As seen on:

As seen on:

Latest Articles

If your purpose is to filter out dependable blue-chip stocks to include in your portfolio, these four deserve your attention.

This week’s Smart Reads covers dependable REITs for retirement, blue chips at record levels, mid-cap earnings growth, and US stocks with long-term potential, plus how falling rates could boost REITs.

Global markets delivered plenty of drama: Intel’s rally to multi-decade highs, TikTok’s US-China deal, and Singapore stocks and REITs took centre stage.

Here are several ways you can filter out promising growth stocks to add to your investment portfolio.

Centurion Accommodation REIT (CAREIT) will be the first pure-play living accommodation REIT to list on the Singapore Exchange.

A simple rule from Benjamin Graham that works just as well in the supermarket as it does in the stock market.

Popular

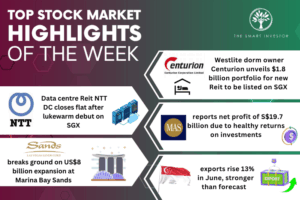

Top Stock Market Highlights of the Week: Centurion Accommodation REIT, NTT DC REIT, MAS, Marina Bay Sands and Singapore Exports

We look at a potential new REIT listing and the expansion of an iconic property along Singapore’s skyline.

These four REITs have the right attributes for a starter income investor’s portfolio.

5 Singapore Blue-Chip Stocks with Negative Year-to-Date Share Price Returns: Is it Time to Buy?

Even with the Straits Times Index hitting a new record high, these five blue-chip stocks saw their share prices languishing.

Earnings Preview: 4 Singapore Blue-Chip Stocks Well-Positioned to Increase Their Dividends

These four blue-chip stocks have a high probability of increasing their dividends during the upcoming earnings season.

Stocks

Looking for stable and consistent income from the stock market? Here are four long-term picks with high dividend yields.

Armed with unmatched AI capabilities, tech giants Amazon, Alphabet, and Microsoft are primed to lead the next market rally driven by strength, innovation and resilient earnings.

Cash-rich Singapore small-caps are standing out for all the right reasons. Backed by strong balance sheets, they’re paying consistent dividends and rewarding investors without compromising on growth.

These four quality Singapore stocks might offer better long-term returns than the safe, risk-free returns guaranteed by CPF.

Getting Started

It takes time, patience and experience to construct a portfolio you can be proud of.

It seems that some of us might have turned into amateur epidemiologists. We think we…

Things look awful right now, but patience is needed. Income investors should focus on businesses that can reward them in the long term, both in good and rough times.

The sharp market fall presents investment opportunities. But investors will need to choose the right investment puzzle to solve.