As the saying goes, cash is king — but which US companies have that in abundance?

Browsing: Blue Chips

Having recently raised its payout, we examine if CapitaLand Integrated Commercial Trust is a buy here.

These five dividend-paying Singapore stocks are knocking on the door of the coveted Straits Times Index.

Asia’s tourism industry is booming again, with airlines, hotels, and leisure businesses set to benefit. The key for investors is identifying which stocks can ride this powerful wave of growth.

ST Engineering and Singapore Airlines (SIA) offer investors aerospace and defence exposure. However, which one is the better buy? We look at these companies individually and determine which one is more attractive.

Income investors should focus on the stability and sustainability of the dividends they receive from companies; in this article, we take a look at three Singapore names that have maintained reliable pay-outs for more than a decade.

From a record-breaking AI chip deal to a historic leadership milestone and major real estate moves, this week’s market highlights showcase how innovation, influence, and investment continue to shape opportunities for investors in 2025.

Singapore’s push towards net-zero by 2050 is opening up fresh opportunities. Discover three Singapore-listed companies that could benefit from the nation’s green transition.

The STI’s 30 blue chips are the backbone of Singapore’s market. Here’s a breakdown of what is inside.

As we enter the easing cycle will DBS or OCBC come out on top?

As interest rates head lower, Singapore’s leading property developers CapitaLand, CDL, and UOL, could see their growth and valuation prospects improve.

The losers today may be winners tomorrow. But not every stock that falls is worth buying.

Singapore’s Straits Times Index (SGX: ^STI) closed above the 4,400 level last Friday, a historical high after advancing approximately 16.5% in 2025.

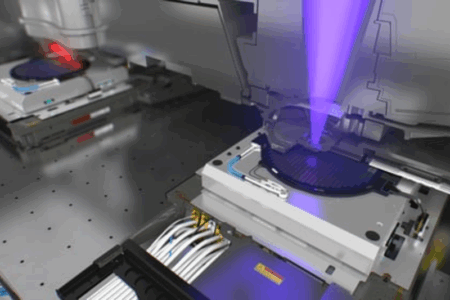

Every smartphone in your pocket, every car with advanced electronics, and every server that powers the internet relies on one company’s machines. That company is ASML.

Singapore blue-chips outpaced the STI in September 2025, proving that smart stock selection still matters in a record-high market.

From income to growth, REITs are a powerful tool to achieve financial freedom and early retirement.

There’s nothing better than having cash drop into your bank account like clockwork.

Three blue-chip stalwarts are buying back their own shares, a signal that they believe that their stock is undervalued.

Income investors take note: these four blue-chip stocks are paying out more than just their core dividends.

The Straits Times Index (SGX: ^STI) has slipped below the 4,300 mark, after spending most of September above this level.