Hunting for great dividend stocks can be a tough endeavour and may sap your time and energy. A ton of preparatory work needs to be done, including detailed research and due diligence, in order to ascertain the quality of the company and the sustainability of its dividend.

The difficulty with the process is not in searching for purely high dividend yield companies, as these may sometimes turn out to be value traps.

What you want are companies that demonstrate a consistent pattern of rewarding minority shareholders, have the capacity to do so, and the prospects to ensure that the flow of dividends can carry on indefinitely.

These conditions form the basis for what I share today. My aim is to make it less confusing for you to define what’s important in determining the makings of a great dividend stock.

As my ValueGrowth article had pointed out, the essence of the strategy involves finding companies with a good mix of both dividends and growth.

Investors should understand that the definition of a “dividend stock” may not be limited to stocks that are classified as pure yield stocks, as this narrow definition may imply the lack of suitable growth opportunities for the deployment of capital.

In my view, good dividend stocks should not just be able to sustain their dividends, but should also incorporate a growth component to the absolute dividend as well.

Here are the two main methods I use to determine if a stock has great dividend potential. I will end off with a brief discussion on the qualitative aspects that need to be considered in conjunction with the quantitative ones.

Free cash flow generation

A key aspect of a great dividend stock is its ability to generate consistent free cash flow (FCF). FCF is defined as the operating cash flow of a business minus the capital expenditure needed to maintain its operations.

A business that generates copious amounts of FCF need not rely on bank financing (i.e. loans and borrowings) to fund its business, thereby providing it with a greater margin for error should something go wrong.

Examples of companies with consistent FCF generation include VICOM Limited (SGX: V01) and SATS Limited (SGX: S58).

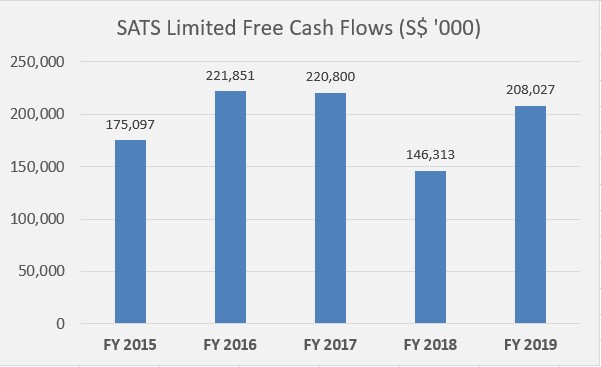

Source: SATS Limited Annual Reports FY 2015-2019

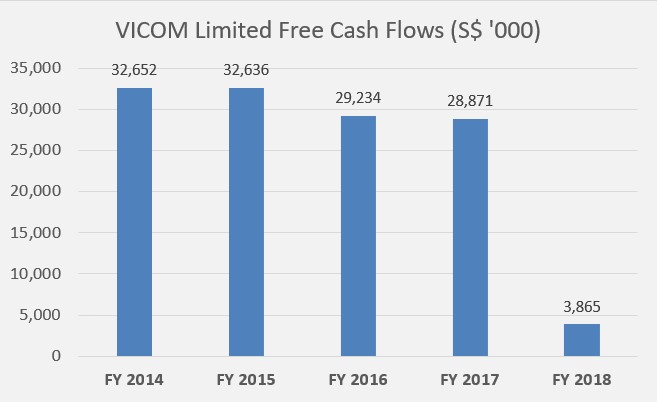

Source: VICOM Limited Annual Reports FY 2014-2018

Incidentally, both companies also paid out an increasing amount of dividends over the last three years, as there is excess cash flow from their businesses.

Note that VICOM’s FCF for FY 2018 was significantly lower because of a S$23.1 million purchase of a new property at Bukit Batok that will be used as the group’s new headquarters. If we strip this expense out, FCF would have been around S$27 million.

Pay-out ratio

The next aspect you should look for is the dividend payout ratio (POR). This ratio measures the percentage of profits that are paid out as dividends to shareholders.

