Healthcare REITs are often prized as a stable source of dividend income.

As a whole, the industry is benefiting from strong tailwinds. As the world’s population grows older, the demand for healthcare services is likely to increase.

However, does this make all healthcare REITs a good investment?

Let’s do an x-ray of Parkway Life REIT (SGX: C2PU) and First Real Estate Investment Trust (SGX: AW9U).

The business checkup

ParkwayLife REIT and First REIT may be in the same industry but the duo has very different profiles.

As of 30 September 2019, ParkwayLife REIT owns three Singapore hospitals, 45 Japanese nursing homes, 1 Japanese manufacturing and distribution facility and a stake in a Malaysian medical centre.

First REIT, on the other hand, owns 15 hospitals and a hotel-cum-country club in Indonesia along with three Singapore-based nursing homes and a hospital in South Korea.

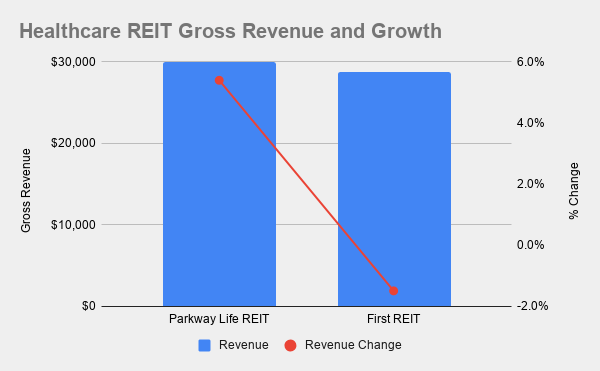

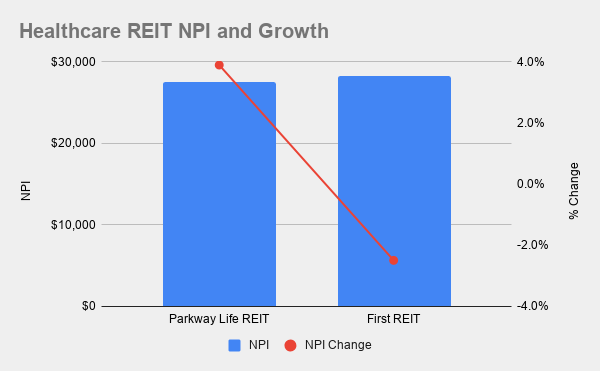

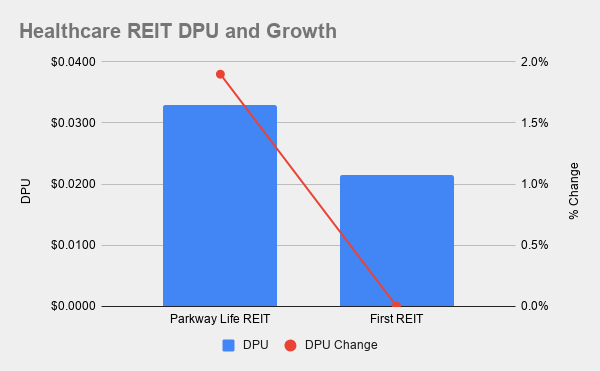

Below is a summary of the growth in gross revenue, net property income (NPI) and distribution per unit (DPU) for their latest quarter.

Source: REIT earnings announcements

Despite the difference in profile, both REITs pulled in about the same revenue for their recent quarters.

Parkway Life REIT delivered solid revenue growth of 5.4% year on year and a 3.9% increase in NPI which led to a pleasing 1.9% DPU growth.

First REIT, on the other hand, recorded a slight decline in both revenue and NPI but its DPU was unchanged.

There has been a lingering concern over the ability of First REIT’s sponsor, Lippo Karawaci, to continue paying its rental on time.

There is some merit to the concern. The REIT’s average day sales outstanding (DSO) rose to a high over 123 days in the third quarter of 2018. But the figure has since declined to around 72 days in its latest quarter.

For context, Parkway Life REIT had an average DSO of 36 days.

