It can be tough to find reliable businesses to invest in when macroeconomic conditions deteriorate.

The situation is made worse by Trump’s raft of tariffs, which have wreaked havoc on supply chains and stock markets.

Through it all, blue-chip stocks provide a safe harbour as they are large businesses that can withstand different economic cycles.

To top it off, these stocks also dish out a dividend that provides you with a steady stream of passive income.

Here are five blue-chip stocks that should give out steady dividends this year.

Venture Corporation (SGX: V03)

Venture Corporation is a provider of technology products, services, and solutions to customers in various technology domains such as healthcare, luxury lifestyle, and measurement instrumentation.

The group reported a downbeat set of earnings for 2024 as the semiconductor sector remained in the doldrums.

Revenue fell by nearly 10% year on year to S$2.7 billion while net profit tumbled 9.3% year on year to S$245 million.

Despite the lower profit, Venture maintained its annual dividend of S$0.75 per share for 2024.

Venture released a similarly downbeat business update for the first quarter of 2025 (1Q 2025).

Revenue fell by 7.5% year on year while earnings per share declined by 6.8% year on year.

However, the group is well-positioned to offer competitive solutions for its customers, which should help to improve its revenue outlook.

Management also sees opportunities to expand its market share in at least three or four of the group’s technology domains.

Mapletree Industrial Trust (SGX: ME8U)

Mapletree Industrial Trust, or MIT, is an industrial REIT with a portfolio of 141 properties across six property segments.

As of 31 March 2025, MIT’s total assets under management (AUM) stood at S$9.1 billion.

The REIT reported a resilient set of earnings for the fourth quarter of fiscal 2025 (4Q FY2025) ending 31 March 2025.

Although gross revenue and net property income (NPI) fell slightly year on year, the REIT’s distribution per unit (DPU) stayed constant at S$0.0336.

For fiscal 2025 (FY2025), MIT’s gross revenue and NPI inched up 2.1% and 2%, respectively, to S$711.8 million and S$531.5 million.

DPU for FY2025 improved by 1% year on year to S$0.1357.

The REIT saw its average borrowing cost dip from 3.1% to 3% over the past three months, with the gearing ratio coming in at 40.1%.

The portfolio maintained a high portfolio occupancy rate of 91.6%, and the Singapore properties enjoyed a positive rental reversion of 8.1% for renewal leases.

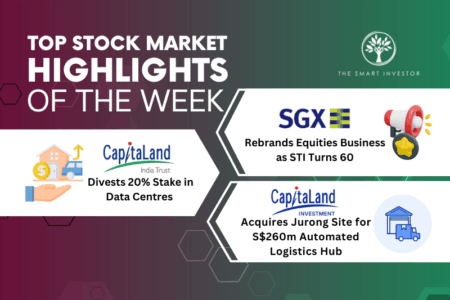

CapitaLand Integrated Commercial Trust (SGX: C38U)

CapitaLand Integrated Commercial Trust, or CICT, owns a portfolio of 26 retail and commercial properties located in Singapore (21), Germany (2), and Australia (3).

The portfolio’s AUM stood at S$26 billion as of 31 December 2024.

Like MIT, CICT also reported a resilient performance.

For 2024, gross revenue edged up 1.7% year on year to S$1.59 billion while NPI increased by 3.4% year on year to S$1.15 billion.

DPU was 1.2% higher at S$0.1088 for 2024.

For 1Q 2025, revenue and NPI were lower year on year because of the absence of contributions from 21 Collyer Quay, which was divested.

On a like-for-like basis, revenue and NPI would have increased by 1.1% and 1.4%, respectively.

Investors can rest assured that CICT also came with a strong set of operational statistics for 1Q 2025.

Portfolio occupancy was high at 96.4% while its retail and office divisions enjoyed positive rental reversions of 10.4% and 5.4%, respectively.

Footfall at its retail malls was also healthy.

1Q 2025 shopper traffic climbed 23% year on year while tenant sales improved by 17.5% year on year.

Singapore Exchange (SGX: S68)

Singapore Exchange, or SGX, enjoys a natural monopoly as Singapore’s sole stock exchange operator.

For the first half of fiscal 2025 (1H FY2025) ending 31 December 2024, SGX reported that net revenue jumped 15.6% year on year to S$646.4 million.

Net profit excluding one-off items shot up 27.3% year on year to S$320.1 million.

The bourse operator declared and paid a quarterly dividend of S$0.09, up from S$0.085 in the previous year.

Management intends to widen SGX’s product suite to broaden investors’ options and also expand regional access to Singapore equities by onboarding more overseas brokers.

SGX is optimistic about achieving its revenue growth target of between 6% to 8% per annum in the medium term.

Dividend per share is also targeted to grow at mid-single-digit per year in line with the growth in revenue and net profit.

Singapore Technologies Engineering (SGX: S63)

Singapore Technologies Engineering, or STE, is a technology and engineering group that serves customers in the aerospace, smart city, and defence sectors.

Like SGX, STE has also been steadily growing its net profit.

2024 saw the engineering giant report an 11.6% year-on-year revenue increase to S$11.3 billion.

Operating profit jumped 17.7% year on year to S$1.1 billion while net profit came in nearly 20% higher at S$702.3 million compared with 2023.

STE raised its total dividend for 2024 to S$0.17, one cent above the prior year’s S$0.16.

During this year’s Investor Day, management committed to increasing the annual dividend to S$0.18 for 2025.

From 2026, the group will pay around one-third of the year-on-year increase in net profit as incremental dividends.

For 1Q 2025, STE reported an encouraging business update with total revenue rising 8% year on year to S$2.9 billion.

All three of the group’s divisions posted year-on-year revenue growth.

Around S$4.4 billion of contracts were snagged during the quarter, taking STE’s order book to S$29.8 billion as of 31 March 2025.

This new 10-minute read could change how you invest this year. Inside:

5 SG dividend-paying blue chips that have quietly powered through past downturns, and could reward you handsomely in the next.

Grab the free report now. It might be the most profitable thing you read today.

Disclosure: Royston Yang owns shares of Mapletree Industrial Trust and Singapore Exchange.