When Warren Buffett buys a beaten-down stock, you may want to sit up and listen.

Recently, 13F filings revealed that Berkshire Hathaway (NYSE: BRK.A), the Oracle of Omaha’s firm, has taken a stake in the beleaguered UnitedHealth Group (NYSE: UNH).

Berkshire is no stranger to the insurance space — in fact, the company’s own sprawling insurance operations were once described by Buffett as one of the “Four Giants” within the conglomerate.

Given that Berkshire has a massive insurance arm and decades of experience in the sector, the move to acquire another insurer raises an interesting question: do they see something in UnitedHealth’s long-term prospects that the average retail investor is overlooking?

Here’s what you need to know: UnitedHealth is a healthcare giant in the US with two major businesses:

- UnitedHealthcare – This is the insurance side. They provide health plans to people, companies, and government programs like Medicare. Basically, they help cover medical costs when people get sick or need care.

- Optum – This is the services side. They run clinics, provide virtual care, manage pharmacy benefits, and use data and technology to help make healthcare more efficient and affordable.

Simply put, UnitedHealth doesn’t just pay medical bills, it’s also involved in delivering care and improving how the whole healthcare system works.

A Chain of Unfortunate Events

UnitedHealth Group hit a rough patch in the second quarter of 2025 (2Q 2025), with rising healthcare costs pushing its medical care ratio to nearly 90%, exerting pressure on its margins.

The medical care ratio is calculated by dividing medical costs by premium revenue.

In simple terms, a lower ratio means the insurer keeps more money from premiums after paying out claims, which is better for profitability.

Unfortunately, the latest quarter’s ratio is much higher than its previous medical care ratios recorded in 2024 (85.5%), 2023 (83.2%) and 2022 (82%).

Earlier in April, the company shocked investors with a rare earnings miss and a drastic cut to its full-year profit outlook, sending shares into their worst single-day drop in decades.

Leadership turmoil followed soon after, with CEO Andrew Witty abruptly resigning, forcing former CEO Stephen Hemsley to step back in.

On top of that, the Department of Justice launched probes into UnitedHealth’s Medicare Advantage billing and Optum Rx practices, adding a layer of regulatory uncertainty to an already challenging period.

3 Reasons Why the Stock May be Primed for Recovery

1. Margin Pressure in UnitedHealthcare (Insurance Arm) Can Be Easily Fixed

The recent collapse in UnitedHealth’s share price is largely driven by temporary margin compression, as medical costs have risen faster than premiums.

However, the insurance model allows UnitedHealth to reprice premiums annually, especially in Medicare Advantage and employer plans.

Management has already guided toward margin recovery starting between 2026 and 2027, by resetting premiums to reflect higher cost trends.

Furthermore, it aims to make benefit adjustments and exit unprofitable plans to improve margins.

2. Rising Aging Population Serves as a Tailwind for Optum (Service Arm)

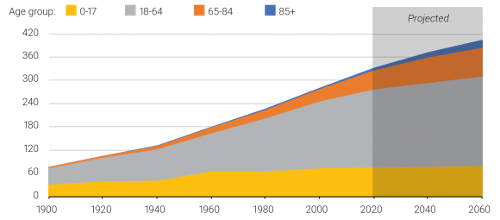

Optum benefits from structural tailwinds driven by an aging US population.

As the number of seniors grows, demand for Medicare Advantage (private health plans that deliver Medicare benefits), value-based care (a model where providers are paid based on patient health outcomes rather than services provided) and prescription management (tools that help patients and providers coordinate drug coverage and usage) will expand.

Optum’s integrated model positions it to be a natural beneficiary of the secular trend.

According to U.S. Census Bureau projections, the U.S. population aged 65 and older will rise from around 55 million in 2020 to about 80 million by 2040.

As the number of Americans aged 65 and older rises, more individuals will qualify for Medicare, and a growing share are expected to select Medicare Advantage plans run by private insurers.

UnitedHealth is already the largest provider in this market, so it stands to benefit disproportionately from this demographic tailwind.

Source: U.S. Census Bureau, decennial censuses and vintage 2017 population projections (2020-2060).

3. Sector Rotational Play

Over the past decade, the healthcare sector has generally kept pace with, and at times outperformed, the broader U.S. market thanks to its defensive growth profile.

Recently, though, healthcare stocks have fallen behind.

Since early 2024, the sector has lagged the S&P 500 by a wide margin, breaking from its long history of tracking closely with the index.

This gap may represent a margin of safety for investors, as healthcare has historically reverted closer to market performance.

Risk and Challenges

1. Department of Justice (DOJ) probe on UnitedHealth

One big concern for UnitedHealth right now is a Department of Justice investigation into how it handles billing for Medicare Advantage and its Optum unit.

Regulators want to know if the company used certain coding practices to collect higher payments than it should have.

If UnitedHealth is cleared, the cloud of uncertainty goes away, and the stock would likely bounce back.

If it’s found guilty, the most likely outcome is a hefty fine rather than a major restructuring, since the company plays such a huge role in U.S. healthcare.

In the latter case, the share price might take a hit at first, but history shows large healthcare firms usually recover fairly quickly after paying fines, since their core businesses remain intact.

2. Rising Medical Cost

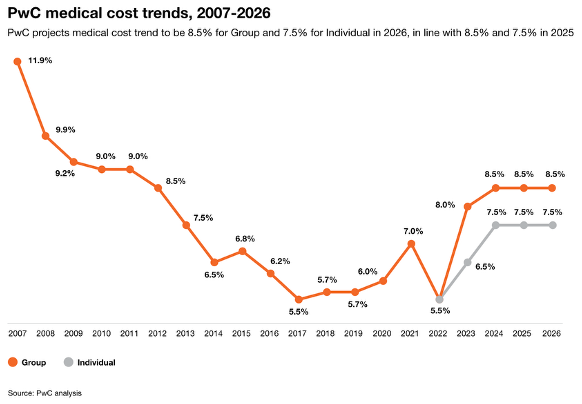

Since the pandemic, patients’ behaviour has shifted, and medical costs have been rising at a fast pace.

If healthcare expenses keep growing at around 8.5% or more, UnitedHealth might struggle to raise premiums quickly enough to fully protect its profit margins.

That said, this is a challenge facing the entire industry, not just UnitedHealth.

As the largest US health insurer, with scale, a diverse Optum business, and strong bargaining power with providers, UnitedHealth is in a better position than most competitors to absorb the pressure and defend profitability, in my view.

Get Smart: A Potential Turnaround

Given UnitedHealth’s scale, diversified business model, and strong long-term positioning in US healthcare, the recent collapse in its share price appears more like a short-term overreaction than a permanent damage to its business.

While challenges such as rising costs, leadership uncertainty, and regulatory investigations have weighed heavily on sentiment, these issues are not structural in nature to undermine the company’s core strengths.

For investors, this sharp sell-off in an industry leader could represent a rare chance to enter at a discount, setting up UnitedHealth as a candidate for a recovery play in the years ahead.

What are the stock secrets to Singapore’s “quiet millionaires?” Chances are, you’ll find at least one of their favourites in this free report. Download it now and see how these stocks could power your portfolio!

Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!

Disclosure: Evan owns shares of UnitedHealth.