The asset manager has ambitious plans to nearly quadruple its funds under management by the end of this decade.

Browsing: Smart Investing

The engineering firm continues to build up its order book as it pursues growth for its three core divisions.

We can learn interesting lessons by observing these two businesses.

The property giant is seeing good traction in growing its asset base but capital recycling remains challenging.

Exchange traded funds or ETFs are a great way to start investing. But before you do so, you should know what you are getting yourself into.

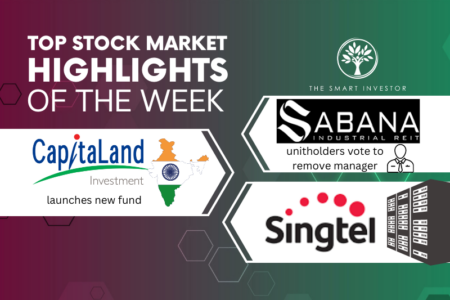

We look at Sabana REIT’s recent extraordinary general meeting and see how a property giant is expanding its funds under management.

We sift out five Singapore REITs that are not only resilient but also sport distribution yields exceeding 5%.

The property giant also declared an interim special dividend of S$0.04 per share.

The US market has performed well this year and lifted the share prices of these four stocks to a year-high. We assess if they can continue to perform well.

The telco saw overall higher revenue and profitability and has declared a S$0.025 interim dividend.

It is a tough decision but we line the three banks side by side to see which makes the best investment.

These four blue-chip stocks have announced higher profits, but can their share prices continue to do well?

We feature five stocks that are dishing out dividends this month.

There are necessary factors that have to be in place in order for economies to advance over time. The good news is these factors are present today.

The blue-chip utility group is building up its renewables capacity and sees good prospects ahead.

When life deprives us of opportunities, we should adapt to the situation to find what we need.

We review the latest acquisition from a hospitality trust and look at how long it takes the average Singaporean consumer to achieve financial freedom.

Singapore’s second-largest bank posted an outstanding set of earnings while raising its interim dividend.

These four stocks have powered ahead this year and more than doubled their share price. Can their run continue?

Singapore’s largest bank also reported its highest-ever return on equity.