As seen on:

As seen on:

Latest Articles

Singapore’s IPO market has rebounded in 2025 — here are the key trends shaping the SGX and the standout debuts from Centurion Accommodation REIT, NTT DC REIT, Coliwoo, and Info-Tech Systems during the year.

CPF offers certainty and safety, while REITs provide higher income potential. As retirement planning evolves in 2026, we compare how each stacks up as a long-term income stream.

Singtel’s latest results show rising profits, stronger dividends, and improving balance sheet strength. The key question now is whether these gains mark a genuine turnaround that can finally translate into sustained share price momentum in 2026.

UOB and OCBC are among Singapore’s most reliable dividend banks. With interest rates expected to fall in 2026, we compare their yield potential, earnings outlook, and payout strength to see which bank currently offers a more compelling dividend profile.

A dividend yield above 5% can beat inflation, but only when payouts are backed by strong cash flow, resilient businesses, and sustainable fundamentals.

A 72.9% market share, a 70% payout ratio, and S$21.7 million in net cash – this unassuming Singapore stock has the makings of a retirement income compounder.

Popular

Three blue-chip stocks have seen their stock price languish, trailing the broader market. Has the market gotten it wrong?

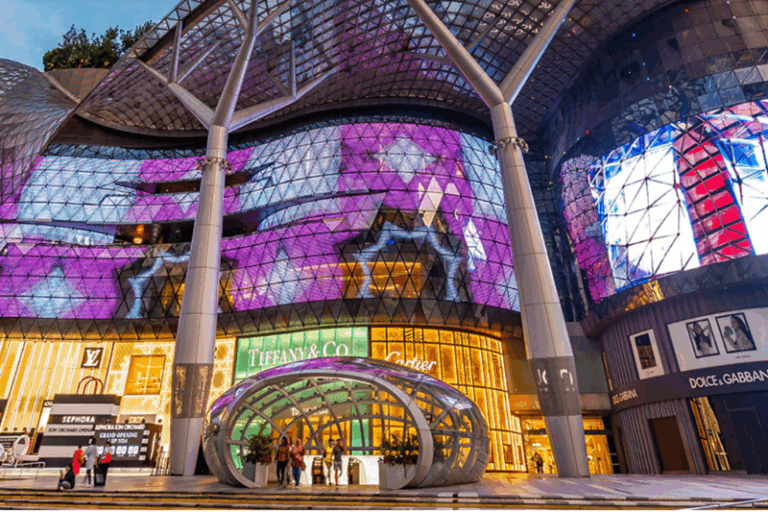

Here’s where Singapore’s blue-chip REITs are finding growth.

Three Singapore blue chips delivered standout first-half results—here’s what dividend investors need to know.

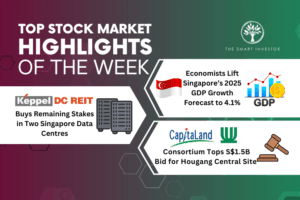

On the dock: Singapore’s economic growth forecast, a data centre REIT’s acquisition of remaining stakes in two properties, and a consortium’s top bid for a mega mixed-use project.

Stocks

AEM and Venture are both Singapore tech manufacturers, but one offers higher growth and risk while the other delivers stability and dividends. Which suits you?

In 2026, safe income stocks are defined by durability, cash flow and balance sheet strength — not headline yields.

All three Mapletree REITs are in the midst of strategic portfolio reshuffles. Here’s what to look for when they report results in late January.

We break down how everyday investors can start building durable, long-term dividend income today.

Getting Started

We explore the key information to look for when you are choosing an ETF to invest in.

How should you react to share price movements affecting the stocks within your portfolio? We take a closer look at what you can do.

How learning from winning stocks can lead to more winners.

Know the company you want to invest in so you can tell when a fall in its price comes from market pessimism or if there’s something wrong with the company.