A lower POR implies that the company is retaining most of its profits for reinvestment to grow the business, while a high POR signifies that the company is willing to pay out most of its profits as dividends.

Of course, what’s “high” and “low” are admittedly subjective, but a rule of thumb I use is the 50% mark – if a business pays out 50% or more of its earnings, I consider that a high POR and may imply that the business has lower prospects for growth.

Low POR companies may give the impression that as the business matures, the POR may be raised, correspondingly lifting dividends higher. The problem here is that there is no hard and fast rule when it comes to POR.

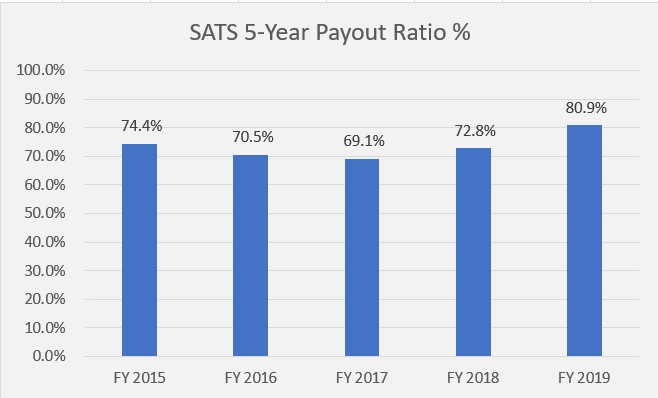

To give an example, SATS Limited has an average POR of 73.5% over the last five years, but it has still managed to pay out an increasing dividend per share (DPS) over the same period.

Source: SATS Limited Annual Reports FY 2015-2019

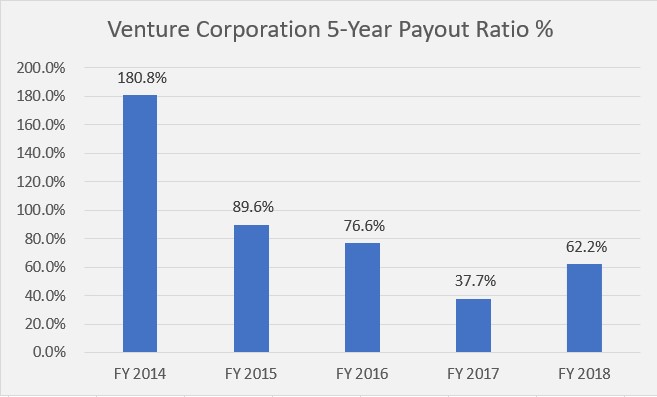

Venture Corporation Limited (SGX: V03) sports an average POR of 89.4%, but this number is somewhat misleading as profits were volatile over the last five years due to the cyclical nature of the electronics and semiconductor industries.

Source: Venture Corporation’s Annual Reports 2015-2019

I have found it to be more useful to observe if the POR is declining over the years, as this may signify that the DPS being paid has yet to keep pace with the earnings growth.

For Venture’s case, POR has fallen from 180.8% in FY 2014 to 62.2% in FY 2018, and this is good news for shareholders as it implies that there is room for dividends to grow if profits continue to climb.

Future prospects

The qualitative aspects are just as, if not more important, as the numerical ones. This involves assessing if the company is in an industry that is growing or shrinking, and whether the company is gaining or losing market share to its competitors.

With an expanding pie, it becomes easier for a company to grow alongside its peers, and for profits and FCF to continue to grow.

Finally, investors need to assess the strategic plans of the company. Are there clear steps being taken to grow the business? Are these initiatives focusing on organic growth or acquisitive growth? Are there clear catalysts and a timeline drawn up for the implementation of the plans?

All these factors will impact potential dividend growth and should be carefully considered.

To learn more about the different types of investing strategies, and how you can apply them in your investing journey, sign up for our free investing education newsletter, Get Smart! Click HERE to sign up now.

None of the information in this article can be constituted as financial, investment, or other professional advice. It is only intended to provide education. Speak with a professional before making important decisions about your money, your professional life, or even your personal life. Royston Yang owns shares in SATS Limited and VICOM Limited.