Welcome to this week’s edition of top stock market highlights.

Trump’s sweeping tariffs

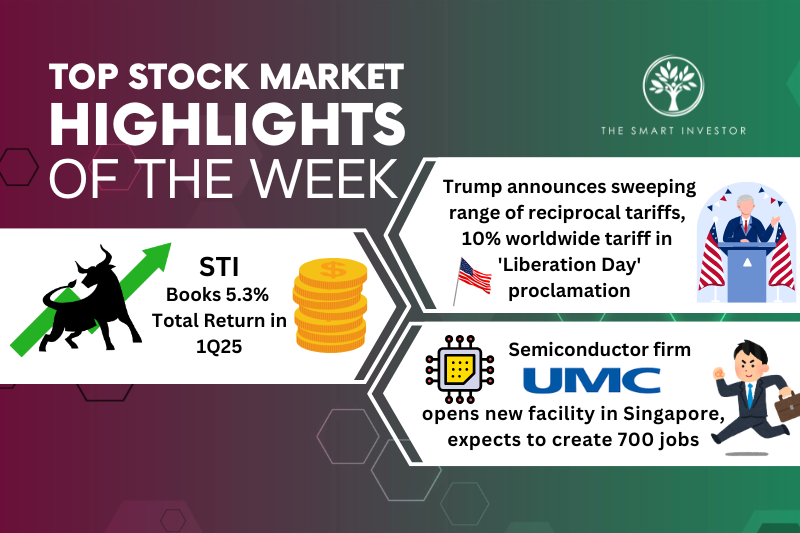

Trump is back once again with this favourite tool – tariffs.

This time, his decision is much more widespread with a proclamation to slap a 10% tariff on most goods imported into the US.

This worldwide assault will see a minimum “baseline” tariff rate of 10% on all exporters to the US along with additional duties on almost 60 countries with the largest trade imbalances with the US.

China, for example, faces a total tariff of 54% while the European Union was slapped with a 20% tariff.

Japan was not spared either, with a proposed 24% tariff levied on the country.

These higher “reciprocal” tariffs are part of Trump’s plan to punish the worst offenders based on the US government’s tally of the total levies and non-tariff barriers enacted against it.

Trump also mentioned that he was being kind to levy just 50% of what these nations taxed the US.

The baseline tariffs of 10% will take effect from midnight of 5 April while the higher duties will kick in on 9 April, according to senior government officials.

This round of new tariffs raises the effective US import tax rate to 22%, up nearly tenfold from just 2.5% last year.

The reciprocal tariffs do not apply to certain goods such as copper, pharmaceuticals, semiconductors, lumber, gold, and energy.

Economists warned that these tariffs, along with a broader, extended trade war, could slow the global economy and raise the spectre of a recession.

It would also raise the living costs of the average US family by thousands of dollars and the country could see a sharp inflation resurgence.

As of this writing, many countries have yet to respond with retaliatory tariffs, with some requesting dialogue to try to get Trump to change his mind.

Straits Times Index (SGX: ^STI)

The Straits Times Index, or STI, has once again turned in a strong performance in the first quarter of 2025 (1Q 2025) despite the tariff threats and amid an elevated interest rate environment.

Including dividends, the index delivered a total return of 5.3% for 1Q 2025.

The bellwether blue-chip index also surpassed the 4,000 level for the first time, taking nearly two and a half years for it to move from the 3,000 level to hit 4,000.

The STI’s strong performance continues from 2024’s total gain of 24.3%.

The five strongest-performing index stocks were Singapore Technologies Engineering (SGX: S63), Sembcorp Industries (SGX: U96), UOL Group (SGX: U14), Singtel (SGX: Z74), and CapitaLand Integrated Commercial Trust (SGX: C38U), or CICT.

ST Engineering led the pack with a stunning 45.7% total return for 1Q 2025 as the stock received numerous broker upgrades this year.

Sembcorp Industries and UOL Group were tied with a 15% gain while Singtel and CICT each chalked up an 11% gain for 1Q 2025.

United Microelectronics Corporation (NYSE: UMC)

United Microelectronics Corporation, or UMC, opened a new facility in Singapore on 1 April that is expected to create 700 jobs over the next few years.

The Taiwanese semiconductor foundry will inject up to US$5 billion into the advanced fabrication facility in Pasir Ris to bring it to its full capacity of 30,000 wafers a month.

This is just the first phase which is expected to commence production in 2026, which will increase UMC’s total production capacity in Singapore to one million wafers annually.

This new facility will produce 22- and 28-nanometre chips used in communications, the Internet of Things, and automotive.

Such chips include premium smartphone display chips, power-efficient memory chips, and next-generation connectivity chips.

The new fab spans 111,800 square metres and is located adjacent to UMC’s existing fab.

The company has over 1,800 employees here, with local staff making up the bulk of its employees.

Singapore will manufacture 14% of UMC’s global output, with the majority still coming from Taiwan (62%).

China and Japan will contribute 15% and 9% of the company’s total global output, respectively.

Explore Singapore’s top “evergreen” stocks with our FREE report. It spotlights 7 Singapore blue-chip stocks with solid dividends and growth potential. Click here to download it now to create a flow of dividend income, regardless of market conditions.

Follow us on Facebook and Telegram for the latest investing news and analyses!

Disclosure: Royston Yang does not own shares in any of the companies mentioned.