Singapore’s REIT landscape is about to welcome a unique player that’s anything but conventional.

Centurion Accommodation REIT (CAREIT) doesn’t offer shopping malls or office towers.

Instead, it’s carved out a distinctive niche as the first pure-play, purpose-built living accommodation REIT to list on the Singapore Exchange (SGX).

What exactly does that mean for dividend investors?

1. CAREIT’s Starting Portfolio

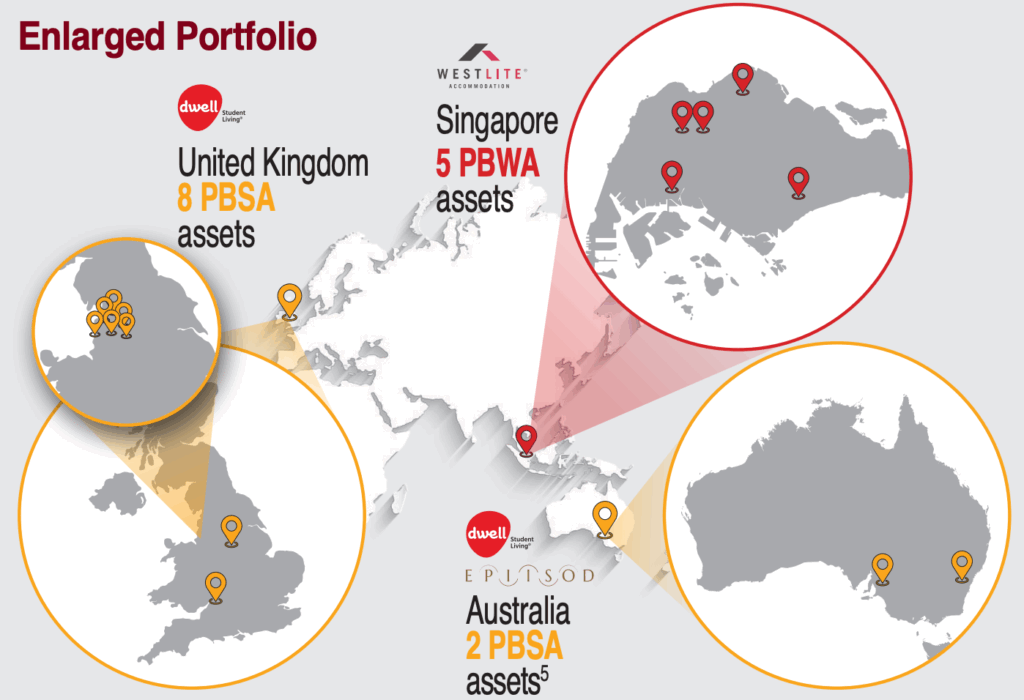

The REIT focuses on two specific asset classes that fly under most investors’ radars: Purpose-Built Worker Accommodation (PBWA) in Singapore and Purpose-Built Student Accommodation (PBSA) across the United Kingdom and Australia.

In layman’s terms, these are dormitories for foreign workers and student halls.

CAREIT will debut with 14 properties valued at approximately S$1.8 billion.

The portfolio breaks down into five PBWA assets in Singapore, eight PBSA properties scattered across UK university towns, and one PBSA property in Australia.

But here’s where it gets interesting: the REIT manager isn’t waiting around.

CAREIT has already signalled its growth ambitions by lining up the acquisition of Epiisod Macquarie Park, a student accommodation property in Australia.

Once this deal closes post-listing, the enlarged portfolio will comprise 15 properties worth approximately S$2.1 billion.

The growth initiatives don’t stop at acquisitions.

CAREIT is actively enhancing its existing assets to squeeze out more value.

Works at Singapore’s Westlite Toh Guan and Westlite Mandai are already underway, with these two properties alone expected to add over 5,400 beds to the portfolio by 2026.

For income investors, this represents something different: a REIT that generates rental income from essential accommodation.

Workers need beds near job sites.

Students need rooms near universities.

It’s a simple equation that promises to weather economic cycles better than other property sectors.

2. CAREIT’s Sponsor and Asset Pipeline

CAREIT comes backed by Centurion Corporation Limited (SGX: OU8), or CCL, the largest PBWA operator Singapore.

The numbers tell an important story.

CCL is stacked with S$2.6 billion in assets under management spanning Singapore, Malaysia, China, the UK, Australia, and the US.

As of 30 June 2025, the sponsor group owns and manages 37 operational accommodation assets totalling 70,291 beds.

To put that in perspective, CCL is seeding its REIT with a portion of its asset base — enough to show commitment while retaining plenty of dry powder for future injections.

CCL’s management is clear about its strategy (bolded for emphasis):

“Our focus remains on capital recycling and reallocation to drive growth in existing and new markets.

This approach includes exploring asset-light models while selectively pursuing development opportunities that are strategically sound.”

Translation for dividend investors?

The sponsor views this REIT as a vehicle for capital recycling – selling mature assets to the REIT while redeploying capital into new developments.

