Centurion, AIMS APAC and FLCT emerged as November 2025’s best-performing REITs, outpacing the market with resilient portfolios and steady fundamentals.

Browsing: Yahoo

November saw three Singapore blue-chip leaders beat the STI with standout performance powered by resilient fundamentals and strategic growth execution.

Beyond the numbers lies the story. Our StarHub site visit shows how first-hand insights help investors understand the drivers behind a company’s performance.

Looking for strong Singapore blue-chip stocks in December 2025? We break down the latest updates from CapitaLand Ascendas REIT, Keppel and Mapletree Logistics Trust, and explain how their capital recycling, divestments and portfolio upgrades could shape long-term returns.

Four resilient Singapore REITs with stable portfolios and improving fundamentals could benefit when interest rates finally fall.

Starting with S$10,000? You do not need complicated strategies or dozens of stocks. This five-step guide shows you how to set your investment goal, choose the right mix of companies, build a strong core with Singapore stocks and stay invested with confidence through 2026 and beyond.

This week’s Smart Reads highlights REITs raising payouts, dividend stocks paying in December, and key risks income investors should watch. We also revisit Keppel’s decade-long returns and spotlight US growth names built for the next decade.

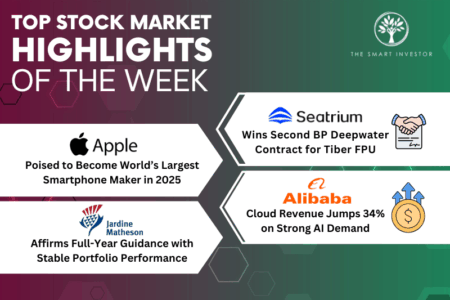

Seatrium wins BP deepwater contract, Apple nears smartphone lead, Alibaba’s cloud grows on AI demand, and Jardine Matheson maintains guidance.

Here’s how to turn small, steady investments into a reliable dividend stream — one month, one stock, one payout at a time.

Discover the three Singapore dividend stocks to watch this December as resilient earnings, steady cash flows and smart capital allocation support sustainable payouts.

Three Mapletree REITs and Frasers Logistics will distribute over S$400 million this December, but only one managed to raise its DPU.

Many Singapore investors lock in profits too quickly, but selling blue-chip stocks too early can mean missing out on years of rising dividends, steady growth and long-term wealth creation.

One’s selling assets, one’s bleeding profits, one’s actually growing – all three paying December dividends.

Three REITs raising DPU in 2025—but only one has genuine tailwinds behind it.

Many investors chase the highest REIT yields without realising that inflated payouts often signal deeper financial risks.

Three under-the-radar Singapore dividend stocks delivered steady payouts in November 2025, backed by resilient earnings and a stronger market environment.

Singapore blue-chip stocks are known for stability and dividends, but even market giants face risks that investors often overlook.

Not all dividends are as safe as they seem. We reveal three proven warning signs that could signal your income stream is in danger.

High yield doesn’t always mean high risk. Elite UK REIT offers 8.5% backed by government tenants and inflation-linked leases.

REITs are making a comeback as rates fall. See why these REITs lifted distributions in 2025.