Singapore has committed to achieve net zero emissions by 2050, with the Singapore Green Plan 2030 laying out ambitious targets to decarbonise electricity generation, transport, and industrial sectors.

This multi-decade transition is creating significant opportunities for companies positioned in renewable energy, sustainable infrastructure, and smart city solutions.

With billions in government and private investment flowing into green projects, businesses that can deliver these transformative technologies stand to benefit substantially.

The big question for investors is: which Singapore-listed companies stand to benefit the most from this megatrend?

In this article, we take a closer look at Sembcorp Industries (SGX: U96), Keppel Ltd (SGX: BN4), and ST Engineering (SGX: S63) – three companies that could shine as Singapore moves towards a cleaner and more sustainable future.

Sembcorp Industries (SGX: U96)

Sembcorp Industries (Sembcorp) has transformed from a traditional fossil fuel-dependent-utility into a renewable energy powerhouse.

This strategic pivot positions it as one of Southeast Asia’s leading green energy players.

Sembcorp reported a net profit of S$536 million for the first half of 2025 (1H2025), down slightly from S$543 million the year before.

More importantly, underlying net profit remained stable at S$491 million versus S$489 million in the prior year, demonstrating earnings resilience despite an 8% year on year revenue decline to S$2.94 billion.

It was in renewables where profit did the heavy lifting, rising 27% to S$132 million, due to favourable wind conditions in India and growing capacity.

The company’s installed renewable capacity reached 13.8 gigawatts in 1H2025, up from 10.0 gigawatts in a year earlier.

Management targets 25 gigawatts by 2028, signalling aggressive expansion plans.

While the company retains some conventional power assets, these are being progressively phased out.

The interim dividend of S$0.09 per share maintains the company’s commitment to returning value to shareholders.

The main risk lies in execution.

Renewable projects require substantial capital investment and face development uncertainties including regulatory approvals, grid connectivity, and weather variability.

Keppel Ltd (SGX: BN4)

Compared to Sembcorp, Keppel has taken a completely different path.

The group has exited capital-intensive offshore-rig building and traditional property development, and now operates as an asset-light global asset manager focused on sustainable infrastructure.

So far, its share price has risen approximately 33.5% year-to-date for 2025, reflecting investors’ confidence in the group’s strategy overall.

For the first half of fiscal 2025 (1HFY2025), net profit was S$431 million, a year-on-year increase of 25%, while recurring income – a key metric for asset managers – rose 7% to S$444 million.

Funds under management grew to S$91 billion as of 30 June 2025, demonstrating strong investor appetite.

To reward shareholders, Keppel declared a S$0.15 per share interim dividend as well as a S$500 million share buyback programme, funded by monetising legacy assets.

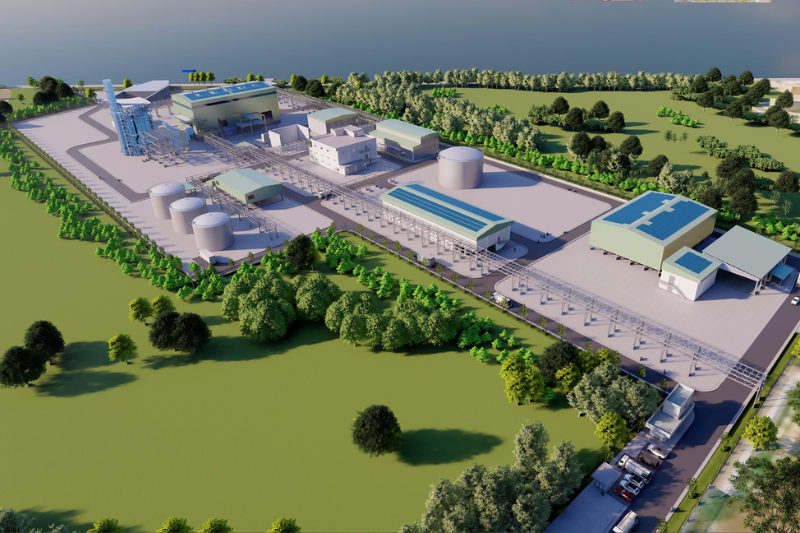

The company is investing in high-growth areas including waste-to-energy facilities, district cooling systems, and data centres.

Success depends on Keppel’s ability to scale its asset management platform while navigating infrastructure market cycles.

The transformation has positioned the group to capture recurring fees rather than lumpy development profits.

Singapore Technologies Engineering (SGX: S63)

While best known for aerospace and defense, Singapore Technologies Engineering (STE) has quietly emerged as a key player in Singapore’s smart-city transformation.

The company’s 1HFY2025 results showed robust growth across all segments: revenue rose 7% to S$5.92 billion, net profit increased 20% to S$403 million, while EBITDA and EBIT grew 11% (to S$871 million) and 15% (to S$602 million) respectively.

The Urban Solutions & Satcom division is particularly relevant for sustainability investors.

It provides intelligent transport systems including electronic road pricing, traffic management, and fare collection systems that reduce congestion and emissions.

These are typically long-term contracts with government agencies, creating predictable recurring revenue streams with high switching costs.

Given the company’s heavy reliance on defense, along with competitive forwarding for smart mobility, STE is not as directly exposed to renewable energy like Sembcorp, or green infrastructure like Keppel.

Instead, the company offers a differentiated play on sustainable urbanisation, which is particularly attractive for investors seeking exposure to the smart city theme without pure renewable energy risks.

Get Smart: Different Paths to Singapore’s Green Future

Singapore’s transition to net zero by 2050 represents one of Asia’s most ambitious decarbonization commitments.

This multi-decade transformation will require massive capital deployment, creating sustained opportunities for well-positioned companies.

These three Singapore Exchange-listed companies offer distinct ways to capitalize on this green transition.

Sembcorp provides pure-play renewable energy exposure with its aggressive capacity expansion but with higher execution risk.

Keppel provides steady fee-based income and is building opportunities in green infrastructure and asset management; while ST Engineering delivers indirect sustainability gains through government-back contracts and smart city solutions that enable the efficient, low-emission urban systems of tomorrow.

For investors, the choice depends on risk appetite and investment approach.

Together, these stocks provide diversified exposure to Singapore’s green transformation – a theme likely to drive returns for decades as Asia’s sustainability leader shows the region how to balance economic growth with environmental responsibility.

When the market is unpredictable, where can you park your money with confidence? Our latest FREE report reveals 5 Singapore dividend-payers built to withstand global storms. Get it now and see what’s still worth holding.Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses

Disclosure: Joseph Gan does not own any shares of the companies mentioned in this article.