Welcome to this week’s edition of top stock market highlights.

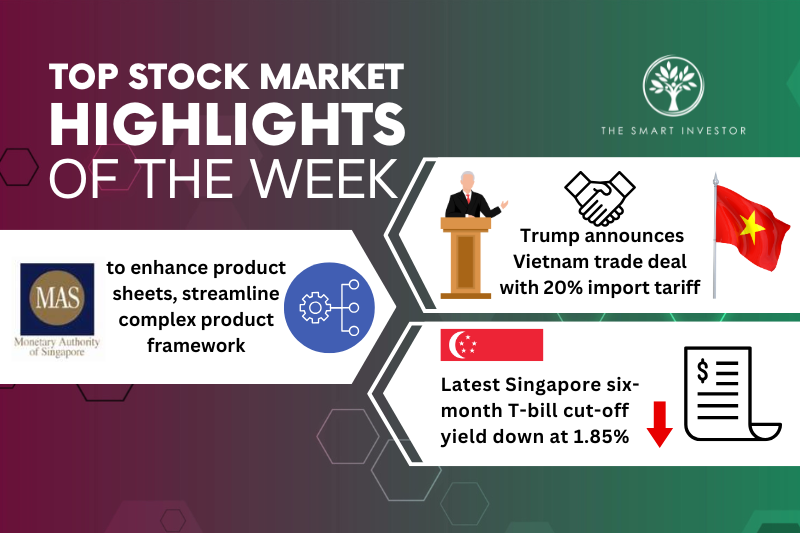

Donald Trump and Vietnam tariffs

After weeks of intense negotiations, President Donald Trump has reached a trade deal with Vietnam ahead of a deadline on 9 July.

Recall that Trump had paused his list of reciprocal tariffs for 90 days after declaring his “Liberation Day” list of tariffs on more than 180 countries.

A 20% tariff will be imposed on all Vietnamese exports to the US, with the levy rising to 40% on any goods transhipped within the country.

In return, Vietnam has agreed to withdraw all levies on US imports.

This deal was secured by Trump after discussions with Communist Party chief To Lam.

This agreement was just the third to be announced, following agreements made with both the UK and China.

The previous reciprocal tariff rate for Vietnam was a high 46%, but was pared down to 10% as Trump entered into negotiations.

The deal was hammered out because Vietnam is viewed as a strategic partner in the US’s efforts to counteract China.

The country’s exports have also become consumer staples in the US.

Vietnam is a major supplier of textiles and sportswear and hosts manufacturing sites for companies such as Nike (NYSE: NKE), Gap Inc. (NYSE: GAP), and Lululemon Athletica (NASDAQ: LULU).

The total value of Vietnam’s exports to the US was worth almost US$137 billion, and its trade surplus with the US was the third-largest globally, behind only China and Mexico.

Vietnam has not only removed all tariffs on US imports but has also promised to purchase more American goods, making this a big win for Trump.

Monetary Authority of Singapore (MAS)

Changes are afoot for a range of investments as the MAS proposes new recommendations for financial products.

Investment-linked products (ILPs) will now require a product highlights sheet (PHS), while MAS has proposed to remove the requirement for investors to seek mandatory financial advice when purchasing “complex products”.

These are just some of the measures announced by Singapore’s central bank to revamp the financial products landscape.

For Collective Investment Schemes (CIS), MAS classifies these as non-complex if the CIS invests in simple products such as shares or gold.

However, CIS that meet investment restrictions but still invest a portion of investors’ funds outside the scope of its core investment approach are classified as “complex products”.

PHS is are documents that help to summarise the key aspects of an investment product, such as the main features, benefits, and risks.

These may include shares, bonds, or units in a CIS.

The revised PHS will help investors to better understand the product’s features with a list on the first page.

A question-and-answer format will also be included to enhance understanding.

Complex products will be flagged with a red label to alert investors to seek advice where appropriate.

Apart from the removal to seek financial advice for complex products, the MAS is introducing a product knowledge assessment (PKA) as an alternative to assessing an investor’s knowledge level.

The PKA will have questions on the key features and risks of a complex product and will serve as a self-assessment tool.

Finally, investors who need additional protection may still opt to go through the mandatory financial advisory process before they purchase complex products.

Singapore Treasury Bill

There’s bad news for investors who are looking for capital-guaranteed investment products with a decent yield.

The cut-off yield for Singapore’s latest six-month Treasury Bill (T-Bill) has fallen once again, marking the eighth consecutive decline.

This round, the cut-off yield slid to 1.85%, below the 2% offered in the previous six-month T-Bill auction.

Despite the lower yield, demand remained strong.

The auction received a total of S$16.1 billion in applications for just S$7.5 billion of bills on offer, translating to a bid-to-cover ratio of 2.15.

This bid-to-cover ratio was slightly above the previous tranche’s ratio of 2.13.

The median yield for the latest auction came in at 1.76%, down from the 1.95% in the previous round of bidding.

Another S$450 billion of securities will be issued, with the government passing a parliamentary motion to raise the issuance limit to S$1.515 trillion.

This new limit will last until 2029.

Big Tech is spending hundreds of billions on AI, and the ripple effects are just beginning. Our new investor guide shows how AI is changing the way companies generate revenue, structure their business models, and gain an edge. Even if you already know the major players, this report reveals something far MORE important: The why and how behind their moves, and what it means for your portfolio. Download your free report now.

Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!

Disclosure: Royston Yang owns shares of Nike and Lululemon.