Oracle Corporation (NYSE: ORCL) shares skyrocketed 36% overnight, catapulting the enterprise software giant to a market capitalisation of US$922 billion.

It’s the kind of move that turns heads — not because single-day surges are rare — but because such gains are extraordinary for a company of Oracle’s size.

The windfall briefly crowned co-founder Larry Ellison as the world’s richest person, surpassing Tesla’s (NASDAQ: TSLA) Elon Musk.

With Ellison owning over 41% of Oracle, his paper wealth swelled by 10s of billions in mere hours — fair game for someone who’s bet his fortune on his own company.

The US$317 Billion Question

What triggered this euphoria?

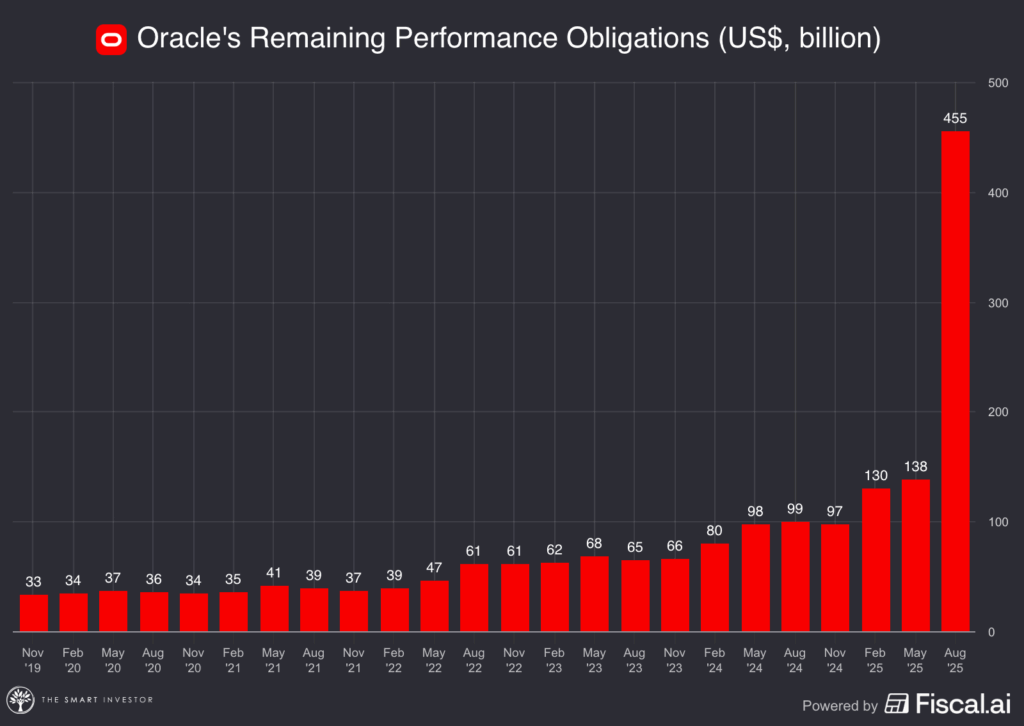

Oracle reported a staggering US$317 billion increase in remaining performance obligations—essentially future contracted revenue.

The number is eye-watering, representing committed business that Oracle will recognise over coming years.

How eye-watering exactly? Take a look.

It’s no wonder Ellison and Musk were pleading with Nvidia‘s (NASDAQ: NVDA) Jensen Huang for GPUs a year ago; they saw this AI gold rush coming.

The catalyst became clear when the Wall Street Journal reported that OpenAI has signed a US$300 billion contract with Oracle for computing power over five years or so, making it one of the largest deals in corporate history.

Simply put, OpenAI needs massive computational infrastructure, and Oracle is positioning itself as the picks-and-shovels supplier for the AI boom.

Then again, investors may want to hold off from popping the champagne.

A Financial Reality Check

Oracle’s financial position raises uncomfortable questions about execution.

The company holds just US$11 billion in cash against a little over US$91 billion in debt, giving it a net debt of around US$80 billion.

Furthermore, its free cash flow (FCF) has recently turned negative.

Over the past 12 months, Oracle has burned through US$5.9 billion as capital expenditure outpaced its operating cash flow.

In short, the math looks challenging.

Oracle must purchase billions in chips and will likely have to take on more debt to build the infrastructure OpenAI needs.

Meanwhile, OpenAI expects to generate US$13 billion in revenue for 2025 — yet, the deal calls for an average spend of US$60 billion per year on capital expenditure for five years.

How exactly will this circular dependency of massive spending work?

Adding another layer of uncertainty: the deal doesn’t commence until 2027.

That’s years away in technology terms — an eternity in the rapidly evolving AI landscape where competitors aren’t standing still.

Get Smart: Execution matters

Sometimes the market gets ahead of itself, confusing tomorrow’s promises with today’s profits.

Oracle’s surge reflects market enthusiasm for AI infrastructure plays, but the gap between contracted revenue and cash generation will eventually have to be closed.

The company must execute flawlessly on unprecedented infrastructure buildout while managing a stretched balance sheet.

Time will tell if Oracle and OpenAI will pull it off.

Generative AI is reshaping the stock market, but not in the way most investors think.

It’s not just about which companies are using AI. It’s about how they’re using it to unlock new revenue, dominate their markets, and quietly reshape the business world.

Our latest FREE report “How GenAI is Reshaping the Stock Market” breaks the hype down, so you can invest with greater clarity and confidence. Click here to download your copy today.

Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!

Disclosure: Chin Hui Leong does not own any of the shares mentioned.