Welcome to this week’s edition of top stock market highlights.

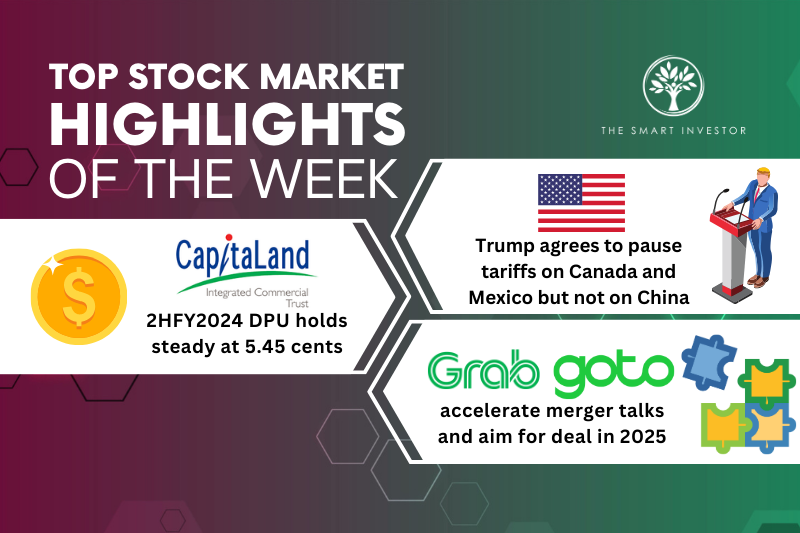

Donald Trump’s tariffs

The new US President, Donald Trump, has wasted no time in delivering on his election promises once he took office.

He swiftly announced the imposition of 25% tariffs for both Canada and Mexico along with a 10% tariff on Chinese imports.

However, the President has agreed to hold off on imposing these tariffs on Canada and Mexico for 30 days, delaying what may turn out to be a bruising trade war.

Canadian Prime Minister Justin Trudeau has agreed to reinforce his country’s borders with the US in a clamp down on migration along with increased surveillance to staunch the flow of Fentanyl, a deadly drug.

Mexican President Claudia Sheinbaum also hammered out a last-minute deal with Trump to reinforce its border with troops to tackle the issue of illegal immigrants.

In turn, the US will limit the flow of guns into Mexico.

The 10% China tariffs has come into effect, with China imposing retaliatory tariffs on a range of US products, including 15% on coal and liquified natural gas and 10% on crude oil and agricultural machinery.

Trump reiterated that the Chinese tariffs were just an opening salvo and that more will come if no agreement is reached between the two countries.

Meanwhile, both Canada and Mexico were also preparing to slap retaliatory tariffs on US goods.

According to Trump, these tariffs are a tool for growing the US economy as they bring in valuable government revenue.

In turn, the tariffs will help to protect jobs and raise America’s tax revenue.

Economists, however, have warned that a trade war could end up raising prices for a wide range of products including cars, steel, and lumber, potentially exacerbating inflation.

Next on Trump’s hit list is the European Union, which he has targeted for tariffs without elaborating further.

It’s still early days, but investors should brace themselves for an all-out trade war should Trump make good on his promises.

CapitaLand Integrated Commercial Trust (SGX: C38U)

CapitaLand Integrated Commercial Trust, or CICT, recently reported a resilient set of earnings for the second half of 2024 (2H 2024) and the full year (2024).

The blue-chip retail and commercial REIT saw its gross revenue for 2H 2024 inch up 1.2% year on year to S$794.4 million, aided by a better overall performance for the portfolio.

Net property income (NPI) increased by 1.3% year on year to S$571.1 million but distribution per unit (DPU) stayed flat year on year at S$0.0545 because of a larger base of units arising from CICT’s recent equity fundraising exercise.

On a full year basis, gross revenue improved by 1.7% year on year to S$1.6 billion while DPU crept up 1.2% year on year to S$0.1088.

Meanwhile, CICT also boasted strong operating and retail metrics.

Portfolio occupancy stood high at 96.7% as of 31 December 2024 with the retail, commercial (office) and integrated developments segments all sporting occupancy rates of 94% and above.

Rental reversion was strongly positive at 8.8% and 11.1% for the retail and office portfolios, respectively, signalling healthy demand for CICT’s portfolio.

Retail metrics were also healthy with shopper traffic for 2024 increasing 8.7% year on year.

Tenant sales increased by 3.4% year on year over the same period.

Grab (NASDAQ: GRAB) and Goto (IDX: GOTO) merger

Both Grab and Goto are in discussions once again on a possible merger this year.

According to people familiar with the situation, both companies see 2025 as a good year to strike a deal to end painful losses.

A merger would help to reduce costs and lower competition in a region that serves more than 650 million consumers.

Profitability has been elusive for both Grab and Goto as competition for customers has impacted margins and capped pricing for both parties.

However, a major hurdle would be an antitrust investigation as both companies command substantial market shares in their respective regions.

Current talks may or may not lead to a transaction, and there is no guarantee that a merger will take place at all.

Demand has also slowed as the customer base gets larger and consumers are wary of spending to hail a ride or order food deliveries in an increasingly challenging macroeconomic environment characterised by high interest rates.

Attention: Investors aiming for both growth and peace of mind. We’ve pinpointed 5 SGX stocks known for consistent dividends. If you want to build a retirement portfolio, but don’t want the stress of stock watching, this report is for you. Click HERE to download now.

Follow us on Facebook and Telegram for the latest investing news and analyses!

Disclosure: Royston Yang does not own shares in any of the companies mentioned.