It’s a model that has worked well with REIT sponsors such as CapitaLand Investment (9CI).

Here’s the important part: CAREIT will have the Right of First Refusal (ROFR) from CCL for future acquisitions.

With the sponsor sitting on 37 assets and only injecting 14 at IPO, that’s a visible pipeline of properties that could potentially find their way into the REIT over time.

3. Post-IPO REIT Ownership

Here’s what demonstrates CCL’s commitment: post-listing, the sponsor will hold approximately 45.8% of the REIT’s units, making it the largest unitholder.

CCL plans to distribute a portion of these units to its own shareholders via a dividend-in-specie in 2026, after which it intends to maintain a 35% to 40% stake.

That’s significant skin in the game.

This move accomplishes two things: it rewards CCL shareholders while ensuring the sponsor retains a controlling interest.

For REIT unitholders, this signals long-term commitment – the sponsor isn’t looking to cash out quickly but rather to grow alongside its investors.

The sponsor has both the incentive and the inventory to support the REIT’s expansion — provided, of course, that valuations remain sensible and deals are yield-accretive.

4. Let’s Talk Numbers

Next, let’s dig into the financials – because dividends don’t pay themselves without solid underlying performance.

CAREIT’s initial portfolio looks promising.

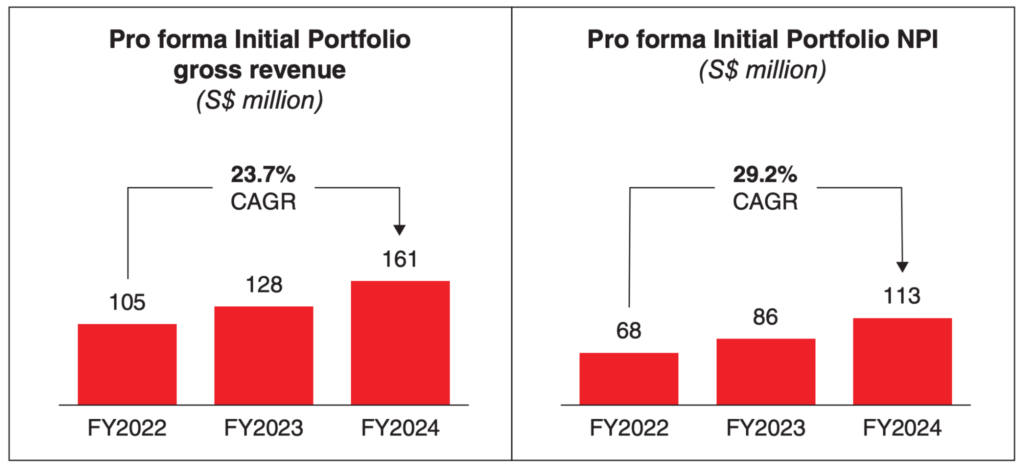

From 2022 to 2024, gross revenue surged at a compound annual growth rate (CAGR) of 23.7% while net property income (NPI) grew even faster at a little over 29% CAGR.

What’s driving these numbers?

Two factors stand out.

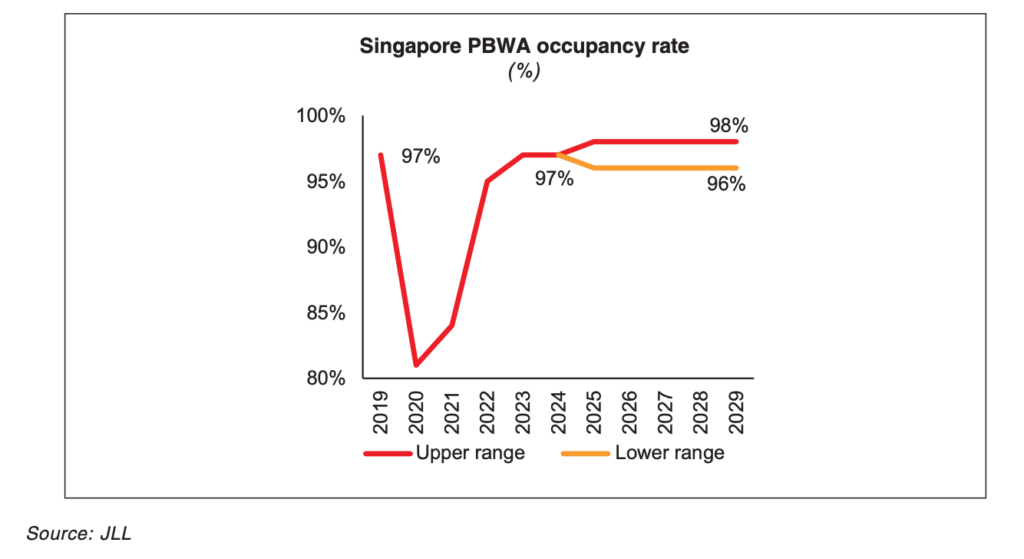

First, occupancy rates have recovered from the pandemic doldrums and surpassed pre-COVID levels.

