I thought the title – The Perfect Storm, after a favourite old movie of mine, is an apt way to describe this recent crisis.

The coronavirus has started to spread outside of China with the number of cases outside China rising rapidly starting with Europe, South Korea, and now USA.

To make things worse, talks at the OPEC+ meeting last Friday collapsed.

Both Saudi Arabia and Russia were no longer willing to curb production limits.

Over the weekend, Saudi Arabia slashed its selling price of oil to the US, Europe and Asia. The move resulted in Brent crude oil prices sinking 21.3% to $35.58 per barrel. US crude oil prices plunged 24.6% to close at $31.13 per barrel.

With supply increasing due to the fall out at the OPEC+ meeting, and coronavirus-related demand losses increasing, the short-term base case for oil prices is getting weaker.

3 Guiding Principles to Tackle This Crisis

Focusing on business fundamentals

Unlike the stock market, a business rarely changes direction dramatically on a day-to-day basis.

Stock prices fluctuate greatly in any given period of time, but in the long run, they always converge towards the underlying fundamentals of the business.

Therefore, invest in businesses that have fortress-like balance sheets, proven generators of profits, free cash flows, and cheap valuations.

Understanding market history

If you take a step back and take a look at past market cycles, in the long history of investing, the current one we are facing is just another blip in the cycle.

The parallels between what we are seeing in the market today, and other events such as the subprime mortgage crisis of 2007/08, the 2016 slowdown in China, US-China Trade War in 2018 are clear for those willing to connect the dots.

While history may not repeat itself, it often rhymes.

Since 2010, here is a list of significant events that have affected the market.

- The first ever downgrade in the history of the United States of America of its credit rating from AAA to AA+ by Standard & Poors in August of 2011.

- Meltdown of Singapore listed Blumont Group, Asiasons Capital, and LionGold Corp which lost S$8 billion in just three days of trading in October 2013.

- Oil prices crashed from $112 per barrel in June 2014 to $48 per barrel in January 2015, due to the slowdown in oil demand from China and India. Saudi Arabia pumped out supply in hopes that countries such as US and Canada would be forced to abandon their more costly production methods.

- The inflation of the Chinese stock market bubble, and its subsequent crash. More than 30% of the value of the A-Shares listed on the Shanghai Stock Exchange was lost in less than one month in July 2015.

- The stock market rout during the month of January 2016. The Hang Seng Index fell over 35% to 18,319 in February 2016 from the high of 28,442 set in April 2015.

- The Shanghai Stock Exchange also fell close to 25%, from 3,539.18 to 2,655.66 in the month of January 2016.

- The US China Trade War in 2018, where at its peak USA slapped tariffs on US$550 billion of Chinese imports and China slapping tariffs on US$185 billion on US imports, before tensions started de-escalating with the signing of the trade deal phase 1.

- The Hong Kong Protest, which was triggered by a controversial bill that would allow the extradition of fugitives to Mainland China, sparked pro-democracy, anti-government protest for more than 6 months.

Staying invested in the market.

There is something that I can never stress enough – the age old argument of timing the market versus time in the market.

While some choose to sell out when times get tough and buy when the negativity has cleared, I beg to differ.

While it would be easier to do so, I argue that your investment returns in the long run would take a hit. Let’s take a closer look at why.

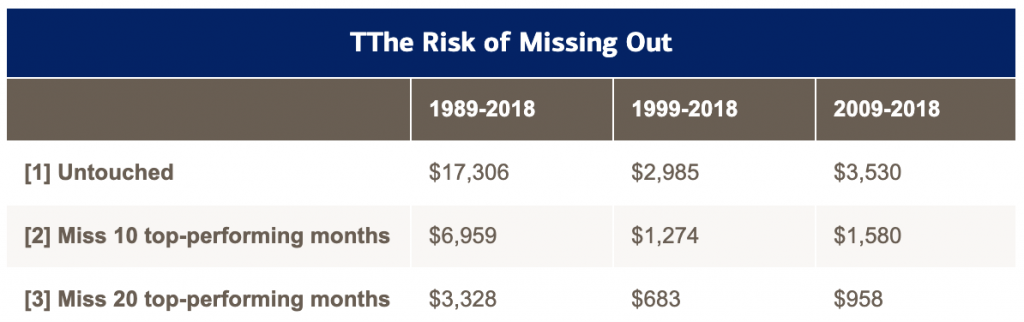

The three columns represent the total returns of a $1,000 investment beginning in 1989, 1999, and 2009, and ending December 31, 2018 in the S&P 500 index.

The first row (Row 1) shows the investment if left untouched for the entire period shown above; Row 2 shows the investment if it was pulled out during the 10 top-performing months; and Row 3 shows the investment if it was pulled out during the 20 top-performing months.

Clearly, the untouched investment returns wins in all three periods.

Get Smart: Learning from Peter Lynch

Peter Lynch managed the Magellan Fund at Fidelity Investments between 1977 and 1990.

During this period, the fund averaged an annual return of 29.2%, which was greater than twice the return provided by the S&P 500 in the same period.

As such, it is fitting to close this article with a quote from him:

Absent a lot of surprises, stocks are relatively predictable over twenty years. As to whether they’re going to be higher or lower in two to three years, you might as well flip a coin to decide.

Ultimately, as investors, we can only choose to be investing in either a good outlook or a good price, but never both!

FREE special report: The Bear Market Survival Guide. If you’d like to learn how to survive this bear market, CLICK HERE to download our special free report.

Get more stock updates on our Facebook page or Telegram. Click here to like and follow us on Facebook and here for our Telegram group.

An earlier version of this article first appeared on Investing Nook.