You don’t need a huge sum of money to start investing, you just need consistency.

With as little as S$500 a month, any Singaporean investor can start building a dividend portfolio that grows into substantial passive income over time.

Now, you may be wondering whether S$500 is enough to start with.

While your monthly contributions may seem modest initially, your savings can grow meaningfully by re-investing dividend income from your portfolio.

How does that work?

Regular investing builds discipline and takes advantage of dollar-cost averaging, a technique wherein you invest a fixed amount in regular intervals.

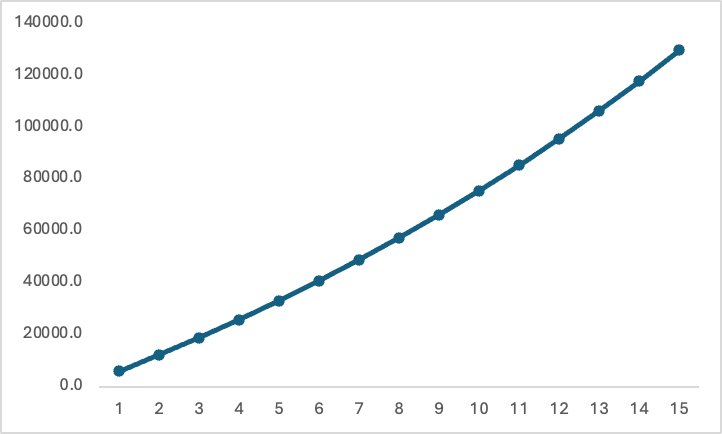

The graph below shows how your portfolio would grow if you invested S$500 per month and achieved a modest annual return of 5% per year.

Portfolio Growth vs Time

Over a period of 15 years, your portfolio would be valued at around S$129,000.

Let’s do the math.

By investing S$500 per month (or S$6,000 per year), your contribution would be S$90,000, which would mean your portfolio grew by over 43% to S$129,000.

While this is a simplified calculation, the key takeaway is that the amount you invest matters less than consistency.

Compounding turns small sums into lasting wealth.

Getting started

Now that we covered the benefits of regular investing, the question arises, “how do we get started?

The first step would be to find a low-cost brokerage that supports monthly investment as described above.

Here are two broker examples you can to start off with:

| Trading Platform | Trading Fees | Minimum Order Size (Buy) |

| MooMoo1 | 0.03%/Trade | US$5 |

| DBS Vickers RSP2 | 0.18%/Trade | S$100 |

Both of these platforms allow you to make monthly deposits which will enable you to invest regularly over the long term.

In fact, you can automate your monthly buys for a fixed-date to make it easier to track your returns.

All good? Let’s continue.

Next, there’s the most essential part: choosing the stocks to invest.

Here, you should focus on strong, dividend-paying companies with sustainable cash flows and a strong track record in the market.

Examples include banks, REITs, and defensive blue-chip companies.

A group of stocks, organised in a diversified portfolio, should provide you with a good mix of growth potential, stability, and steady dividend streams.

Some companies that could fit the bill are:

DBS Group Holdings (SGX: D05): As Singapore’s leading bank, DBS has deep pockets and a reliable stream of banking income.

CapitaLand Integrated Commercial Trust (SGX: C38U): CICT’s commercial focused REIT has a strong portfolio of malls and offices in Singapore, earns stable revenues, and has a dividend yield of 4.7%

Singapore Exchange (SGX: S68): As Singapore’s sole stock exchange, SGX provides steady and recurring cash flow.

Netlink NBN Trust (SGX: CJLU): Netlink owns the only nationwide-fibre network in Singapore, making it a defensive business.

All four stocks pay a dividend too, which are done quarterly or semi-annually, with an annual yield of between 4% and 6%.

Furthermore, some brokerages allow for dividend reinvestment, where you can reinvest your cash dividends back into the business, without any transaction costs.

This feature will help you cut cost and boost your future dividends as the dividends reinvested will compound and increase your dividend payouts in the future.

Remember, your task is to pick dependable dividend stocks rather than chasing high yields.

Take your time to diversify.

Don’t try to own everything all at once.

Instead, you should gradually build up your portfolio.

You can also consider rotating monthly between buying new sectors or topping up current holdings.

