Tap into China’s long-term growth with these five Hong Kong stocks.

Browsing: Smart Analysis

The land transport giant was formed in 2003 through the merger of two companies.

Income investors can look to these four stocks that are providing attractive yields.

Ride the wave of digital banking with these five innovative US fintech stocks in 2025.

With new companies coming to market, investors will also have a wider choice of investment options.

This trio of stocks has the characteristics that the Oracle of Omaha is looking for.

The importance of blue-chip stocks cannot be emphasised more in giving you dividends and peace of mind.

These four stocks could be perfect for a growth investor’s portfolio.

Here are four stocks that I could buy if I had extra cash.

We feature five US stocks with solid dividend track records that reported a commendable set of earnings.

Here are three REITs announcing corporate actions that deserve your attention.

We look at four stocks breaking through their 52-week highs to determine if they are worthy of being included in your investment portfolio.

Looking for more passive income? Here are four stocks dishing out dividends next month.

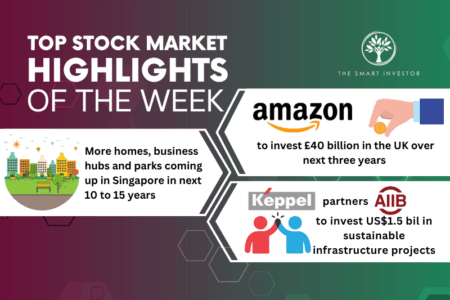

We look at an e-commerce giant’s latest investment commitment along with Singapore’s plans for new HDB and towns within the heartlands.

Here’s how you can identify companies that are poised to declare special dividends.

We feature four companies dishing out special dividends that can boost your passive income.

These four companies have been raising their dividends steadily over the years.

Discover which companies are buying back their shares and what could be your next investment move.

Investors now have an expanded range of Hong Kong and Thai stocks to choose from.

We explore the three local banks to determine if their share prices can continue to break new highs.