Giant deals are back in style.

This week, Singapore Telecommunications (SGX: Z74) solidified its claim as a regional digital powerhouse with a record-breaking data centre acquisition, while Hongkong Land Holdings (SGX: H78) transformed its Singapore portfolio into a massive S$8.2 billion private fund.

We dive into what these landmark moves mean for the future of these two market heavyweights.

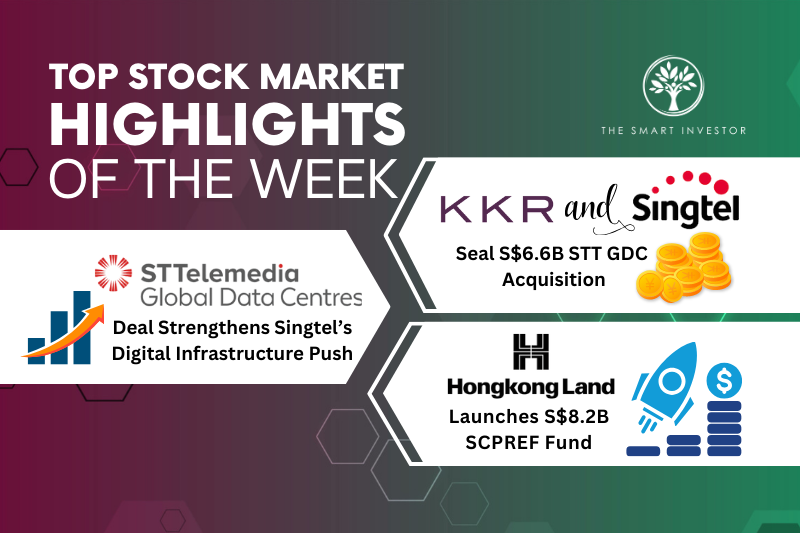

KKR and Singtel seal S$6.6 billion deal to fully acquire STT GDC

Singapore Telecommunications, or Singtel, and global investment firm KKR (NYSE: KKR) signed definitive agreements on 4 February to acquire the remaining 82% stake in ST Telemedia Global Data Centres (STT GDC) for S$6.6 billion.

The deal implies an enterprise value of S$13.8 billion, making it Singapore’s largest M&A transaction in four years.

Upon completion, KKR and Singtel will hold 75% and 25% stakes respectively.

Founded in 2014, STT GDC operates over 100 data centres across 12 markets with a combined capacity of 2.3 gigawatts (GW).

Singtel will contribute S$740 million in cash from internal resources, with the deal expected to close in the second half of 2026.

Analysts see STT GDC deal accelerating Singtel’s digital infrastructure ambitions

Investors reacted positively, sending Singtel shares to a record high of S$4.95 following the news.

Analysts view the acquisition as a pivotal step in the Singtel28 growth plan, which targets a massive shift toward “growth engines” like AI and data centres.

By combining STT GDC with its existing unit, Nxera, Singtel will command a total capacity of 2.8 GW, cementing its position as a top-tier Asia-Pacific player.

Crucially for income investors, Singtel confirmed its dividend policy remains intact, supported by a strong balance sheet (1.1x net debt to EBITDA) and a S$10 billion to S$15 billion pipeline of assets identified for future capital recycling.

Hongkong Land launches Singapore’s largest commercial real estate private fund

Hongkong Land Holdings officially launched the Singapore Central Private Real Estate Fund (SCPREF) on 3 February 2026, establishing the Republic’s largest office-focused private fund with S$8.2 billion in assets under management at inception.

The fund’s initial portfolio – comprising 2.6 million square feet of net lettable area at 96% occupancy – includes marquee assets such as Asia Square Tower 1, One Raffles Link, and stakes in Marina Bay Financial Centre and One Raffles Quay.

Backed by founding investors like the Qatar Investment Authority and APG Asset Management, SCPREF has a mandate to grow its gross asset value to S$15 billion through selective acquisitions.

This launch, alongside the recent sale of MBFC Tower 3, has allowed the group to recycle US$3.4 billion in capital since 2024, reaching over 80% of its 2027 target.

In tandem with this strategy, the group announced a US$300 million expansion of its share buyback programme, bringing the total allocation to US$650 million through June 2027, a move that helped drive shares up 4.7% to close at US$8.67 on the day of the launch.

Many Singapore stocks fall behind inflation, which means your money quietly loses strength over time. Dividend stocks have a very different track record. Some continued delivering 6% to 13% every year across the toughest market conditions.

In this FREE report, discover 5 crisis-tested dividend stocks that kept rewarding investors while the market struggled. Download your dividend investing guide now.

Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!