Singapore bank stocks have been on a roll.

The share prices of Singapore’s three big banks, namely DBS Group (SGX: D05), United Overseas Bank Ltd (SGX: U11), or UOB, and OCBC Ltd (SGX: O39) have all hit a 52-week high recently.

This strong performance is a refreshing change from a year ago.

To kick things off, DBS reported a record S$2 billion in net profit for its fiscal 2021 first quarter (1Q2021) earnings.

UOB and OCBC did not disappoint, either.

The two lenders reported a rise in net profit that widely trumped analysts’ estimates, with UOB’s net profit rising 18% year on year to S$1 billion and OCBC more than doubling its net profit year on year.

While sentiment remains positive now, can the banks continue to see bright days ahead?

Could there be room for further price appreciation?

Fee income is the saviour

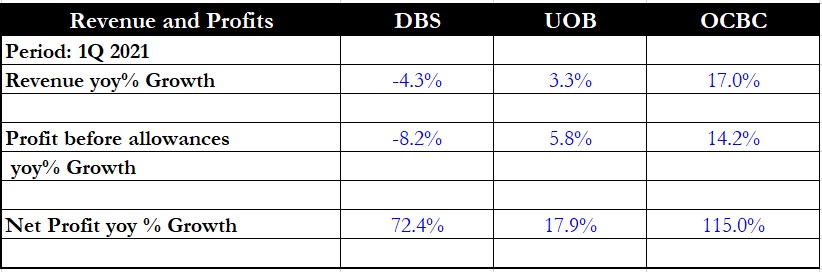

Source: Banks’ earnings and author’s compilation

First off, let’s review how the three banks fared in 1Q2021.

Both UOB and OCBC reported year on year revenue growth while DBS suffered a slight year on year dip.

Net interest income fell across the board for all the lenders as net interest margin (NIM) was compressed by lower global interest rates.

However, fee income was the saviour for all three banks, offsetting the decline.,

For DBS, the fall in NIM was the most pronounced and led to an overall decline in total income despite fee income rising year on year.

However, all the banks recorded healthy year on year profit growth due to a lower level of allowances, signalling a brighter overall outlook for the economy.

NIM has stabilised for now

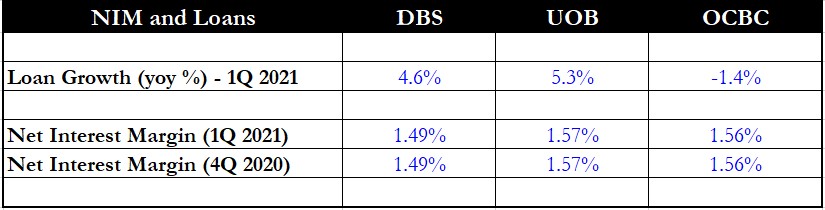

Source: Banks’ earnings and author’s compilation

Looking at NIM, it appears that it has stabilised as all three banks reported flat quarter on quarter NIM.

Compared to a year ago, the plunge in NIM was steepest for DBS as its NIM, at 1.86% for 1Q 2020, was the highest of the three banks at the time.

The situation has reversed now with DBS logging the lowest NIM among the three banks.

However, both DBS and UOB chalked up healthy mid-single-digit year on year loan growth, while OCBC recorded a slight year on year dip in gross loans.

The good news here is that the banks have managed to grow their loan book, albeit slowly, while NIM has stayed constant for now.

Should economic activity pick up, the acceleration in loan growth will compensate for the lower NIM to lift net interest income.

Digitalisation lowers costs

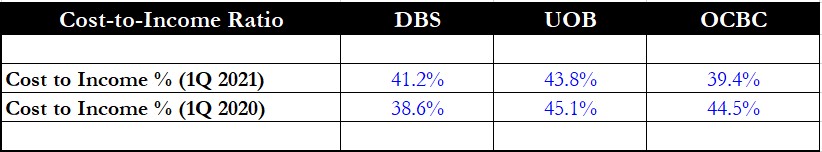

Source: Banks’ earnings and author’s compilation

Another positive aspect is that the banks are reporting lower cost-to-income ratios.

