Every few months, thousands of people await a single company’s results.

NVIDIA’s (NASDAQ: NVDA) earnings have grown into one of those events. What used to be a check-in on a chipmaker is now treated like a macroeconomic indicator.

That’s because the company sits at the centre of the AI boom, and its numbers tell us something crucial: whether the wave of capital expenditure (CapEx) from the world’s largest tech players is still rising or starting to stall.

The stakes are high.

Simply said, if hyperscalers such as Microsoft (NASDAQ: MSFT), Google (NASDAQ: GOOGL), and Amazon (NASDAQ: AMZN) keep pouring billions into NVIDIA’s GPUs, the AI build-out looks alive and well. If these orders slow, markets worry that the boom has peaked.

It may even trigger another sell-off in AI-related stocks.

This is why NVIDIA’s quarterly print often moves not just its own stock but also the broader NASDAQ and the S&P 500.

As I said, the stakes are high.

Headline Numbers

Total revenue for Nvidia came in at US$46.7 billion, up 6% quarter over quarter (QoQ) and 56% year over year (YoY).

Net income was US$26.4 billion, which was up 41% QoQ and 59% YoY.

This signals operational efficiencies, as its profit is growing faster than its revenue.

Diluted EPS was US$1.08, which was higher than analyst estimates of $1.01.

Gross margin saw an increase of 11.9 percentage points QoQ; however. it decreased slightly by 2.7 percentage points compared to a year ago.

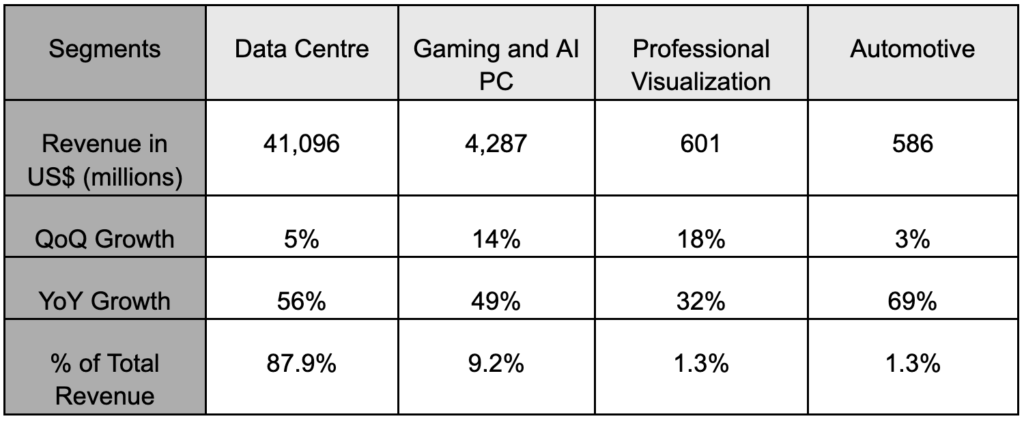

Growth across segments

Key Drivers

Nvidia’s strong year-on-year topline growth was driven by structural demand for accelerated computing platforms used for large language models (LLMs), recommendation engines, along with generative and agentic AI applications.

For the second quarter ended 27 July 2025 (2Q’FY25), Nvidia benefited from a US$180 million release of previously reserved H20 inventory connected to the sale of approximately US$650 million of H20 to an unrestricted customer outside of China.

The gross margin for the 2Q’FY25 decreased YoY due to product mix.

For context, Blackwell revenue comprised mainly of full-scale datacente

r systems with lower profit margins while last year’s Hopper HGX systems had higher profit margins.

Guidance & Outlook

For 3Q’FY25, revenue is expected to be US$54 billion, give or take 2% either way.

This estimate excludes H20 shipments to China.

During the earnings call, Nvidia said that between US$2 billion and $5 billion in H20 chips could be shipped to China in the current quarter.

The number depends on getting licenses from the US government, and clearances that only a “few” customers have received so far.

Moving down the line, GAAP and non-GAAP gross margins are expected to be between 73.3% and 73.5% respectively, plus or minus 50 basis points.

Market & Investor Reaction

Despite beating on revenue and EPS estimates, Nvidia’s stock price slid 3.1% in after-hours trading on Thursday morning, purportedly due to data centre revenue coming in slightly below expectation.

Get Smart: Priced to Perfection?

Nvidia’s latest earnings results suggest that the stock was priced for perfection.

Even a minor miss can shake investor confidence.

While the results were strong overall, the market reaction highlights how sensitive sentiment is, especially when data centre growth comes in a bit lighter than expected.

That said, growing data centre revenue by 56% year-over-year at this scale is nothing short of impressive and reinforces NVIDIA’s leadership in AI infrastructure.

Still, as the company gets bigger, maintaining that kind of growth will be harder, and future performance will depend heavily on flawless execution while navigating external challenges.

Big Tech is spending hundreds of billions on AI, and the ripple effects are just beginning. Our new investor guide shows how AI is changing the way companies generate revenue, structure their business models, and gain an edge. Even if you already know the major players, this report reveals something far MORE important: The why and how behind their moves, and what it means for your portfolio. Download your free report now.

Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!

Disclosure: Evan does not own any Nvidia Shares.