The financial health checkup

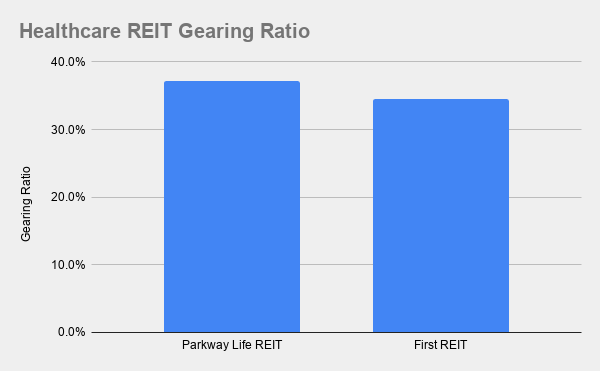

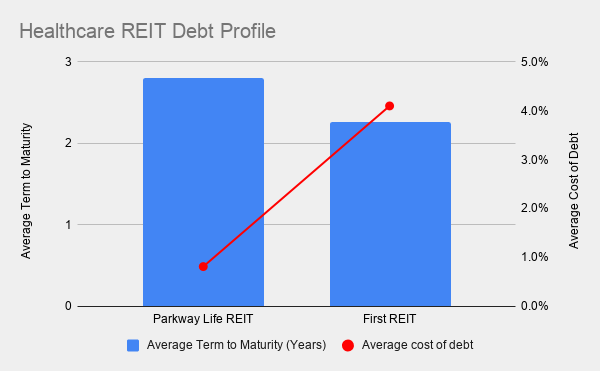

Looking at a REIT’s gearing, the average cost of debt and the average term to maturity provides a view on whether the individual trusts are growing responsibly.

Source: REIT earnings presentation

The contrast between Parkway Life REIT and First REIT is evident in their debt profile as well.

Notably, Parkway Life REIT’s cost of debt is below 1% compared to its Indonesian peer’s 4.1%. The former’s average term to maturity is also longer at almost three years, indicating a fairly well spread out debt profile.

That said, Parkway Life REIT’s gearing currently stands at 37.2%, leaving it with less wiggle room for acquisitions in the future.

The valuation checkup

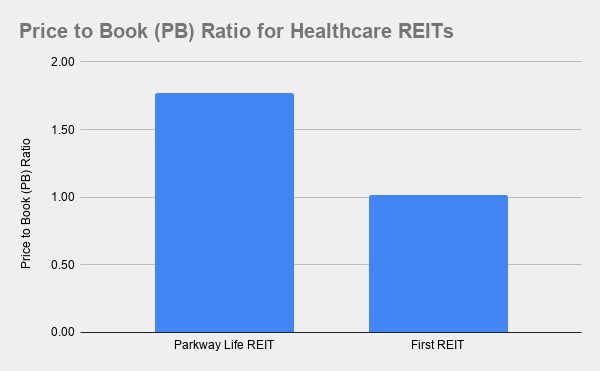

The difference in risk profile between the two REITs shows up in how they are priced in terms of price-to-book (PB) ratio.

Source: Yahoo Finance; REIT earnings announcement and presentation

First REIT is currently priced around its net asset value but Parkway Life REIT’s PB ratio is almost touching 1.8 times. Currently, the stock market is placing a sizable premium for the latter.

Get Smart: Risk and Reward

Industry tailwinds can provide a boost, but a rising tide does not lift all boats. The two REITs will need to put in the work to benefit from the growth.

The sharp contrast in valuation between Parkway Life REIT and First REIT is a clear demonstration of how much the market is willing to pay up for reliability. The difference in the cost of debt is another sign of how banks view the risk between the two REITs.

That said, First REIT does offer the longer runway. The REIT as the right of first refusal (ROFR) from both Lippo Kawaraci and OUE Lippo Healthcare (SGX: 5WA) with a pipeline of up to 37 operational hospitals at the moment.

As a whole, understanding the risks and rewards that both REITs offer is the key to making the right allocation decision for your own portfolio.

For more on REITs, check out my coverage on retail-based REITs and commercial-based REITs.

If you’d like to learn more investing concepts, and how to apply them to your investing needs, sign up for our free investing education newsletter, Get Smart! Click HERE to sign up now.

None of the information in this article can be constituted as financial, investment, or other professional advice. It is only intended to provide education. Speak with a professional before making important decisions about your money, your professional life, or even your personal life. Disclosure: Chin Hui Leong owns shares in Parkway Life REIT.