Exchange-traded funds or ETFs are rising in popularity.

According to Morningstar, assets under management by ETFs worldwide crossed the US$9 trillion mark in July 2021. That’s huge, to say the least.

And it’s not hard to see why the investment vehicle is appealing. You can get wide diversification instantly with most ETFs. Expense ratios are typically low as well, enabling you to keep most of the returns generated.

But not all ETFs offer the same advantages. Before you invest, you may want to take note of these eight key points:

1. What is an ETF?

An ETF is a fund that is traded on a stock exchange, and it can be bought and sold just like any other stock on a stock exchange; the fund can invest in all kinds of shares depending on its intended purpose.

Many ETFs that aim to track the performance of a stock market index.

For instance, Singapore’s main stock market index is the Straits Times Index.

There are two ETFs that track its performance, namely, the SPDR Straits Times Index ETF, and the Nikko AM Singapore STI ETF.

2. Macro is not performance: The gap between a positive macro-economic trend and stock price returns can be a mile wide.

For example, gold was worth A$620 per ounce at the end of September 2005 and the price climbed by 10% per year for nearly 10 years to reach A$1,550 per ounce on 15 September 2015.

But an index of gold mining stocks in Australia’s market, the S&P / ASX All Ordinaries Gold Index, fell by 4% per year from 3,372 points to 2,245 in the same timeframe.

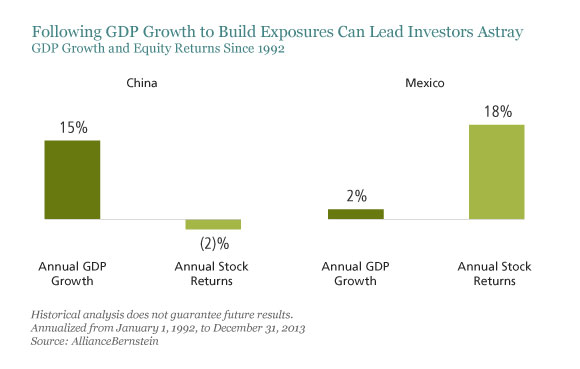

In another example, see the chart below on the disparity between the stock market returns and economic growth for China and Mexico from 1992 to 2013.

Despite stunning 15% annual GDP growth in that period for China, Chinese stocks actually fell by 2% per year; Mexico on the other hand, saw its stocks gain by 18% annualised, despite its economy growing at a pedestrian rate of just 2% per year.

So when finding themes to invest in via ETFs, make sure that the macro-economic theme you’re betting on can translate into commensurate stock market gains.

3. The real thing: ETFs can mimic the performance of a stock market index through two broad ways: Synthetic replication, or direct replication.

3. The real thing: ETFs can mimic the performance of a stock market index through two broad ways: Synthetic replication, or direct replication.

Synthetic replication involves the use of derivatives without directly investing in the underlying assets.

It is the less ideal way to build an index-tracking ETF, in my view, because there is more complexity involved and hence a higher risk that a large proportion of the underlying index’s performance can’t be captured.

Direct replication has two sub-categories: (a) Representative sampling, where the ETF holds only a sample of the stocks within an index; and (b) full replication, which involves an ETF buying the same stocks in nearly identical proportions as the weights of all the stocks that make up an index.

Try to look for ETFs that utilise full replication if possible.

4. Reputation matters: Look for an ETF that is managed by a reputable fund management company. Vanguard, SPDR, iSHAREs, Blackrock are just some examples of reputable providers of ETFs.

5. Track record: Ideally, an ETF should have a listing history of at least a few years, so that we can see how the ETF has actually done, and not just rely on the performance of the underlying index.

6. Watch that cost: The expense ratio (essentially all of the fees that an investor has to pay to the provider of the ETF) should be low.

There’s no iron-clad rule on what “low” means, but I think anything less than 0.3% for the expense ratio can be considered low.

Having a low expense ratio puts an ETF on the right side of the trend of investment dollars flowing toward low-cost index-tracking funds, which lowers the risk of an ETF’s manager closing the ETF down for commercial reasons.

7. A wide base of investors: The amount of assets under management for an ETF should also be high (ideally more than US$1 billion).

Having high assets under management for an ETF would also lower the chance that the ETF will close in the future. It’s not uncommon for ETFs to close. When a closure happens, it creates hassle on the investors’ part to find new ETFs to invest in.

8. Mind the gap: Lastly, look for a low tracking error. An ETF’s returns should closely match the returns of its underlying index. If the tracking error has been high in the past, there’s a higher chance that the ETF can’t adequately capture the performance of its underlying index.

When done properly, stock market investing can do wonders for your wealth. It can also put you firmly on the path to a secure and comfortable retirement.

The stock market doesn’t have to be a confusing place. We’re here to guide you every step of the way. Start by downloading our special FREE report, How To Invest in Stocks: A Beginner’s Guide. Just CLICK HERE to download now! We’ll cover all you need to know about what is stock market investing and how to get started!

Don’t forget to follow us on Facebook and Telegram for the latest investing news and analyses!