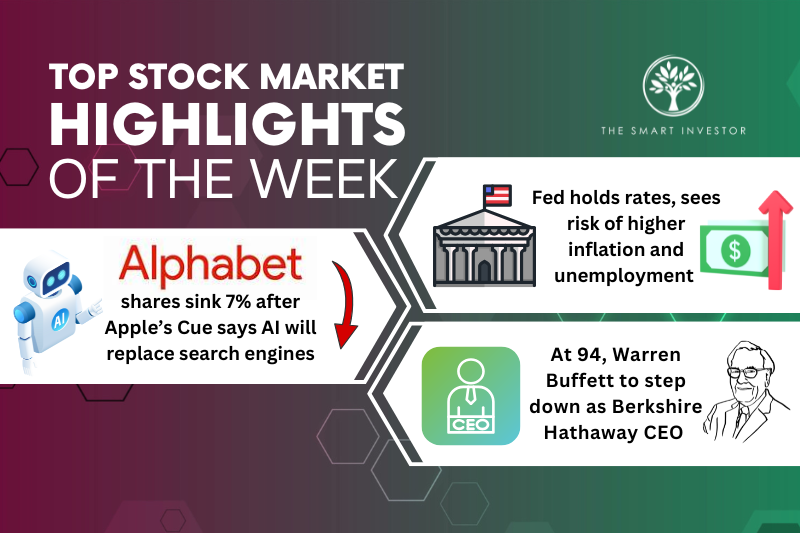

Welcome to this week’s edition of top stock market highlights.

US Federal Reserve

REIT investors who were hoping for an interest rate reduction would have been disappointed at the latest US Federal Reserve’s (“Fed”) decision.

The Fed held interest rates steady for the third straight meeting as it flagged a growing risk of higher inflation and rising unemployment.

The committee released a statement stating that uncertainty about the economic outlook has increased further, with official voting unanimously to maintain the benchmark rate in the range of 4.25% to 4.5%.

President Donald Trump’s wave of reciprocal tariffs is not helping, with economists expecting these tariffs to boost inflation and weigh on consumer demand.

Fed officials are comfortable with keeping rates steady until they have a better understanding of where the economy is headed.

In other words, they need to analyse more of the data to feel confident that both the central bank’s objectives are met.

The problem here is twofold.

Should the Fed lower rates pre-emptively, it may spark a resurgence in inflation, which flummoxed the central bank for most of 2022 and 2023.

But if rates are held high for too long, it may contribute to a slowing economy as businesses hold back from borrowing and people curtail their spending.

The US economy may have contracted at the start of this year for the first time since 2022, but a gauge of underlying demand has so far held firm.

Alphabet (NASDAQ: GOOGL) and Apple (NASDAQ: AAPL)

Eddie Cue, Apple’s services chief, said that he believes artificial intelligence (AI) search engines will eventually replace standard search engines such as Google, which is owned by Alphabet.

Apple is expected to add AI services from OpenAI, Perplexity and Anthropic as search options in Apple’s Safari browser sometime in the future.

Cue was testifying in a federal court in Washington as part of the Justice Department’s lawsuit against Alphabet for illegally dominating advertising technology markets.

The judge is looking to determine what penalties and corrective action should be taken against the company.

Google has a practice of paying platform providers such as Apple to become the default search engine.

Should the lawsuit require Google to amend its business practices or threaten its advertising business, it could have dire consequences for its revenue and profits.

The problem is that this lawsuit also has negative implications for Apple.

Back in 2022, Google paid Apple as much as US$20 billion per year, according to testimony given during the trial, for Google’s search engine to be the default for the latter’s iPhones.

Cue’s remarks could imply that this long-term relationship is at risk, with both companies could see their revenue and profits being adversely impacted as a result.

Warren Buffett and Berkshire Hathaway (NYSE: BRK.B)

At Berkshire Hathaway’s annual general meeting last week, CEO Warren Buffett dropped a bombshell.

He announced that he had asked the board of directors to replace him as CEO with long-term heir apparent Greg Abel.

The company’s shares fell by 5% following the conglomerate’s board’s unanimous approval to appoint Greg at the top seat.

Abel will take over as CEO on 1 January 2026, but Buffett will remain as chairman.

Since Buffett began running Berkshire Hathaway in 1965, the stock has massively outperformed the bellwether S&P 500 Index.

From 1965 to 2024, the stock has rallied 5.5 million per cent, significantly higher than the S&P 500’s performance of 39,054 per cent over the same period.

This works out to a compound annual growth rate (CAGR) of 19.9%, just shy of 20%, for Berkshire Hathaway.

The S&P 500’s CAGR was not too shabby at 10.4% but pales in comparison with Buffett’s performance.

Investors may be questioning whether they should still hold on to the stock now that Buffett is officially retiring from his CEO position.

It remains to be seen if Abel can steer the conglomerate with the same business acumen as the famed “Oracle of Omaha”.

Big Tech is spending hundreds of billions on AI, and the ripple effects are just beginning. Our new investor guide shows how AI is changing the way companies generate revenue, structure their business models, and gain an edge. Even if you already know the major players, this report reveals something far MORE important: The why and how behind their moves, and what it means for your portfolio. Download your free report now.

Follow us on Facebook and Telegram for the latest investing news and analyses!

Disclosure: Royston Yang owns shares of Alphabet and Apple.