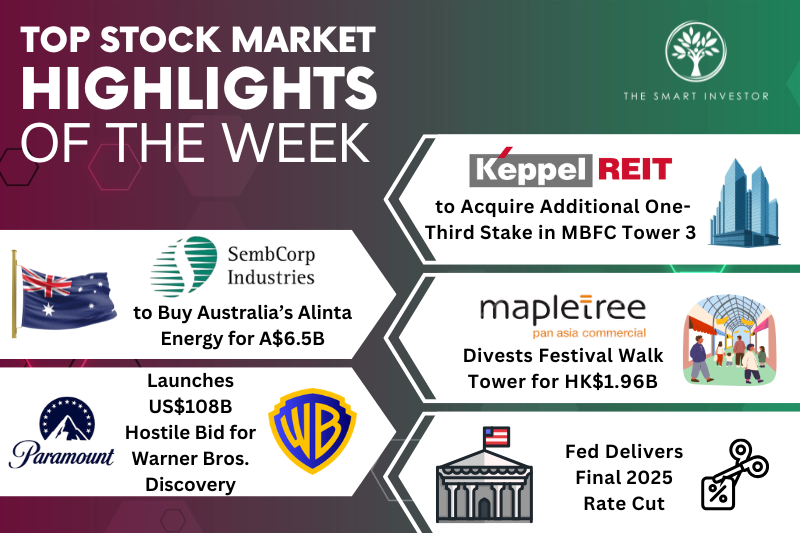

As the year winds down, companies are not slowing down.

This week saw a flurry of major corporate activity, from billion-dollar acquisitions to strategic portfolio reshuffles, even as the US Federal Reserve delivered its third consecutive rate cut while signalling a pause ahead.

Keppel REIT takes on a major acquisition

Keppel REIT (SGX: K71U) is acquiring an additional one-third interest in Marina Bay Financial Centre Tower 3 for approximately S$908 million, bringing its total stake to two-thirds.

Completion is scheduled for 31 December 2025.

The agreed property value of S$1.453 billion represents a 1% discount to the independent valuation of S$1.467 billion.

MBFC Tower 3 is a 46-storey premium Grade A office tower at 12 Marina Boulevard with approximately 1.3 million square feet (sqft) of net lettable area.

Anchored by DBS Group (SGX: D05), the property boasts 99.5% committed occupancy and a weighted average lease expiry of 3.5 years as at 30 September 2025.

The total acquisition cost of around S$938 million (including fees) will be funded primarily through a preferential offering, covering 94.5% of the total cost, with the remainder from debt financing.

The Manager cited several strategic benefits, including no new Marina Bay office supply expected between 2026 and 2029, with passing rent sitting approximately 10% below market average.

Post-completion, Keppel REIT’s Singapore portfolio exposure increases from 75.8% to 79%.

Interestingly, based on FY2024 figures, the acquisition is expected to be 3.6% to 6.4% DPU-dilutive.

Meanwhile, aggregate leverage will decrease marginally from 42.2% to 41.9% after receipt of preferential offering proceeds, as the net proceeds raised will be used to repay the equity bridge loan.

Sembcorp Industries makes a big move in Australia

Sembcorp Industries (SGX: U96) has agreed to acquire 100% of Alinta Energy, Australia’s fourth-largest utilities provider, for an enterprise value of A$6.5 billion (around S$5.6 billion).

The acquisition, announced on Thursday, is expected to complete in the first half of 2026, subject to regulatory approvals.

The seller, Chow Tai Fook Enterprises (CTFE), acquired Alinta in 2017 for A$4 billion.

Alinta serves about 1.1 million customers and operates 3.4 GW of generation capacity across coal, gas, wind and solar assets, including the 1,140 MW Loy Yang B coal-fired power station in Victoria.

The Aussie firm also offers access to a 10.4 GW development pipeline of renewables and firming systems.

The deal is expected to be immediately earnings-accretive, with pro-forma EPS for the prior 12 months to June 2025 rising 14% to S$0.65, while return on equity is expected to increase from 19.7% to 22.5%.

The purchase will be fully funded in cash through a committed bridge facility.

Australia is a key market for Sembcorp’s ambition to grow its renewables capacity to 25GW by 2028, with the acquisition increasing its developed market exposure from 25% to 31%.

Mapletree Pan Asia Commercial Trust divests Festival Walk Tower

Mapletree Pan Asia Commercial Trust (SGX: N2IU) or MPACT is divesting Festival Walk Tower, the office component of Festival Walk in Hong Kong, for HK$1.96 billion (around S$328 million).

Completion is targeted for February 2026.

The four-storey office tower has a lettable area of 213,982 sqft with 94.2% committed occupancy.

The divestment consideration is in line with independent valuation but represents a 16% decline from the original purchase price of HK$2.33 billion.

Proceeds will be directed towards debt reduction, improving aggregate leverage from 37.6% to 36.5%.

MPACT will retain the Festival Walk retail mall, which has close to 100% occupancy.

Paramount’s Hostile bid for Warner Bros Discovery

Paramount, a Skydance (NASDAQ: PSKY) corporation, has launched a hostile takeover bid to acquire all of Warner Bros. Discovery (NASDAQ: WBD) for US$108.4 billion, offering US$30 per share in an all-cash deal.

The bid, announced on Monday, comes just three days after Netflix (NASDAQ: NFLX) agreed to acquire WBD’s studio and streaming assets for US$82.7 billion.

Paramount’s offer covers the entire company, including CNN and TNT, while Netflix’s deal excludes the traditional TV assets.

Paramount Skydance CEO David Ellison, who is leading the charge, argued that its bid provides shareholders US$18 billion more in cash than Netflix’s mixed cash-and-stock offer of US$27.75 per share.

The bid is backed by the Ellison family, RedBird Capital, and US$54 billion in debt commitments from Bank of America, Citi and Apollo. Additional financing comes from Saudi Arabia’s Public Investment Fund and Jared Kushner’s Affinity Partners.

The tender offer expires on 8 January 2026, with WBD required to respond within 10 business days.

2025’s Final Interest Rate Cut

The US Federal Reserve cut interest rates by 0.25 percentage points on Wednesday night, lowering the benchmark rate to between 3.50% and 3.75%.

However, the decision came with clear signals of a pause ahead, with Chair Jerome Powell noting the Fed is “well positioned to wait to see how the economy evolves.”

The vote was notably divided, drawing three dissents—two officials preferred holding rates steady while another pushed for a larger half-point cut.

Looking ahead, projections show the median policymaker expects just one quarter-point reduction in 2026, at odds with market expectations of two cuts.

Many Singapore stocks fall behind inflation, which means your money quietly loses strength over time. Dividend stocks have a very different track record. Some continued delivering 6% to 13% every year across the toughest market conditions.

In this FREE report, discover 5 crisis-tested dividend stocks that kept rewarding investors while the market struggled. Download your dividend investing guide now.

Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!