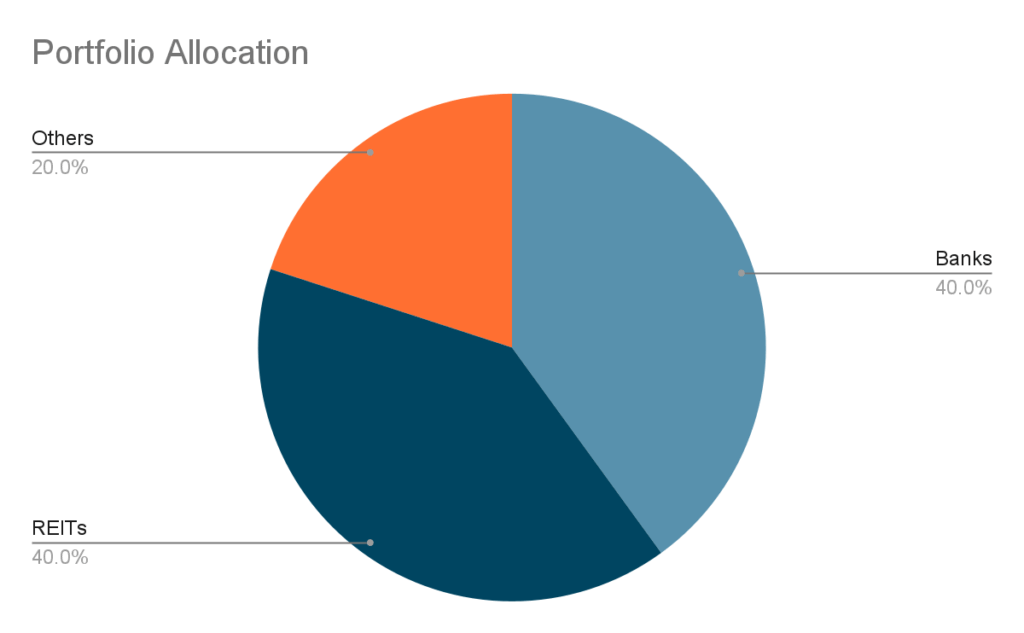

A sample investment plan could look like:

First three months: Banks (40% of total portfolio)

Next three months: REIT (40% of total portfolio)

Next three months: Utilities and telecommunications (20% of total portfolio)

As a side benefit, diversification can help smooth out market volatility, while still reaping the benefits from dividend income.

What you don’t want to do is to get caught up with the market swings, causing you to jump in and out of stocks in hopes of short-term profit.

Re-investing dividends in the early years of your portfolio can be very beneficial, due to the compounding effect.

To see the benefits of re-investing dividends, let’s assume we have an initial investment of S$10,000, dividend yield of 3% per annum, stock price growth of 5% per annum, and annual dividend re-investment.

| Year | Without Dividend Reinvestment (S$) | With Dividend Reinvestment(S$) |

| 0 | 10,000 | 10,000 |

| 10 | 16,289 | 21,589 |

| 20 | 26,533 | 46,610 |

| 30 | 43,219 | 100,627 |

This table shows that even annual re-investment of dividends can lead to around 2.5x increase in portfolio value as compared to the same portfolio without re-investments.

The underlying principle behind this is dividend yield-on-cost: over time, as your dividends compound, they make up a larger percentage of your initial stock purchase price.

This is a good reminder that dividend growth is more important than short-term prices.

The real power of dividends is time — patience and reinvestment build financial freedom.

Now that we’ve covered what to do, here’s a reminder on what to not do!

Avoid chasing high yields from fundamentally weak companies, as the dividends may be cut in the future.

In addition, don’t overconcentrate in one REIT or stock, no matter how much you believe in it, diversification is key to long term success.

While trading fees may seem cheap on the surface, don’t ignore them, as they can be a silent killer in the long run if you trade too often.

The good news is anyone with discipline, and S$500 a month can start building a meaningful dividend portfolio.

Start small, stay consistent, and let time and compounding do the heavy lifting.

Get Smart: Small Steps, Big Dividends

Dividend investing isn’t about timing — it’s about commitment.

The best investors start early, invest regularly, and let dividends become their financial engine for life.

Some companies cut dividends in a downturn. These 5 didn’t.

Find out which Singapore blue chips have weathered past chaos…and why they could be your portfolio’s anchors in the next wave of downturn. Download the report free.

Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!

Disclosure: Raghav does not own any of the stocks mentioned in the article.