Does Berkshire Hathaway see value in UnitedHealth’s business that common investors are overlooking?

Browsing: Yahoo

Oracle shareholders woke up US$235 billion richer yesterday but who is paying the bill?

With President Trump unleashing a wave of tariffs across more than 180 countries, here’s how you can navigate the choppy stock market.

Income investors who are looking for higher dividends can add these names into their buy watchlists.

The US market offers a plethora of attractive growth investments for you to choose from.

Can STE’s strong performance continue, or does turbulence lie ahead?

Is there any upside left for Singtel’s share price?

Timing the market may cost you more than you think.

With stocks peaking and Fed cuts ahead, learn what lower interest rates could mean for investors.

If your purpose is to filter out dependable blue-chip stocks to include in your portfolio, these four deserve your attention.

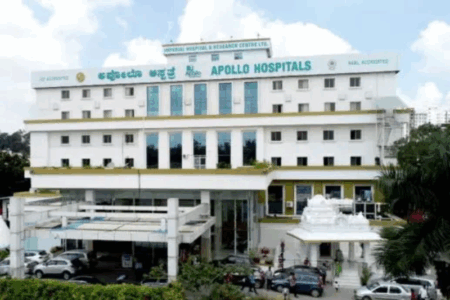

Discover the leading companies in India driving its future.

With thousands of ETFs on the global market, how do you know which one to pick? Here are 7 key guidelines to help you.

It’s dividends galore for these three stocks that managed to increase their dividends by more than 100%.

This week’s Smart Reads covers dividend-paying stocks, blue chips at highs and lows, REITs to watch, Singtel’s Investor Day highlights, and timeless strategies for retirement and long-term investing.

The Straits Times Index has climbed from a 52-week low in April to a record high of 4,300 in September 2025 — a stunning 27% rebound in just five months. What drove this rally, and what should investors focus on now?

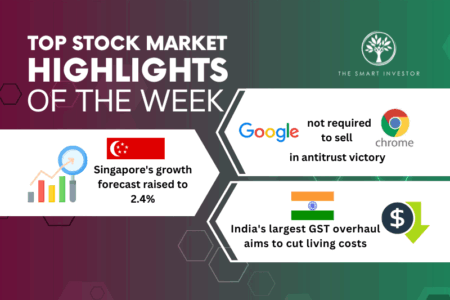

We look at an anti-trust case involving one of the internet’s biggest search engines, and explore the latest forecasts for Singapore’s GDP growth.

If the business is performing well, why did the stock prices fall?

Learn the simple mental trick Buffett uses to make better decisions and sleep well at night.

There’s nothing better than having cash drop into your bank account like clockwork.

Three unlikely blue-chip winners emerged in August, highlighting the market’s diversity.