When it comes to dividends, it always seems to be “the more, the merrier”.

There are, however, always other aspects to consider as well when it comes to selecting a good dividend stock.

Comparing two stocks that pay dividends to see which is more attractive can be tough.

That’s because the two companies may be in different industries and engaged in different core businesses, making it difficult to do an “apple to apple” comparison.

Granted, the COVID-19 pandemic has severely crimped many companies’ ability to maintain, or even pay out, a consistent level of dividends.

Sheng Siong Group Ltd (SGX: OV8) and iFAST Corporation Limited (SGX: AIY) are two exceptions.

iFAST’s revenue jumped 25.8% year on year in the previous quarter, while net profit rose 85$ year on year.

Not to be outdone, Sheng Siong reported strong growth in both revenue and net profit for the second quarter of the fiscal year 2020, up 75.8% and 150% year on year, respectively.

Both companies have been paying out regular dividends over the years.

Let’s take a look at several aspects to determine which is the more attractive dividend stock.

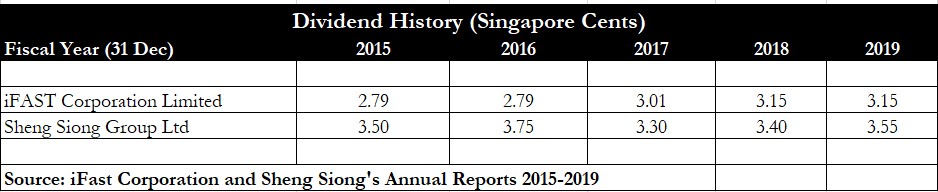

Dividend history

iFAST went public in late 2014 and has consistently paid out a quarterly dividend since then.

As the group steadily increased its assets under administration (AUA) over the years, its dividend also rose in tandem.

The table above shows a steady increase in the dividend paid out, with the group either maintaining or increasing dividends.

Sheng Siong, on the other hand, saw a dividend increase in 2016, but subsequently, the dividend fell to S$0.033 and took another two years to surpass the dividend paid out in 2015.

Overall, iFAST’s annual dividend rose by 12.9% from 2015 to 2019, while Sheng Siong’s dividend increased by a mere 1.4%.

Winner: iFAST

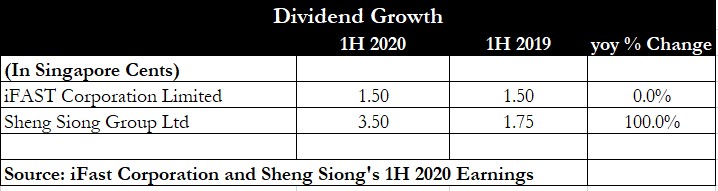

Recent dividend increase

Although iFAST reported an impressive set of earnings, it has kept its interim dividend for the second quarter of 2020 constant.

The financial technology company is retaining its earnings for further growth, and also gearing up for a potential digital banking licence in Singapore.

Sheng Siong, though, has doubled its interim dividend from S$0.0175 to S$0.035 on the back of a stellar rise in net profit.

Winner: Sheng Siong

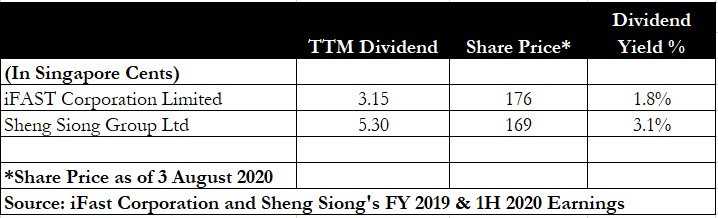

Dividend yield

No analysis is complete without looking at the dividend yield for each company.

We have used the trailing 12-month dividends for each company to make a fair comparison.

As iFAST’s share price has run up substantially year to date, its dividend yield now stands at 1.8%.

Sheng Siong’s dividend yield is slightly higher at 3.1% even while its shares are hitting an all-time high of close to S$1.73.

Investors who purchase Sheng Siong can enjoy a higher dividend yield, although this is paid out twice a year rather than four times a year with iFAST.

Winner: Sheng Siong

Business prospects

Finally, we assess the future prospects of each company to determine which can further raise dividends.

Sheng Siong has benefited greatly from the circuit breaker measures and partial lockdowns imposed by the government due to the pandemic.

With more people cooking, working and studying from home, the retailer has enjoyed a big boost to sales and profits.

However, this strong surge may taper down when the pandemic is brought under control and more people return to schools and offices.

The group’s final dividend may also see a year on year increase, but the future outlook for dividends may not be that sanguine.

Once conditions normalise, Sheng Siong could see stagnant dividends like what was witnessed from 2015 through to 2018.

iFAST has continued to grow its AUA consistently since its IPO, and now boasts a record high AUA level of S$11.15 billion.

With more wealth flowing into Singapore as a haven during the pandemic, this trend looks set to continue even after the crisis is over, as such assets are usually “sticky”.

iFAST thus has a higher potential for raising dividends over the long-term as the industry adapts to a new normal – one that benefits all wealth managers by boosting fund flows into their accounts.

Winner: iFAST

Get Smart: Long-term trumps short-term

iFAST is the winner here as it demonstrates the ability to continue growing its business and scaling it up.

The group has demonstrated a knack for attracting capital with its long track record and user-friendly platform.

Sheng Siong offers a higher dividend yield in the near-term as the retailer enjoys a strong surge in sales due to the pandemic.

However, iFAST qualifies as the better buy as the effects from the pandemic should continue to linger and benefit the group over the long-term.

Special FREE Report: How You Can Make Money Investing In REITs During This Pandemic. Download your free copy HERE or just key in your email below!

Disclaimer: Royston Yang owns shares in iFAST Corporation Limited.