In this week’s edition of top stock market highlights, AI giant Nvidia delivered blockbuster earnings that exceeded Wall Street expectations, providing reassurance to investors worried about an artificial intelligence bubble.

Meanwhile, Singapore’s equities market received a significant boost with multiple initiatives announced to enhance market liquidity and attract global investors.

The Monetary Authority of Singapore revealed its second batch of asset managers under a multi-billion-dollar programme whilst unveiling a revolutionary partnership between SGX and Nasdaq to streamline dual listings.

Nvidia Beats Q3 Revenue Estimates, Countering AI Bubble Fears

Nvidia (NASDAQ: NVDA) delivered stellar third-quarter results that exceeded Wall Street expectations, helping counter growing concerns about an artificial intelligence bubble.

The AI chipmaker reported revenue of US$57.01 billion, beating estimates of US$54.92 billion, with adjusted earnings per share of US$1.30 versus expectations of US$1.25.

The company’s crucial data centre division generated US$51.2 billion in sales, surpassing the US$49.09 billion forecast and demonstrating continued robust demand for AI infrastructure.

Nvidia also provided stronger-than-expected guidance for the fourth quarter, projecting revenue of approximately US$65 billion compared to analyst expectations of US$61.66 billion.

CEO Jensen Huang revealed the company holds roughly US$500 billion in orders for 2025 and 2026 combined, with CFO Colette Kress noting “the number will grow.”

The results show Nvidia maintaining its dominant position in AI chips despite concerns about valuations and competition, with its next-generation Blackwell chips already generating strong demand that’s expected to exceed supply for several quarters.

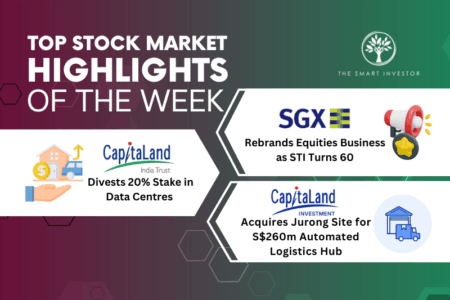

MAS Places S$2.85 Billion with Six Asset Managers

The Monetary Authority of Singapore (MAS) has placed S$2.85 billion with six asset managers under the second batch of its Equity Market Development Programme (EQDP), bringing total allocations to S$3.95 billion across nine managers.

The selected managers include global powerhouses BlackRock and Lion Global Investors, alongside Amova Asset Management (formerly Nikko Asset Management).

The EQDP aims to develop Singapore’s fund management industry and increase investor participation in local equities by leveraging diverse expertise, investment strategies and distribution networks.

Additionally, MAS launched a S$30 million “Value Unlock” programme to help listed firms improve investor engagement and shareholder returns.

This initiative provides companies with resources to build competencies in corporate strategy, capital optimisation, and investor relations whilst offering regulatory clarity on forward-looking communications.

The programme reflects Singapore’s aggressive push to strengthen its position as a leading Asian financial hub.

SGX-Nasdaq Partnership Creates Dual-Listing Bridge

Singapore Exchange (SGX: S68) and Nasdaq (NASDAQ: NDAQ) have unveiled a groundbreaking dual-listing bridge that will revolutionise cross-border capital access for growth companies.

Expected to launch by mid-2026, the bridge targets Asian companies with market capitalisation of at least S$2 billion and global ambitions, providing a direct pathway to simultaneously tap capital pools in North America and Asia.

The harmonised framework will allow companies to use a single set of offering documents, dramatically streamlining regulatory hurdles and reducing repetitive paperwork.

MAS deputy chairman Chee Hong Tat noted that companies with Asian operations, customers and investors could leverage the arrangement to improve investor engagement whilst accessing deeper US capital markets.

The initiative arrives at an opportune moment, with Singapore leading Southeast Asia in IPOs this year, raising over S$2 billion including notable debuts like UltraGreen.ai’s US$400 million listing.

This strategic partnership positions Singapore as the gateway for Asian companies seeking global expansion whilst attracting international investors looking for Asian growth opportunities.

SGX Reduces Board Lot Size to 10 Units

In a move to democratise equity investing, SGX will reduce its board lot size for securities priced above S$10 from 100 units to just 10 units.

This tenfold reduction significantly lowers minimum investment requirements, making blue-chip stocks and index components more accessible to retail investors.

For instance, investors previously needing thousands of dollars to purchase premium stocks can now participate with much smaller capital outlays.

The change aligns Singapore with global practices whilst broadening investor participation and potentially boosting trading activity.

SGX will also modernise its post-trade custody model, facilitating investor adoption of broker custody accounts that enable broader investment services including portfolio management, fractional trading, and robo-investing.

The board lot size was last reduced in January 2015 from 1,000 to 100 units, when SGX noted it would make investing more “affordable” for retail investors.

This latest reduction represents another significant step in Singapore’s efforts to enhance market liquidity and attract a wider investor base to support its growing equities ecosystem.

If you’re nervous, confused, or worried about buying your first stock, then our latest beginner’s guide to investing can help. It’s easy to read yet packed with valuable insights. Download it for free today, and buy your first stock in the next few hours. Click here to get started.

Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!