Every smartphone in your pocket, every car with advanced electronics, and every server that powers the internet relies on one company’s machines.

That company is ASML Holdings (NASDAQ: ASML).

Despite playing such a critical role in the semiconductor industry, ASML remains an unfamiliar name to many.

These machines, each costing as much as US$378 million, are indispensable.

Let’s look at how they function and why a relatively unknown Dutch firm holds such an outsized influence over the future of technology.

The Extreme Ultraviolet (EUV) marvel

ASML, which stands for Advanced Semiconductor Materials Lithography, was founded in 1984 and is based in Veldhoven, the Netherlands.

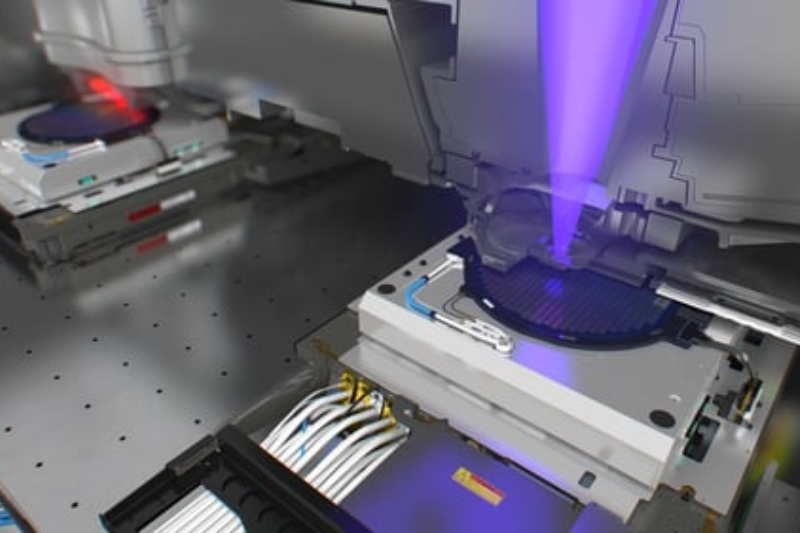

The Dutch company’s key development is the EUV lithography machine, an engineering marvel due to its highly sophisticated assembly process.

Lithography itself is essentially a printing method, using light to project patterns onto silicon wafers and form the circuits that drive chips.

However, EUV takes this process to the extreme.

By using light with a wavelength of only 13.5 nanometers, these machines allow billions of transistors to be crammed onto surfaces no larger than a fingernail.

The scale and sophistication of these systems explain their cost.

Each one contains more than 100,000 carefully engineered parts sourced from suppliers around the globe. The parts must not only operate in a vacuum, they also have to achieve nanometer level precision, all of which are extremely difficult.

The largest semiconductor manufacturing companies, namely TSMC (NYSE: TSM), Intel (NASDAQ: INTC), and Samsung (KRX: 005930) rely on these tools to manufacture the most advanced processors.

Without ASML, today’s world would look very different.

We’ve have neither the latest smartphones in our hands, nor the GPUs that drive artificial intelligence or the energy-efficient chips that power electric cars and cloud servers.

Nearly every innovation, from streaming services to machine learning, is made possible by chips that trace back to ASML’s machines.

In essence, the EUV maker is not just a supplier of tools but a foundation for the digital economy.

ASML’s Strategic Role

ASML has become a strategic asset in the global race for technological dominance.

The sophistication of its EUV systems has placed it at the center of geopolitical tensions.

For instance, the US has restricted the sale of ASML’s most advanced machines to China in an effort to preserve its own technological edge.

As a result, the Dutch firm is often pulled into international trade disputes, national security policies, and the future balance of power in innovation.

Looking forward, the company is working on High-NA EUV, the next generation of lithography machines.

These new machines will deliver higher resolution and efficiency, opening the path toward chips at the 2-nanometer logic nodes and beyond.

However the challenges are immense, factors such as rising costs, increasingly complex research and development (R&D), and fragile supply chains.

That said, ASML has a proven track record and has positioned itself as the only player capable of pushing semiconductor technology into the next decade.

