about strategy and strength.

Bear markets can feel terrifying, but selling everything at the wrong time may do more harm than good — here’s how smart investors respond when markets fall.

These three SGX-listed companies are set to reward shareholders next month – but their latest results reveal very different pictures of dividend sustainability.

Discover why small-cap stocks in Singapore are a smarter way to invest. Go beyond the STI to find quality businesses hiding in plain sight.

Transportation stocks may gain as part of a broader recovery taking shape across Asia’s tourism markets.

DBS shares are hitting record highs, but for long-term investors, the real question is whether selling now helps or hurts future returns.

NVIDIA’s meteoric rise has made it one of the world’s most valuable companies. We examine what’s driving its trillion-dollar valuation — and what investors should watch before deciding their next move.

Markets have changed in 2026. Here’s what investment strategies are delivering results today, and which approaches are quietly falling behind.

Three Singapore blue chips reached 52-week highs in January 2026, giving investors the dilemma of profit-taking versus long-term holding. We analyze the fundamentals, valuations, and strategic tailwinds driving these record prices.

DBS is near S$59. Is it time to lock in gains?

TSMC’s US$56 billion capex projection signals strong demand — here’s how tonight’s earnings from ASML, Microsoft, and Meta will reveal whether the AI investment thesis is paying off.

SATS’ latest results show rising profits, surging free cash flow, and a higher dividend. The question now is whether these improvements are enough to drive a sustained share price recovery.

With cash, we can easily position our portfolios to capture opportunities as and when they arise.

Hospitality REITs offer attractive income but higher volatility — here’s how to assess risks, cycles, and sustainability before investing in these Singapore-listed REITs.

SGX shares have rallied on stronger volumes and renewed market interest — but does the exchange still offer long-term upside for investors today?

As Singapore banks report their earnings, here’s what you should watch.

AEM and Venture are both Singapore tech manufacturers, but one offers higher growth and risk while the other delivers stability and dividends. Which suits you?