Part of the reason is due to cost-cutting, while online adoption and digitalisation efforts have also borne fruit in reducing expenses.

All three banks are proponents of digitalisation to stay in touch with customers and smoothen the banking process for them.

The lenders are also gearing up for increased competition as Singapore’s digital banks will take off next year.

DBS reported a slightly higher cost-to-income ratio compared to 1Q2020 due to expenses relating to its recent acquisition of Lakshmi Vilas Bank in India.

Reduced allowances

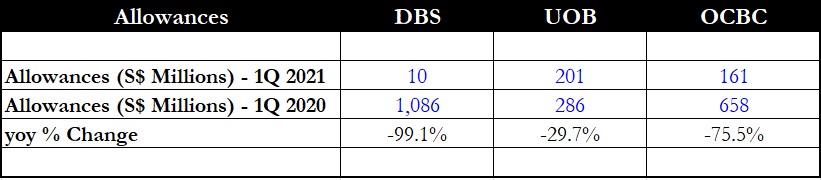

Source: Banks’ earnings and author’s compilation

Yet another clear sign of an improving economy can be gleaned from the allowances made by the banks.

When businesses are under financial stress, banks may need to write off more of their loan book as these businesses are unable to service their debt loads.

Conversely, when conditions improve, lenders can then reduce the provisions made for bad loans as more borrowers can pay up.

The table above shows all three banks reducing their provisions year on year, with DBS’ allowances falling by 99% as it was the only bank among the three that wrote back provisions.

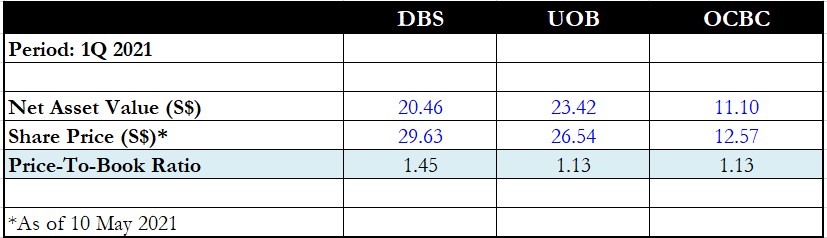

Banks are more expensive now

Source: Banks’ earnings and author’s compilation

A quick check on the banks’ valuation shows that they are trading more expensively than they did three months ago.

Price-to-book ratios for all three banks are elevated, reflecting investors’ confidence in the economic recovery.

In particular, DBS’ ratio has risen from 1.34 two months ago to 1.45 presently due to its purchase of a 13% stake in a profitable Shenzhen bank as part of its strategy to grow its Greater Bay Area exposure in China.

Get Smart: Calm before the storm?

The evidence is clear.

All three banks have reported better net profit amid rising sentiment.

The previous provisions made by the banks in anticipation of a wave of bad loans has, fortunately, not come to pass.

However, investors need to remain vigilant.

A second, more deadly wave of infections is sweeping across countries such as India and Nepal.

Bank CEOs have opined that 1Q2021 may be an exceptional quarter.

It remains to be seen if this performance can carry through to successive quarters.

There is a risk that the global economy may take another hit if the pandemic rears its ugly head.

With valuations at a higher level, investors may want to be cautious.

We are in the golden age of growth where there is no shortage of growth trends. Over the past decade, we have seen the likes of Apple (NASDAQ: AAPL), Amazon (NASDAQ: AMZN) and Alphabet (NASDAQ: GOOGL) surpass the trillion-dollar market cap mark. Growth trends alone will not guarantee success. You need to find excellent companies that are capitalising on these trends too. And we believe cloud computing is one trend that fills this sweet spot. Join us for a FREE webinar: The Golden Age of Growth to maximise your chances of success in this booming trend.

Follow us on Facebook and Telegram for the latest investing news and analyses!

Disclaimer: Royston Yang owns shares of DBS Group.