This recovery is important given how hard the accommodation sector was hit during border closures and foreign worker restrictions.

Second, the REIT’s focus on short tenancies is proving its worth in an inflationary environment.

Unlike office or retail REITs locked into multi-year leases, CAREIT can reprice its rents more frequently to keep pace with inflation.

When costs are rising everywhere, this flexibility shows up as rental growth.

That said, as unitholders, we do not want growth to depend on the kindness of inflation alone — that’s why the next part matters as well.

5. Gearing up for the future

Next, let’s talk about the balance sheet – because sustainable dividends need a solid financial foundation.

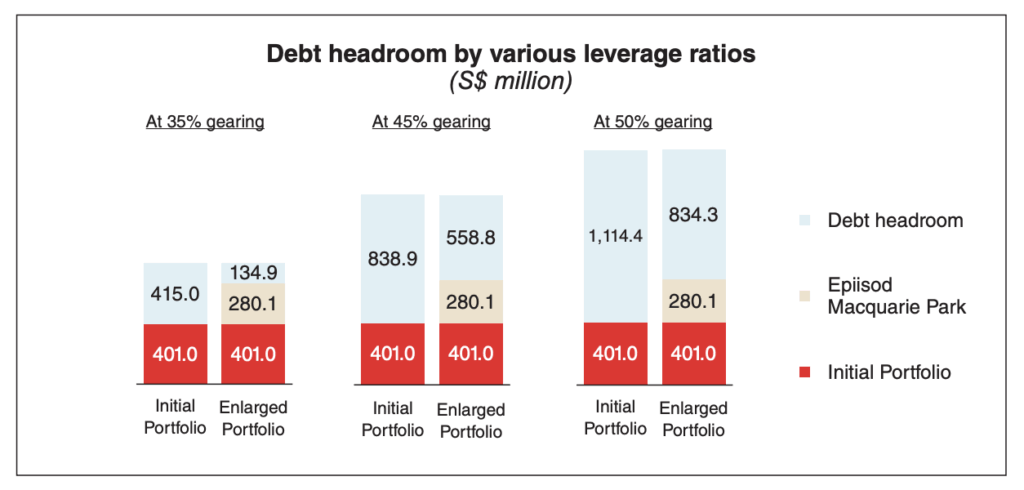

CAREIT will list with a conservative gearing ratio of approximately 20.9%.

After the fully debt-funded acquisition of Epiisod Macquarie Park in Australia, gearing will rise to 31%.

To put that in perspective, Singapore REITs can leverage up to 50% of their asset value if they maintain a minimum interest coverage ratio.

At a 45% gearing limit, the level most REITs target, CAREIT would have debt headroom of nearly S$559 million.

That’s enough financial firepower to add another asset to its current portfolio without raising a single dollar of equity – again, assuming the REIT manager can find yield-accretive opportunities, of course.

6. Show me the DPU!

Here’s what dividend investors really want to know: at the IPO price of S$0.88 per unit, CAREIT is projecting a distribution yield of 7.47% for 2026, rising to 8.11% for 2027.

These estimates are based on the enlarged portfolio (including the Australian acquisition) and factor in the REIT’s commitment to distribute 100% of its distributable income through 2027.

After that, distributions will normalise to at least 90% of annual distributable income.

The first distribution will cover the period from listing to 31 December 2025, with payment expected by 31 March 2026.

After that, expect semi-annual payouts like most Singapore REITs.

How to Get Your Hands on Units

The IPO structure is straightforward.

CAREIT is offering 262.2 million units at S$0.88 each, with 13.2 million units reserved for Singapore retail investors through its public offer.

The remaining 249 million units are allocated to institutional and other investors through the placement tranche.

The timeline is tight.

The public offer opened at 10 pm last night and will close at noon on 23 September 2025.

Units are expected to begin trading on 25 September 2025 at 2 -pm.

Get Smart: Not Your Typical REIT

CAREIT isn’t your typical retail or office play.

It’s a bet on essential accommodation – the beds that foreign workers and international students need regardless of economic cycles.

Is it a slam dunk? Hardly.

The concentration in worker and student accommodation comes with its own risks – regulatory changes, economic downturns affecting foreign worker demand, or shifts in international education patterns could all impact returns.

But for dividend investors looking to diversify beyond the usual fare, CAREIT offers something different: exposure to the growing demand for purpose-built accommodation, backed by a sponsor with the operational expertise and skin in the game.

At S$0.88 per unit, CAREIT is offering a high distribution yield upfront.

Whether that proves to be a bargain or fair value will depend on management’s ability to execute on its expansion plans while maintaining those impressive occupancy rates.

The question for investors isn’t whether CAREIT is perfect – no REIT is.

It’s whether the projected 7.46% yield is sufficient for the risks you see.

This new 10-minute read could change how you invest this year. Inside:

5 SG dividend-paying blue chips that have quietly powered through past downturns, and could reward you handsomely in the next.

Grab the free report now. It might be the most profitable thing you read today.

Disclosure: Chin Hui Leong does not own any of the shares mentioned.