The US and China AI Race

The US and China are both pushing hard to lead in artificial intelligence, but the real race isn’t only about software.

The real choke point is the hardware that makes the chips.

ASML, a company from the Netherlands, is the only one that can build the EUV machines needed for the most advanced semiconductors.

China has been trying to build something similar, but the process is incredibly tough.

It relies on years of specialized knowledge and a web of global suppliers, which is why some believe China is still a decade or more behind.

Even if China manages to put together a working version, that’s just step one.

Scaling it up into steady production is another story.

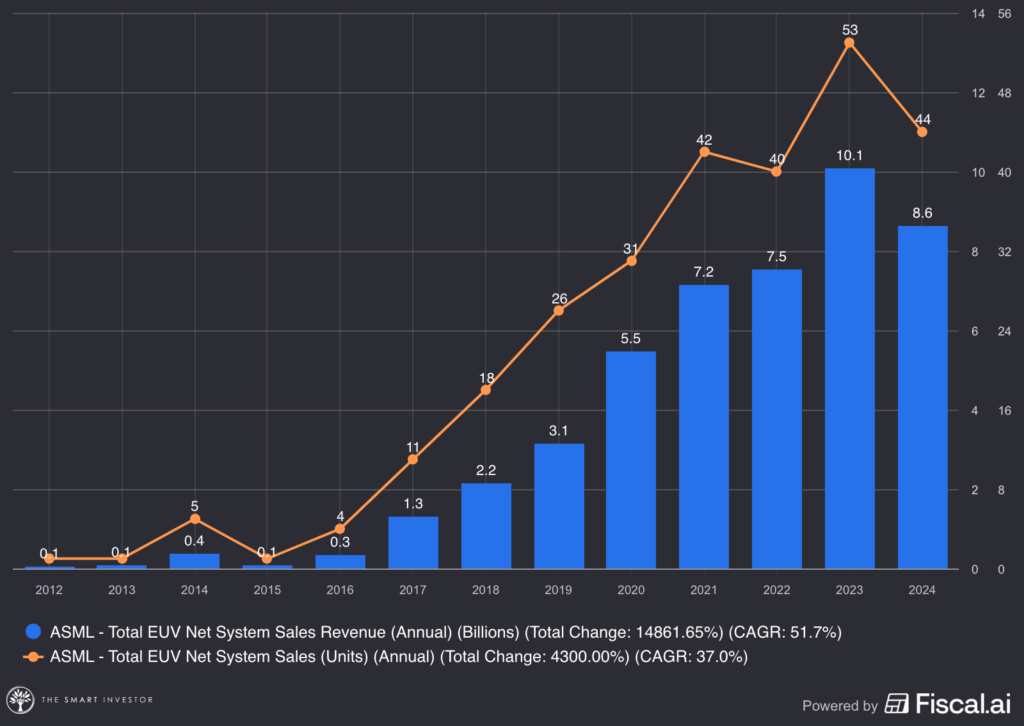

ASML itself can only turn out a limited number of these machines each year, and that’s with decades of head start.

The graph below provides more context on its EUV revenue and number of systems sold between 2012 and 2024.

For China, making one would be impressive, but mass-producing them consistently is on a completely different level.

That’s why, even if the gap narrows, the US and its allies are likely to stay ahead in high-end AI hardware for quite some time.

Get Smart: More than an Equipment Maker

Seen from the outside, ASML may seem like a quiet industrial supplier.

In reality, it is the invisible giant that keeps modern life running.

The future of smartphones, artificial intelligence, and even entire economies rests on its machines.

Put simply, without ASML, the digital age would come to a halt.

Many investors think DeepSeek lowering AI costs means less revenue for tech companies. But that’s not the full story, and believing it could cost you. In our latest free report, we unpack a surprising insight from a top tech CEO who explains why lower AI costs may actually drive more tech spending, not less — and he’s got the numbers to prove it. If you’ve misunderstood this trend, you could miss out on some of the biggest investment opportunities. Click here now to access “How GenAI is Reshaping the Stock Market” today to get the full breakdown.

Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!

Disclosure: Evan Chang owns ASML shares.