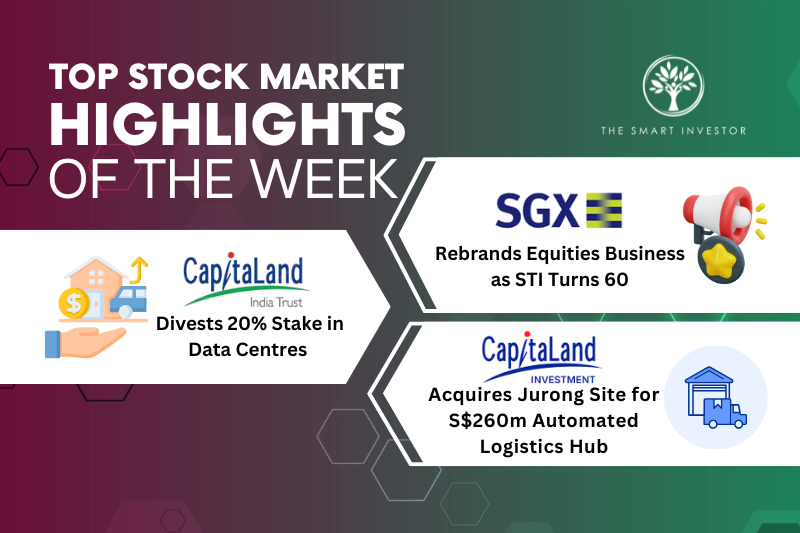

Singapore’s stock market entered a historic new era this week with a major bourse rebranding and strategic shifts in the data and logistics sectors.

From the STI’s 60th-anniversary milestones to CapitaLand’s latest asset maneuvers, here are the key highlights.

SGX Securities becomes SGX Stock Exchange as STI marks 60th anniversary

Singapore Exchange’s equities business has officially rebranded as SGX Stock Exchange.

Announced by Singapore Exchange Limited (SGX: S68) CEO Loh Boon Chye on 5 January 2026, the renaming marks the 60th anniversary of the Straits Times Index (SGX:^STI) and follows the Equities Market Review Group’s recommendations to revitalize the local market.

The rebranding arrives amid a surge in momentum; the STI delivered a total return exceeding 28% in 2025, while total market capitalization surpassed S$1 trillion.

Average daily traded value reached its highest level since 2010, with small- and mid-cap turnover jumping 40% year on year.

Furthermore, 2025 saw the strongest IPO activity since 2019, raising over S$2.4 billion.

Looking ahead, the upcoming SGX-Nasdaq Global Listing Board, set for mid-2026, will provide Asian growth companies a streamlined bridge to international capital.

This transformation reinforces the exchange’s role as a core pillar of SGX Group’s multi-asset ambitions during a period of renewed investor confidence.

CapitaLand India Trust divests partial stake in three data centres

CapitaLand India Trust (SGX: CY6U, CLINT) has announced the divestment of a 20.2% stake in three data centre assets under development to the CapitaLand India Data Centre Fund for approximately S$99.73 million.

The deal, based on an enterprise value of S$738.2 million, was negotiated at a premium to independent valuations.

The assets – located in Navi Mumbai, Chennai, and Hyderabad – feature a combined power capacity of 200 MW.

CEO Gauri Shankar Nagabhushanam stated that this move allows CLINT to unlock value early in the development cycle while retaining a majority stake to benefit from future growth.

This “portfolio reconstitution” enhances financial flexibility, allowing the Trust to recycle capital into its development pipeline.

Additionally, the partnership grants CLINT the right to participate in future developments and explore exit options, such as a potential initial public offering, ensuring the Trust remains well-positioned within India’s rapidly expanding digital infrastructure landscape.

CLI fund acquires Jurong site to develop S$260 million automated logistics hub

CapitaLand Investment Limited (SGX: 9CI), or CLI has acquired a 5.1-hectare site at 19 Gul Lane through its SEA Logistics Fund to develop Omega 1 Singapore.

This state-of-the-art automated logistics facility is valued at approximately S$260 million and is slated for completion in 2028.

Spanning 71,000 square metres, the five-storey hub will feature advanced robotics and an automated storage and retrieval system capable of handling 60,000 pallet positions.

Upon completion, the facility will be fully master-leased to Ally Logistic Property (ALP) with built-in rental escalations.

Patricia Goh, CEO of CLI Southeast Asia, noted that the project addresses the rising regional demand for modern logistics solutions driven by e-commerce, labor costs, and supply chain rationalization.

This strategic move increases Singapore’s share of the fund’s assets under management to 55%.

The development highlights CLI’s commitment to “New Economy” assets that leverage technology to overcome traditional industrial constraints.

Many Singapore stocks fall behind inflation, which means your money quietly loses strength over time. Dividend stocks have a very different track record. Some continued delivering 6% to 13% every year across the toughest market conditions.

In this FREE report, discover 5 crisis-tested dividend stocks that kept rewarding investors while the market struggled. Download your dividend investing guide now.

Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!